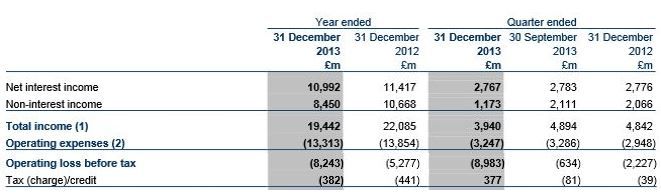

RBS has posted a pre-tax loss of £8.243 billion for 2013, its largest annual loss since 2008, compared to £5.2 billion in 2012. RBS (Royal Bank of Scotland) was bailed out by the UK taxpayer in 2008.

RBS still managed to set aside bonus money for its executives, £576 million, which is 15% less than 2012. Half of the bonus money went to investment bankers.

RBS’ new chairman, Ross McEwan, believes the bank will not fully recover for at least three to five years. In the Today progam he said:

“People – including the executives of the bank – didn’t realize how big a change process we had to go through to get this bank back into shape….. We’re in the least trusted industry and we’re one of those banks that aren’t trusted.”

RBS was bailed out by the UK taxpayer to the tune of several tens of billions of pounds. Many economists would today class it as a zombie company – one that could not survive without bailouts.

RBS downsizing

RBS, which is 81% owned by the UK government, used to be one of the largest banks in the world. It has announced plans to reduce the size of several operations. Seven divisions and support departments will be restructured, leaving just three customer businesses.

“We will cut our cost base as we move from a structure fit for a global titan to one better suited to a first-rate UK bank. Our cost to income ratio has soared to 73%. We have set out targets today to achieve a cost income ratio of around 55% by 2017 and a longer term target of around 50%. This year that will mean cutting around £1bn of operational spend on things that don’t help our customers.”

“We have shrunk the investment bank by three quarters since 2008 and, as a result of today’s structural changes, we are going further to reduce Risk Weighted Asset intensity as part of our capital plan – this will result in our Markets business shrinking further. Once the re-sizing is complete we will have a Markets business that achieves acceptable returns while reinforcing our position as a strong corporate bank.”

“We will be a more UK focused bank, with UK assets increasing from 60% to 80% of our total business.”

McEwan added that he plans to bring its current cost-to-income ratio of 73% down to 55% by 2017.

Thousand of job cuts to come

UK media have been talking about thousands of job cuts at RBS. This week RBS has said reducing staff levels is inevitable, but did not specify numbers.

The bank says it is planning to reduce costs by 40%, or £5.3 billion over the next four years; £3.1 billion of it should come from selling several businesses, including Citizens, its US retail franchise.

For the next twenty-fours months restructuring costs could be “elevated”, the bank warns, as it strives to improve customer service and bring costs down. According to analysts, it will be some time before the benefits of restructuring become apparent.

Reuters Quotes Morgan Stanley, which wrote in a note to clients “We see the strategic plan as setting out a realistic pathway to more sustainable earnings and a lower cost of equity.”

RBS used to have global ambitions, which brought the bank to its knees. Had the UK taxpayer not bailed out the company it would have collapsed completely during the financial crisis. It has managed to slice £1 trillion off what used to be the largest balance sheet in the world.

(Source: Royal Bank of Scotland)

RBS with massive losses and bumper bonuses

While RBS carries on reporting huge losses and the taxpayer sits on paper losses of approximately £14 billion from the bailout, the company continues paying fat bonuses. Regarding bonuses, McEwan said “We need to be pragmatic. I need to pay these people fairly in the market place to do the job.”

Awarding top executives large bonuses or exaggerated pay rises while performance falls used to be a common banking behavior, and it appears to be coming back. JP Morgan, the largest bank in the US, announced yesterday that it is cutting 8,000 employees from its retail banking and mortgage sections, but managed to award its CEO Jamie Dimon a 74% increase in pay.

HSBC is seeking European Union approval to increase the bonus cap for executives from 100% of salary to 200%, despite a drop in profits in the last quarter of 2013.

Barclays say it has plans to lay off up to 12,000 employees this year, but is raising bonuses for top executives.