The Venezuelan economy is now officially in recession, the Banco Central de Venezuela (Central Bank of Venezuela) announced on Tuesday. It added that GDP has been contracting throughout the whole of 2014.

After several months of complete silence regarding the state of the country’s economy, the central bank’s announcement came as no surprise to economists within Venezuela and across the world.

Venezuela’s Gross Domestic Product (GDP) contracted by -2.3% in the third quarter of this year. The central bank added that GDP shrank by -4.8% and -4.9% in the first and second quarters respectively.

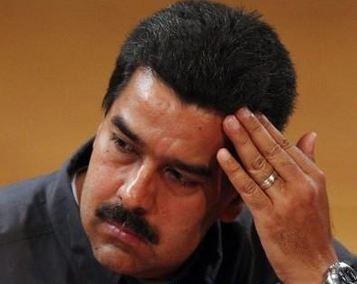

According to President Nicolás Maduro, the problems have nothing to do with his and his predecessor’s economic policies. He blames his country’s mess on falling oil prices, political instability, and US measures to undermine Venezuela’s and Russia’s performance.

Since the beginning of the millennium, Venezuela’s socialist government has nationalized and/or confiscated thousands of thriving businesses and has left the country virtually completely dependent on oil for export income.

Mr. Maduro, who has none of the charisma of the late Hugo Chavez, is clearly out of his depths as his country sinks. His popularity rating has slid to below 24%, and is likely to continue falling further.

According to the Banco de Venezuela, annual inflation in November reached 63.6%.

Reforms announced but no details

Mr. Maduro unveiled several economic measures to bolster GDP growth and bring down inflation, including reforms to its currency control system. He told reporters that details of what he had planned will be explained after the New Year celebrations.

Opposition leader Henrique Capriles tweeted “Yet again, no announcements. He (Maduro) doesn’t know what to do.”

If Mr. Maduro does not act he risks letting Venezuela become a failed state. The country’s oil basket, which trades at a discount to other benchmarks because of its higher heavy oil content, plunged from $99.1 per barrel in June 2014 to $46.97 on Tuesday. Ninety-six percent of Venezuela’s hard currency revenues come from oil. A hard currency is one that investors, companies, governments and private individuals trust because they are unlikely to lose their value – examples include the US dollar, pound sterling, and euro.

A necessary move, something that should have been done months (possibly years) ago, is to allow the bolivar to float from 6.3 to the dollar to near black market rates of 170+ bolivars to the dollar. This would immediately provide a much-needed boost to oil receipts, which are denominated in dollars.

Shoppers queueing for staples such as sugar, diapers, milk and eggs, in the country with the world’s largest oil reserves. Venezuelans have lived with shortages for years, but now basic goods are becoming much more scarce.

The Financial Times quotes chief Andean economist at Bank of America Francisco Rodríguez, who said “Without a large adjustment of the exchange rate, we will almost certainly have triple-digit inflation and we could even see the economy dipping into four-digit annual inflation.”

Mr. Maduro says Venezuela has become a bystander victim of America’s economic war against Russia and its attempts to smash the oil carterl OPEC.

Mr. Maduro said “The US wants to impose a unipolar world controlled from Washington. That is madness.”

Venezuela’s opposition parties and a growing percentage of the population say Mr. Maduro’s and his predecessor’s (Hugo Chavez’) socialist policies are to blame for the country’s economic decline, severe and chronic shortages of many staples, rocketing inflation, and record crime rates.