Canadian oil sands producer MEG Energy announced on Friday that its planned 2014 capital investment will be reduced by 31% to $1.2 billion, compared to its original budget of $1.8 billion. The company, which is digging in for a protracted period of weak crude prices, is deferring some spending on new projects.

The Calgary-based company says the lower level of 2014 capital spending will be driven mostly through cost savings following a change in focus from major greenfield projects to incremental brownfield expansions of existing facilities.

President and Chief Executive Officer, Bill McCaffrey, said:

“Our 2015 capital program is illustrative of MEG’s ability to adapt to the current market conditions while still delivering meaningful growth. With only twenty per cent of our budget required to maintain our current level of production, we have significant flexibility within our plans should we need to further respond to the market environment.”

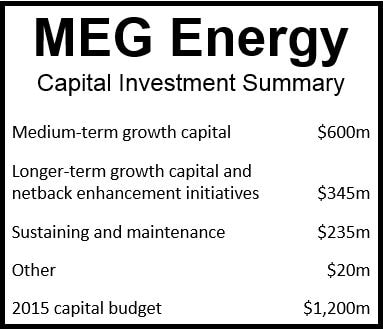

On Friday, the company’s Board of Directors approved a capital program of $1.2 billion for 2015, which includes $235 million in sustaining and maintenance capital aimed at maintaining current productions levels, and $965 million of growth capital to support its medium-term average growth of ten-to-fifteen percent per year.

Source: MEG Energy.

Regarding its planned turnarounds of Christina Lake Phases 1 and 2 in 2014, the company used the interconnections between processing plants to “redirect barrels to the Phase 2B plant to test its overall throughput capability. As a result of the successful testing, it has been determined that the Phase 2B plant is capable of processing in excess of 55,000 bpd of bitumen, significantly higher than its initial design capacity of 35,000 bpd.”

Based on this testing, the company is allocating $355 million to the first of a series of brownfield expansions of Phase 2B. It has also allocated $160 million to the drilling of infill wells and SSEGD well pairs to expand the implementation of eMSAGP, supporting the firm’s medium-term growth profile.

MEG is also allocating $85 million for follow-up brownfield expansions of Phase 2B.

Production guidance

The company aims to produce between 78,000 and 82,000 bpd, which is about 19% more than its upwardly revised 2014 production guidance. It forecasts that non-energy operating costs per barrel will be in the $8-$10 range in 2015.

Discover more from Market Business News

Subscribe to get the latest posts sent to your email.