Expectations for the US economy 2014 among the American adults are slightly more negative this year than one year ago.

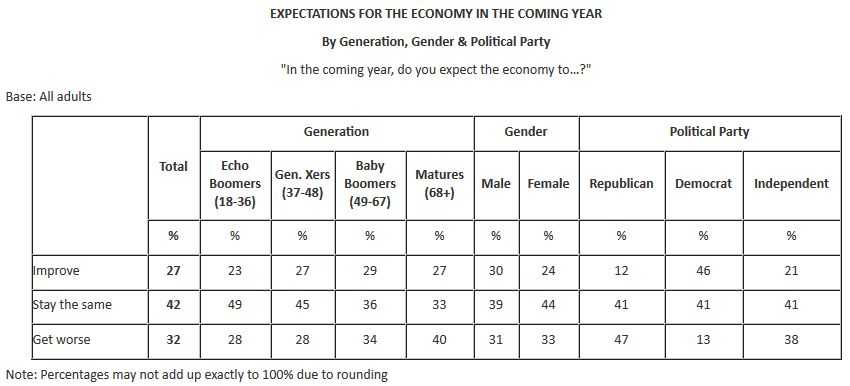

The data, gathered from a Harris Poll that evaluated 2014 US economic expectations, found that thirty-two percent of respondents expect the US economy to get worse this year, compared to 27% who think it will get better and 42% who forecast no change.

The Harris Poll involved 2,311 American adults who were interviewed between December 11th and 17th, 2013, by Harris Interactive.

The number of people today who believe the economy will remain unchanged has increased by ten percentage points compared to a year earlier, while those expecting an improvement have dropped 6 points and the pessimists have fallen 4 points.

US economy 2014 expectations among Democrats and Republicans

Nearly four times as many Democrats (46%) believe the US economy will improve this year compared to Republicans (12%).

Thirteen percent of Democrats forecast a worsening economy in 2014 versus 47% of Republicans.

The percentage of people who expect no change this year stands at exactly 41% among both parties and Independents.

(Source: Harris Interactive)

How expectations influence financial planning

The surveyors also asked American adults about their financial plans for 2014, as well as what plans they had made in 2013, and whether they saw them through.

According to the Poll, US adults reported a “solid follow-through ratio for 2013 financial plans.” A significantly higher number of Americans followed through on financially “responsible” actions in 2013 than those who did not, examples include:

- 49% planned and followed through on cutting back on household spending compared to 15% who did not.

- 41% followed through on paying down their level of debt compared to 15% who did not.

- 22% followed through on their plan to carry out home improvements that would increase the value of their property, compared to 10% who failed.

- 19% got rid of their credit cards versus 8% who had planned to do so but did not.

As far as 2014 is concerned:

- 45% plan to cut back on household spending.

- 40% plan to pay down their level of debt.

- 40% plan to save more.

- 23% plan to save for retirement.

- 15% plan to get rid of at least one credit card.

- 15% plan to carry out improvements in their homes in order to increase the value of their property.

Financial plans for 2014 are fairly similar to what they were 12 months ago, with slightly more people planning to save and put some money aside for retirement (in both cases up three percentage points).

However, compared to five years ago the proportion of Americans planning to cut back on spending during the next twelve months is ten percentage points down, while those intending to get rid of at least one credit card is 9 percentage points down.