Public health by far places the greatest pressure on UK public spending today and will do in years to come, says Britain’s Office for Budget Responsibility in a new report. The United Kingdom has an ageing population that is pushing up demand for healthcare services, while technological advances raise costs, the report authors say.

An ageing population also increases pressures on the state pension and adult social care. The state pension and adult social care face policy-driven cost pressures, in the form of the triple lock and the National Living Wage respectively.

Other pressures on public spending include:

– the uncertain costs of cleaning up nuclear power plants,

– reimbursing tax that, according to the courts, should not have been collected,

– compensating victims of clinical negligence.

Fire precautions add to UK public spending pressures

Over the short term, the Government will also need to finance a comprehensive programme of fire safety measures following the Grenfell Tower tragedy in North Kensington, London, in which at least eighty people died.

In a press release published today, the Office for Budget Responsibility wrote:

“All these have to be considered in the context of medium-term spending plans that imply significant real terms cuts in spending per person over the next three years, on top of those implemented since 2010.”

“Lifting current limits on public sector pay increases would pose a fiscal challenge to the extent that departments had their budgets increased to pay for it, rather than simply giving them greater flexibility over how they manage their pay bills.”

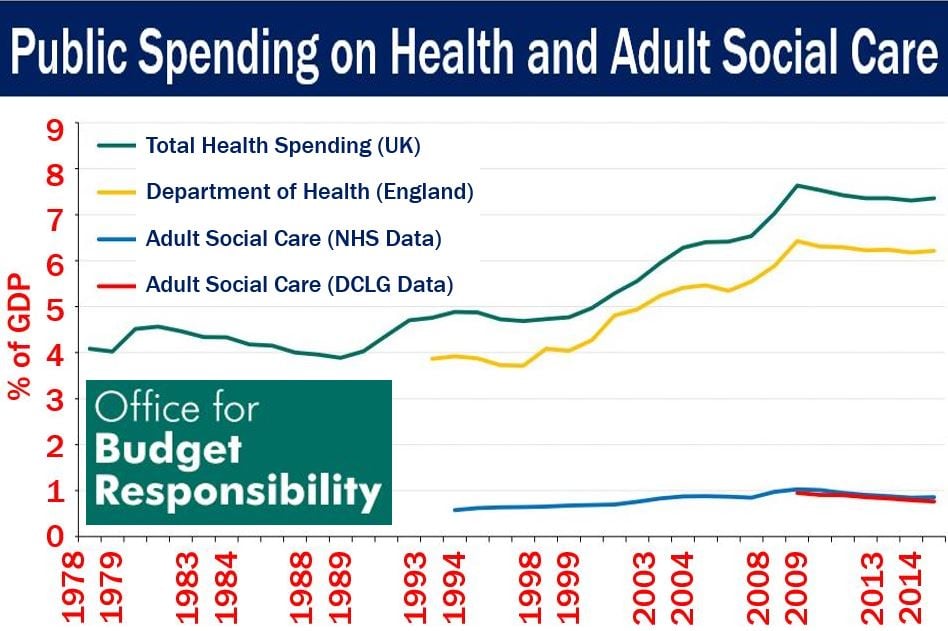

Over the past four decades, UK public spending on health and adult social care has risen from about 4% of GDP to nearly 8%. DCLG and NHS stand for the Department for Communities and Local Government, and the National Health Service respectively. (Image: adapted from cdn-.budgetresponsibility.org.uk)

Over the past four decades, UK public spending on health and adult social care has risen from about 4% of GDP to nearly 8%. DCLG and NHS stand for the Department for Communities and Local Government, and the National Health Service respectively. (Image: adapted from cdn-.budgetresponsibility.org.uk)

BREXIT’s effect on UK public spending pressures

The new Government also has to manage the risks posed by BREXIT – BRitain EXITing the European Union (EU). Britons voted in June 2016 to leave the EU in a referendum.

UK public spending pressures posed by BREXIT are on top of the possible shocks and likely pressures that all economies are vulnerable to. The report authors warn that leaving the European Union may affect the likelihood and impact of many of them.

The EU Divorce Bill, which is likely to go into the many tens of billions of pounds, will be a one-off hit that the authors believe will not pose a big threat to fiscal sustainability.

What matter more are the implications of whatever agreements are reached with Brussels (the EU) and other trading partners for the long-term growth of Britain’s GDP (gross domestic product).

The Office for Budget Responsibility wrote:

“If GDP and receipts grew just 0.1 percentage points more slowly than projected over the next 50 years, but spending growth was unchanged, the debt-to-GDP would end up around 50 percentage points higher.”

