Nowadays, investors need to look further than their own bottom line and stop using the standard return-seeking approaches. The modern socio-economic environment puts a heavy emphasis on social and environmental responsibility, as well as transparency and diversity. This shift has made the investing world change its overall mindset and spawned a new class of sustainable investing methods, collectively known as Environmental, Social and Governance (ESG) investing.

In this article, we will take an in-depth look at what ESG investing covers as well as the different issues it tackles. We will also explain why the method has become so popular and what factors are driving it even further.

What Is ESG Investing?

ESG investing is an umbrella term for investments that aim to achieve both financial returns and a positive impact on the environment, society, and performance of a business. ESG covers a broad range of terms, including ethical investing, sustainable investing, impact investing, and socially responsible investing. A good example of ESG is investing in clean air and water initiatives or avoiding investments in tobacco companies or non-sustainable energy industries.

Responsible investing has existed for hundreds of years, but initially, it revolved around exclusion — avoiding investments in sectors and assets that generated negative effects for society. Nowadays, it has developed to include active efforts to influence positive change in a number of social and economic areas. ESG is now viewed as its own investment class and an overall investment approach — a person’s perception of themselves and their role in society as a factor in their investment framework.

The Issues That ESG Investing Tackles

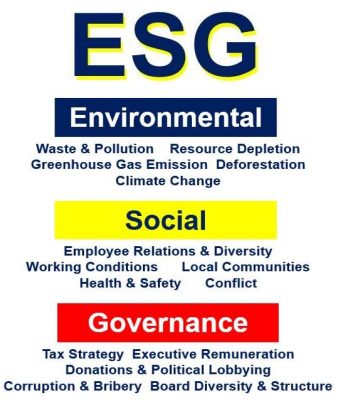

ESG investing considers a variety of environmental, social, and governance issues that are particularly problematic in our modern world.

Environmental Issues

Businesses from many industries generate varying levels of environmental risk related to water, air, land, ecosystems, and human health. ESG factors that influence company investments include preventing pollution, reducing greenhouse gas emissions and climate impact, and minimizing environmental liabilities. Responsible investing also targets issues like resource depletion, deforestation, and energy efficiency. Companies that utilize ESG investing methods mitigate a significant amount of reputation, litigation, and regulatory risk.

Social Issues

Companies in general, and especially large enterprises, can have a significant impact on society as a whole. Investing in working conditions, health and safety measures, employee relations and diversity, as well as human rights is important for every modern brand. Turning the focus to local communities and actively combating slave and child labor are other factors that influence ESG investing. Companies also need to make sure that their products and services are developed with integrity. As a result, businesses that use the ESG investing framework benefit from improved brand loyalty, better staff productivity and morale, reduced turnover, and positive PR.

Governance Issues

In this age of digital information and social media, the way companies are run gets a lot of scrutinies — both from society and from regulatory bodies. Topics like brand independence, diversity, excessive executive compensation, and corporate risk management are on the forefront more than ever. Investing in activities such as board accountability and diversity, reporting and disclosing information, and protecting shareholders should be on the agenda of every modern company. Mitigation and prevention of bribery and corruption, as well as political lobbying and donations, are important in today’s business world.

Why Is ESG Investing So Important?

As we’ve already mentioned, financial incentives are no longer the only factor that motivates investors. The impact of their investments and their role in dealing with global issues takes the center stage more often. The shift in demographic mentality plays an important role here. According to the Cone Communications CSR Study conducted in 2017, 63% of Americans want businesses to take the lead in driving social and environmental change. What is even more striking, 87% will purchase a product because a company was active on a social issue they cared about and 76% will refuse to purchase a company’s products or services if they learn that the company does not share their views on social and environmental topics.

Another major reason for the popularity and importance of ESG investing is its role in risk mitigation. In the current environment, investing in a company or policies that are not ESG-compliant can lead to many problems. Bad publicity, worker strikes, and litigation can seriously harm an investor’s portfolio. From this standpoint, ESG is no longer an alternative way of investing. It is becoming the standard under which all investors should operate.

Factors That Drive ESG Investing

There are a variety of reasons why ESG investing is becoming not only advisable but necessary. Perhaps the most important one is the free access to information in this day and age. The rise of the Internet, social media and 24/7 worldwide news coverage allows people to instantly find out what is happening anywhere in the world. Transparency is at an all-time high, which naturally leads to increased public scrutiny of anything a company says or does. This new playing field gives public opinion the power to make or break a business. Investors are quickly adjusting to that reality.

The push for corporate responsibility and accountability forces companies to direct their capital to ESG initiatives. In turn, this affects how asset managers deal with available funds and interact with businesses.

As a result, ESG regulatory frameworks and benchmarks have emerged, along with investment metrics and tools. The current socio-economic environment not only encourages ESG investing as an overarching mindset — it demands it.

Author Bio

Shannon Bergstrom is a LEED Green Associate, TRUE waste advisor. She currently works at RTS, a tech-driven waste and recycling management company, as a sustainability operations manager. Shannon consults with clients across industries on sustainable waste practices.

Interesting Related Article: “Investing your money? An investment option to consider“