Airlines globally are expected to post a collective net profit of about $19.9 billion in 2014, up from June’s estimate of $18 billion, the International Air Transport Association (IATA) announced in its Economic Performance of the Air Transport Industry report.

Improved overall profitability is due to falling oil prices and global GDP growth.

IATA says consumers will benefit significantly from the industry’s stronger performance as lower costs and efficiencies are passed through.

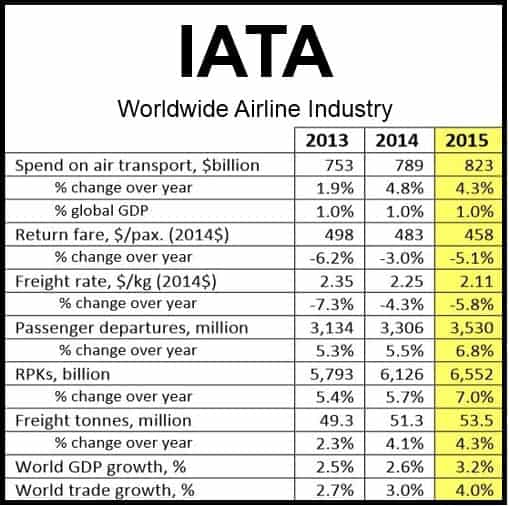

After factoring in inflation, average return airfares (excl. surcharges and taxes) are predicted to fall by about -5.1% on 2014 levels, while cargo rates are forecast to decline by -5.8%.

The predicted $25 billion net post-tax profit represents a margin of 3.2%. In 2015, airlines are expected to make a net profit of $7.08 per passenger, compared to $6.02 in 2014, and $3.38 in 2013.

The ROIC (return on invested capital) is expected to increase to 7% in 2015, versus 6.1% in 2014.

Source: “Economic Performance of the Airline Industry,” IATA.

IATA’s Director General and CEO, Tony Tyler, said:

“The industry outlook is improving. The global economy continues to recover and the fall in oil prices should strengthen the upturn next year. While we see airlines making $25 billion in 2015, it is important to remember that this is still just a 3.2% net profit margin. The industry story is largely positive, but there are a number of risks in today’s global environment – political unrest, conflicts, and some weak regional economies- among them. And a 3.2% net profit margin does not leave much room for a deterioration in the external environment before profits are hit.”

“Stronger industry performance is good news for all. It’s a highly competitive industry and consumers – travelers as well as shippers – will see lower costs in 2015 as the impact of lower oil prices kick in. Airline investors will see ROIC move closer to the WACC. And a healthy air transport sector will help governments in their overall objective to stimulate the economic growth needed to put the impact of the global financial crisis behind them at last.”

2015 Forecast Drivers

Oil prices: have declined considerably since June, and are expected to continue into next year. IATA expects the 2015 full-year average to be $85 per barrel (Brent). If the prediction is right, it will be the first time the average oil price has fallen below $100 per barrel since 2010.

Jet fuel prices: are forecast to average $99.9 per barrel in 2015. The industry is expected to spend $192 billion on jet fuel, which represents just over one quarter (26%) of total industry costs. IATA pointed out “It is important to note that the impact of lower fuel prices will be realized with a time lag, due to forward fuel-buying practices. Improving fuel efficiency continues to be a priority for airlines. Fuel efficiency is estimated to have improved by 1.8% in 2014 and a further improvement is expected in 2015. Fuel efficiency improvements could be accelerated by reducing the 5% of wasted fuel burn as a result of airspace and airport inefficiencies.”

Global GDP growth: is expected to reach 3.2% in 2015, compared to 2.6% in 2014. It will be the first time the global economy has expanded by over 3% since 2010.