How much do you spend on your car maintenance each year? It’s probably one of the most significant expenditures in your budget. Think about insurance, fuel costs, registration, and not to mention the car’s monthly amortization.

Most cars come with an automatic manufacturer’s warranty that lasts up to three years and covers certain components. But the problem is that once it expires, you’ll have to cover your car’s repair expenses out of pocket. That could turn out to be pretty costly. You can also check out reputable

Fortunately, getting a car warranty can help you reduce the cost of car ownership. Read on to find out how you can save money and find a reputable extended car warranty company.

Buy an Extended Car Warranty Early

Did you know that the price of an extended car warranty increases as your car ages? When buying a pre-owned or a new car from a dealer, think about how long you plan on keeping the vehicle. If you intend to own it longer than the initial manufacturer’s coverage, then you might have to consider buying an extended car warranty right away. Although it will be effective after the factory coverage ends, it will likely cost more if bought at a later date.

It’s also important to note that you will not lose the amount you invested on an extended car warranty should you decide to sell the car. You can use it as an incentive to make a great selling point and may even increase your vehicle’s asking price.

Don’t Waste Money on High Deductibles

Most extended warranties require you to pay a deductible every time you bring your vehicle in. High deductible warranties mean that you’ll have to dig deeper into your pockets if your car is damaged. While they keep your monthly payments low, you are at a higher risk of facing massive repair bills that you cannot afford to foot.

The big question is: How much can you comfortably dish out of your pocket to cover urgent repairs? Can you set aside that amount in your annual budget to cover the out-of-pocket expense? If not, then you need to re-evaluate your deductible. There is no point in getting a high deductible plan that might never have to pay off any of your car repair expenses.

Find Alternatives to Maintenance From Dealerships

An extended car warranty doesn’t cover routine maintenance, such as oil changes, brake components, and tire rotations. This means that you don’t have to get your car serviced at a dealership. It’s fairly common knowledge that dealerships charge more for their services than independent mechanics. Their bills are inflated with unnecessary replacements, fluid flushes, and overpriced lubricants that you can buy for 30% less at a regular store. You can perform routine maintenance yourself or go to an independent mechanic to avoid unnecessary rip-offs and save more.

Get an Inclusionary Extended Car Warranty

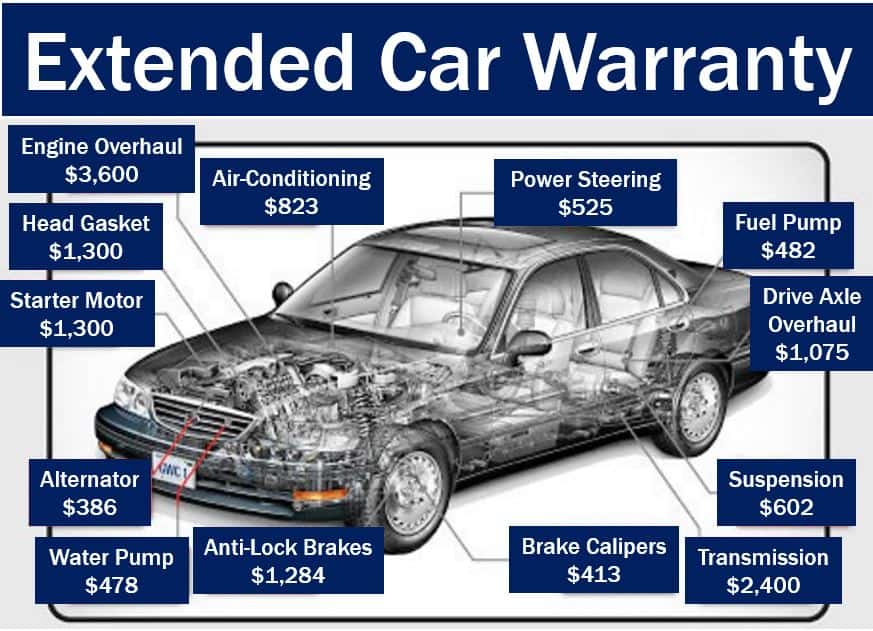

An inclusionary extended car warranty covers specific components of a vehicle. It’s often called the listed-item coverage because it provides a detailed list of all the components it covers. It allows you to find the level of coverage that fits your budget and needs. This is much cheaper than an exclusionary extended car warranty.

The only problem is that it covers less. But you can always modify it to cover the most expensive components and those that are costly to fix. It is important to read through the terms and ask for clarifications from your dealer, so you can get prepared when something breaks down.

Customize Your Policy

Extended car warranties vary in price. They can cost anywhere between a few hundred dollars and a few thousand dollars. Some dealerships require you to haggle for the best price, and if you are not keen, you might end up with an overly exaggerated policy.

The level of coverage that you choose to go with determines the cost of an extended car warranty. Vehicle protection plan providers should consider your vehicle’s information to give you a price range of different coverage options. You can then settle for an option that fits your budget.

Know What Your Warranty Demands

Shopping for an extended car warranty is a serious matter. Knowing what your warranty demands helps you avoid unnecessary pitfalls. For instance, some policies don’t offer full-rate payment on labor, leaving you with no choice but to foot your bill balance. Others will limit you to a few repair shops to have your car fixed. This means that you can’t go to your regular mechanic. Some simple googling can help you narrow down to the most favorable policy.

Bottom Line

An extended car warranty can help you save a few dollars, but it all depends on your specific needs. If you’re worried about spending on repairs after the manufacturer’s warranty runs out, then it’s a good call to get one. If you’re not planning on trading in your car anytime soon, an extended car warranty will increase your resale value. Then, you can sell it at a price close to your first asking. Make sure to do your homework well to avoid potential scams. Check reviews online to help you make the right decision.

Interesting Related Article: “Why Is My Car Insurance So High?“