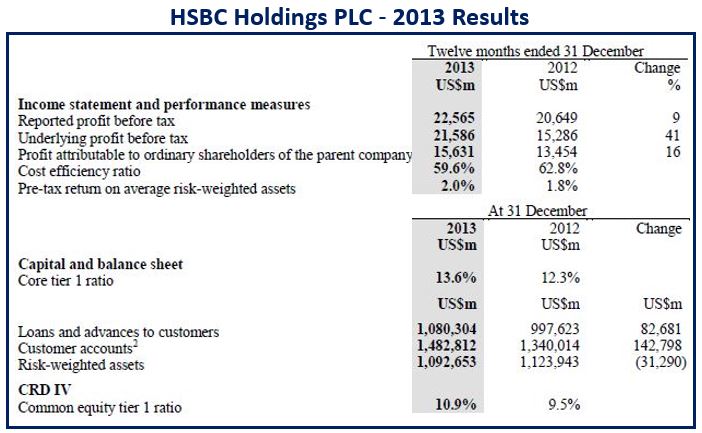

HSBC profits reached $22.6 billion in 2013, missing analysts’ forecasts of of $24.3 billion, but 9% higher than $20.6 billion registered in 2012.

Europe’s largest bank closed or sold 20 non-strategic businesses, cut costs and “has become much more streamlined.”

Earnings per share were $0.84 while dividends per share were $0.49, compared to $0.74 and $0.45 respectively for 2012. Return on equity was o.8%, a 9.2% increase on 8.4% in 2012.

Growth in commercial banking and a “resilient performance in global banking and markets” underpinned higher underlying revenue of $63,295 million in 2013 compared to $61,597 in 2012.

(Source: HSBC Holdings PLC)

HSBC profits in Q4 2013 disappointing

In the last quarter of 2013, HSBC profits fell 10% compared to the third quarter. In early trading in London on Monday HSBC shares fell 4.5% to 625p.

HSBC Group CEO, Stuart Gulliver, said:

“Our performance in 2013 reflects the strategic measures we have taken over the past three years. Today the Group is leaner and simpler than in 2011 with strong potential for growth. In 2013 we grew underlying profits by US$6.3bn, generated US$10.1bn in core tier 1 capital, achieved an additional US$1.5bn of sustainable cost-savings and declared US$9.2bn in dividends in respect of the year.”

“Our strong capital generation continues to support our progressive dividend policy and reinforces HSBC’s status as one of the best capitalized banks in the world.”

In May 2013 Gulliver said he would reduce annual expenses by an additional $3 billion after beating a previous target with the sale or closing of over 60 businesses.

HSBC gets the bulk of its profits from Asia, and is concentrating on this market as regulation and compliance costs increase.

2014 will see “choppy markets”

As emerging markets adapt to different economic circumstances, HSBC said there could be “choppy markets” in 2014. The bank says it remains optimistic regarding the long-term prospects of emerging markets, but added there could be greater volatility this year as the effects of the monthly tapering of the Fed’s bond-buying stimulus program continues.

Cutting workforce and raising bonuses, a banking trend

HSBC is the first bank to announce that it will seek shareholder approval to lift the new European Union bonus cap of its top executives’ salaries from 100% to 200%.

Gulliver’s total pay for last year, the last year before the EU bonus cap becomes effective, increased to £8.03 million in 2013 from £7.53 million in 2012. His variable pay rose to £5.5 million from £4.95 million.

According to the bank’s financial results statement, HSBC boosted its bonus pool to £2.3 billion ($3.9 billion). A total of 239 employees took home £1 million or more in 2013.

Much to the annoyance of millions of people worldwide, especially after financial scandals and bailouts of financial institutions by the taxpayer over the last few years, many banks have been firing staff because of “costs” while raising bonuses for their higher-level executives.

Barclays raised bonuses while reducing its workforce, JP Morgan gave its CEO a massive 74% increase in pay while explaining that it had to reduce staff numbers because of financial problems and falling profits.

Gulliver said:

“Although much progress has been made since 2011, we did not meet all of our targets by the end of 2013. Our reported cost efficiency ratio of 59.6 per cent and return on equity of 9.2 per cent in 2013 were both outside our target ranges, in part affected by continuing UK customer redress.”

The bank, which now employees 254,000 people, reduced its workforce by 410,000 last year through restructuring and disposals.