A UK GDP growth forecast has been upgraded from 2.4% to 2.7% for 2014 and 2.5% to 2.8% for 2015, according to the British Chambers of Commerce. By the summer of 2014, British GDP (gross domestic product) will have regained and exceeded its 2008 pre-recession level.

The British Chambers of Commerce (BCC) also forecasts that wage growth will exceed inflation by the middle of 2014, UK interest rates will rise to 0.75% in the third quarter of 2015, youth unemployment will stay at three times the national average until the end of 2016, and GDP will rise by 2.5% in 2016.

In the second quarter of 2014, the economy is expected to grow at a faster rate than its pre-recession peak, one quarter earlier than expected.

UK GDP is “gaining momentum”, says BCC Director General John Longworth. He paid tribute to companies across the country that have striven to expand and create jobs.

(Source: British Chambers of Commerce)

UK GDP growth still facing major challenges

Longworth also warns, however, that the country still faces long-term challenges despite recent progress.

Below are some highlighted data from the BCC forecast:

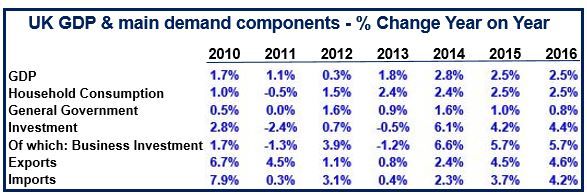

- UK GDP growth of 2.8% in 2014, 2.5% in 2015 and 2.5% in 2016.

- In Q2 2014, GDP growth will exceed its Q1 2008 pre-recession peak.

- In Q1 2014, GDP is forecast to grow by 0.7%, and then 0.6% in Q2 2014, before averaging 0.6% each quarter through 2016.

- Output from services and household consumption will be the main drivers of UK GDP growth.

- Household consumption grew by 2.4% in 2013, and is forecast to expand by 2.4% in 2014, and 2.5% in 2015 and 2016.

- Service sector output is predicted to expand by 2.9% in 2014, 2.7% in 2015, and 2.7% in 2016.

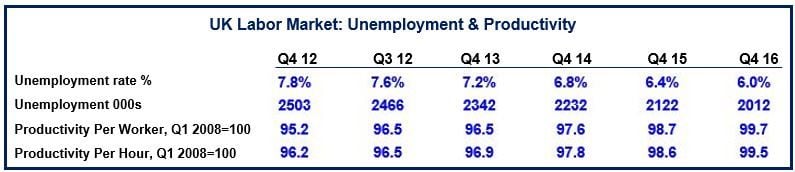

- Unemployment stood at 7.2% in Q4 2013, and is expected to fall to 6% by the end of 2016.

- Youth unemployment (16 to 24 years of age) will stay at nearly three times the national average, dropping to 17.8% in Q4 2016 from 19.9% last year.

- Business investment is forecast to expand by 6.6% in 2014, 5.7% in 2015, and in 2016 by 5.7%. Despite these impressive increases, it will still be lower in 2016 compared to 2008.

- In Q3 2015, the official UK interest rate is forecast to rise to 0.75%, followed by 0.25% increments until 1.5% is reached in Q3 and Q4 of 2016.

(Source: British Chambers of Commerce)

Keep the champagne on ice, says Longworth

Longworth said:

“Our economic recovery is gaining momentum. Businesses across the UK are expanding and creating jobs, and our increasingly sunny predictions for growth are a testament to their drive and ambition. Our new forecast shows that the service sector is performing particularly well, and is likely to be a key driver of growth. And the manufacturing sector, although small, is pulling its weight too, and will play an important role in sustaining our recovery.”

“But it’s not time to break out the champagne glasses just yet. Major issues remain, such as the unacceptably high level of youth unemployment. We urge the Chancellor to use this month’s Budget wisely by incentivising businesses to hire young people so that the next generation of workers are not left behind.”

“Crucially, Britain is simply not investing enough. While business investment is expected to grow, it will remain way below pre-crisis levels for some time. There is also more to do in securing access to finance for growing firms – as this too will be crucial to securing our economic future. So is getting public and private sector funding together to address the crippling gaps in our transport, digital and energy infrastructure.”

“We just hope that as the General Election gets closer, politicians are not tempted to abandon a drive for long-term economic security in favour of short-term vote winners. No government over the next decade can afford to get distracted – and our leaders must do everything in their power to ensure the economy goes from being merely good, to being truly great.”

(Source: British Chambers of Commerce)

Current account deficit could harm the economy

BCC’s chief economist David Kern warned that over the long-term the country’s economic health could be undermined by the high current account deficit. Although business investment is set to accelerate rapidly, it is still a very long way behind the country’s pre-recession peak. In order to improve this “we need higher productivity.”

Kern added that companies will only increase their capital if an environment of low interest rates and low inflation persists. “The revamped forward guidance policy goes some way to easing business concerns, and the long-term security will encourage them to invest. However some MPC members seem to be signaling early interest rate rises. This kind of unhelpful speculation will only prevent business from investing and put pressure on an already strong pound, which could put the recovery at risk,” Kern said.