Managerial finance mainly focuses on the analytical aspects of finance rather than the technical ones. It aims to figure out the real meaning of all the data and numbers lingering around in a financial file of a company. When a company can understand and interpret its data, it is then able to make changes and tweak its methods of service accordingly.

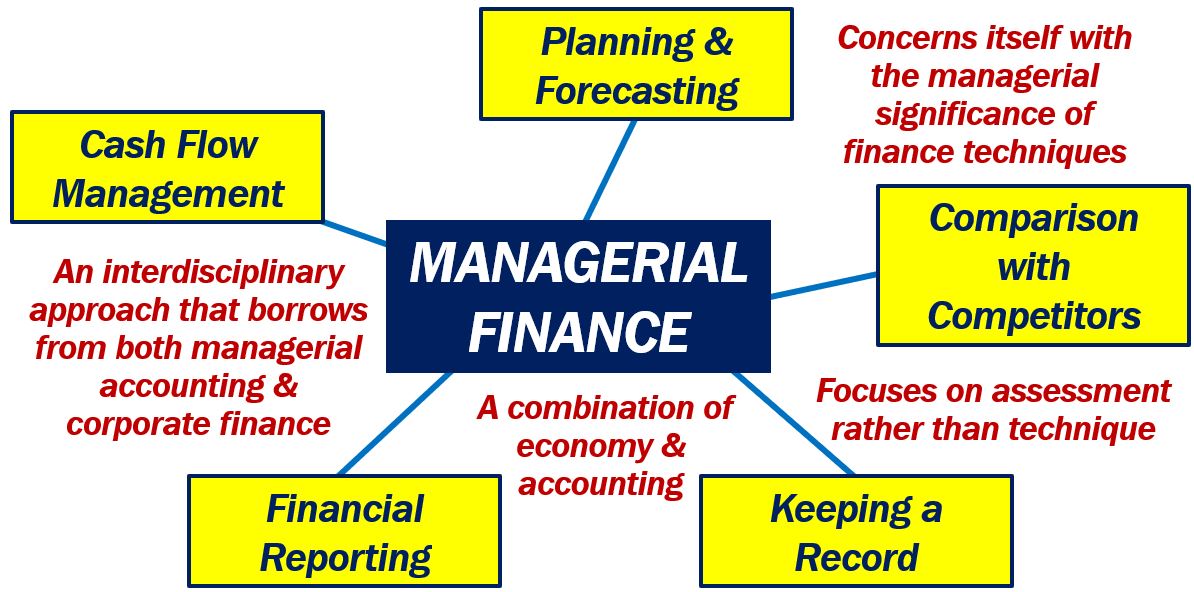

In other words, it is an interdisciplinary approach between corporate finance and managerial accounting that enables a business to operate efficiently and improve performance. The two primary focuses of managerial finance are profit maximization and performance improvement.

People often take education on both an undergraduate and graduate level to enter the field of managerial finance. Universities offer courses such as finance, business economics, and data analysis for students to develop specific analytical and cognitive skills.

Those holding a finance degree or who are already in a managerial position will be best suited for this kind of job. Having a double major in both finance and management would be an added advantage and is in high demand in many businesses.

Many top universities offer online financial management courses that enable you to learn the basics of managerial finance in a short period. It could be beneficial to anyone that does not have a financial background but would like to increase their financial knowledge for managerial purposes.

Key Tasks Incorporated in Managerial Finance

Cash flow management

This helps businesses ensure they have enough finances available to meet their future goals. It also makes it possible for them to analyze ways forward when they do not have the necessary cash flow. They can make decisions to cut down on costs or raise more funding from internal or external sources. Potential problems with cash flow are taken care of by using the company’s working capital (current assets – current liabilities). Once that is figured, it is easier to examine cash inflows and outflows in the future and plan the company’s expenses accordingly so that there are no problems ahead.

Financial reporting

This task is a crucial one when you have to represent your business in front of investors. The managerial department is required to come up with a complete report that includes cash flow, sales, profits, expenses, the percentage change of market share, etc. Moreover, there are certain ratios are also made available using the horizontal and vertical analysis for an in-depth outlook of the company.

Planning and forecasting

This involves the planning of future revenue, expenses, losses, bad debts, etc. to shape or design a budget. It requires assessing the trends of past years and how things have changed recently and implementing the same changes or others in the years to come. A business can alter and adjust the strategies outlined in the planning phase. It might be necessary as the aims and objectives of the company can change over time.

Comparison with competitors

Now, this one involves a bit of extra work. You have to analyze the results of your competitors or estimate their results when it is not publicly accessible. You would then need to compare these figures to your performance, so you identify areas in which they are outperforming you. You will then be able to analyze why this is and what you need to do to improve your performance. Remember, this does not mean simply implementing their strategies or policies in your business but rather to help you find new and creative and new ways to be just as successful as them.

Keep a record

Keeping a record and remaining organised inevitably leads one to success. Hence, no matter what you are doing, do it with an exceptional work ethic and attitude. Also, make sure that you keep track of everything that you do, and in doing so, you will be well and truly on your way to success.

Why Study Managerial Finance?

Whether you are a freshman in college or an experienced working professional, you must have asked yourself this question at least once. Below, we will give you a few reasons why you should select managerial finance as your career.

-

Niche Yet Demanding

It is a field that requires special cognitive skills to be successful. However, it is a field that is in demand in almost all businesses across industries. Hence, there will be a high demand in the job market for someone in this field.

-

Personal and Professional Growth

Since you will be closely involved in all company operations, you will have a unique view of how businesses operate. It can also develop rich interpersonal skills as you will be interacting with a large number of your colleagues, ranging across many departments. It could also develop a collaborative nature within you.

-

Diverse Career Opportunities

Knowledge of financial management is a universally applicable skill and utilised in several industries in a variety of positions.

Advantages of Managerial Finance

- Better decision making: You will have the ability to analyze a situation to improve performance and ensure continued success.

- Control of finance: Makes sure that companies do overspend and do not have a significant amount of bad debts.

- Profit maximization: It assists you to analyze situations and determine what the best steps forward are for success. Also, the improvement will ultimately lead to profit maximization.

- Enhancement of managerial efficiency: This one goes without saying – when you manage everything in a calculated manner, the outcome is bound to come in your company’s favor.

Disadvantages of Managerial Finance

- Costly: As a business, employing someone with a decent amount of experience in this job can be difficult to find and costly.

- Rigidity: Standards of analysis are set within certain parameters, and can be restrictive at times.

- Difficulty in applying control measures: In terms of theory, some of the policies may sound easy. However, when it comes to actual implementation, operational difficulties could occur.

Final Words

If you are a student confused between majors or if you are already in a managerial position, all the above information could be useful to your current and future career. One can be confident to say that a career in this field can create many opportunities.

____________________________________________________________

Interesting related article: “What is Business Finance?”