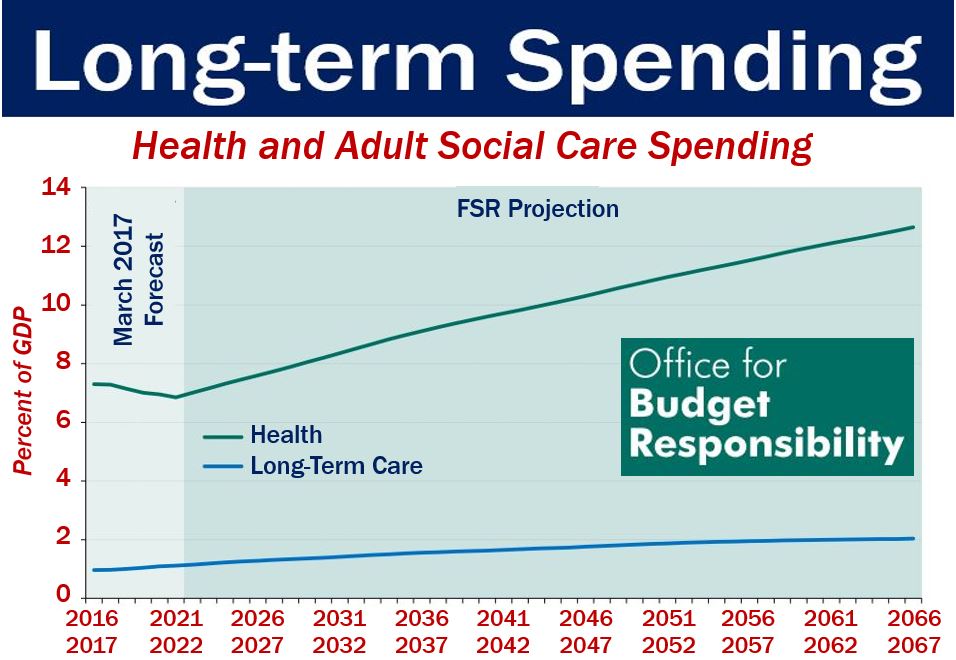

The Office for Budget Responsibility forecasts that by the the year 2066, UK public spending on health and adult social care will reach more than 12.5% of GDP. (Image: adapted from cdn-.budgetresponsibility.org.uk)

The Office for Budget Responsibility forecasts that by the the year 2066, UK public spending on health and adult social care will reach more than 12.5% of GDP. (Image: adapted from cdn-.budgetresponsibility.org.uk)

UK public spending pressure at a sensitive time

The authors explained that they have produced this latest report at a sensitive time. Approximately ten years after the outbreak of the global financial crisis and the Great Recession that followed, net borrowing is significantly down from its peak.

However, the budget continues to be in deficit by two to three percent – as it was just before the crisis struck – and net debt, as a share of GDP, is over double what it was before the crisis, and shows no signs of falling.

Consequently, Britain’s public finances are considerably more sensitive to interest rate and inflation changes or surprises than they used to be.

According to the report:

“In terms of the political backdrop, the previous Government had to abandon a number of measures to increase taxes and cut welfare spending, the new Government has just agreed a ‘confidence and supply’ arrangement that increases public spending significantly in Northern Ireland and the Chancellor of the Exchequer notes of austerity that ‘people are weary of the long slog’.”

Fiscal stress test results – fiscal position vulnerable to further shocks #OBRrisks https://t.co/2Lp4WkDnBb pic.twitter.com/k4IAhyG7lc

— OBR (@OBR_UK) July 13, 2017

What is the Office for Budget Responsibility?

The Office for Budget Responsibility (OBR), which was created in 2010, provides authoritative and independent analysis of the country’s public finances. It is one of many official independent fiscal watchdogs across the globe.

On its online About Us page, the OBR writes:

“We produce detailed five-year forecasts for the economy and public finances twice a year. The forecasts accompany the Budget Statement (usually in March) and the Autumn Statement (usually in late November). They incorporate the impact of any tax and spending measures announced in those statements by the Chancellor.”

The OBR also:

– Evaluates performance against targets

– Assesses the long-term sustainability of UK public spending

– Evaluates fiscal risks

– Scrutinizes tax and welfare policy costing

Video – life expectancy in UK

Life expectancy in the UK has been increasing and will continue to do so for decades to come. This will put increasing pressure on spending on pensions, the National Health Service, and adult social services.