New Chinese policy guidelines, which call for limits on the activities of state-owned companies, paves the way for a more even playing field for private companies competing in the energy sector and other key industries, says IHS, a global information company.

Economic reform was the main theme discussed at the Third Plenum of the Chinese Communist Party’s (CCP) 18th Congress, held in Beijing in November. It agreed on a road map for ongoing policy adjustments.

A new IHS white paper – “China’s New Road Map for Accelerated Reform: An IHS View on the Third Plenum.” – writes that according to details laid out on the road map, reforms in China will gather pace and state involvement in the market will be restricted, allowing private enterprises to play a more dominant role.

Brian Jackson, an economist at IHS, said:

“Documents issued from China’s Third Plenum paint a picture of a market where all participants have open, fair and equal access to compete in key industries. This represents a critical turning point in an economy where the role of the state – often through SOEs – continues to loom large, particularly in capital-intensive sectors such as energy, chemical and mining.”

While the documents reaffirm the role of SOEs in areas where natural monopoles exist – such as natural gas pipelines and electric power transmission – the new principles could result in more fair market conditions for private enterprises, if implemented.”

The impact of Chinese policy guidelines

Most Third Plenums of the CCP’s Congresses have initiated new Chinese policy guidelines that eventually led to wide-ranging reforms. “In some cases, these reforms have dramatically altered the course of China’s economic development.”

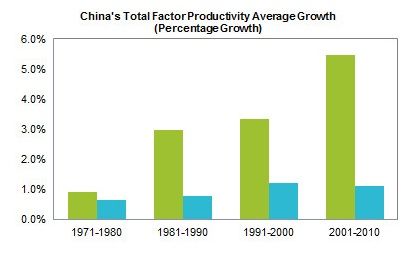

The 1978 Third Plenum opened up the country’s economy, leading to three decades of hyper-economic growth. Annual GDP growth before 1978 averaged 3.9% compared to 8.7% between 1978 and 2012.

(Source: IHS Inc.)

Equalizing the competitive landscape, a major reform

Paving the way for a more even competitive landscape is a significant reform for the Chinese Communist Party. Over the coming months and years, IHS foresees more concrete policies will be issued allowing private companies, including foreign ones, to become more involved in the market.

At the moment, market regulators have little administrative authority, especially over the country’s leading state-owned enterprises. Bureaucratic reforms which give those regulators more teeth would be a welcome measure, IHS believes.

Jackson said:

“The document recognizes that there are parts of the economy where natural monopolies exist and that state participation remains crucial in those sectors. However, it calls for setting clear boundaries for SOEs in these sectors and separating the monopolistic functions from functions that can be opened up for competition.”

”Natural-resource sectors are singled out because many segments in these areas are natural monopolies, such as natural gas pipelines and electric power transmission.”

Chinese policy guidelines – the impact on the energy sector

”Xizhou Zhou, senior manager, research, for the IHS China energy insight team, said:

“The decision document stipulates that all energy prices that can be formed through market competition should be determined by the market, with little government intervention.”

“IHS believes that natural-resource sectors, including gas, power and oil products, will see further price reforms as competitive segments experience a retreat of government price-setting. Specifically, the recent linking of domestic gas prices to oil prices will further progress to allow domestic gas prices to reach parity with imports. Also, the further tweaking of the oil product pricing mechanism will improve the timely reflection of global crude price movements.”

IHS believes structural reforms in the power and gas sector will accelerate. The Chinese government has made it evident that it wishes to open up existing monopolies to private competition “a challenging task involving major vested interests.”

IHS expects several national energy companies that currently own and run critical infrastructure to be significantly restructured. “If successfully implemented, this would allow more non-state players into the non-natural monopoly parts of the gas and power markets, creating a more level playing field and encouraging further investment to meet the country’s surging energy demand.”

Environmental protection

The decision documents contains a whole section dedicated to environmental and ecological protection, a clear response to public demand for better protection of land resources, water and air.

This probably means switching from coal to gas and more stringent environmental regulations as well as their enforcement.