Allergan should acquire a company in order to put Valeant Pharmaceuticals’ hostile bid to bed, shareholders are urging. Allergan has $14 billion in cash which could be used to buy a drugmaker, something the company’s stakeholders say should occur as soon as possible.

In an interview with the Financial Times, the Botox maker’s chairman, David Pyott, said “Our stockholders have been fairly clear that if we have a deal that we can do, we should do it soon. On the other hand, Valeant is trying to use our own balance sheet to buy us.”

A large acquisition would slam the brakes on Valeant’s cash-and-stock bid.

An Allergan Shire takeover?

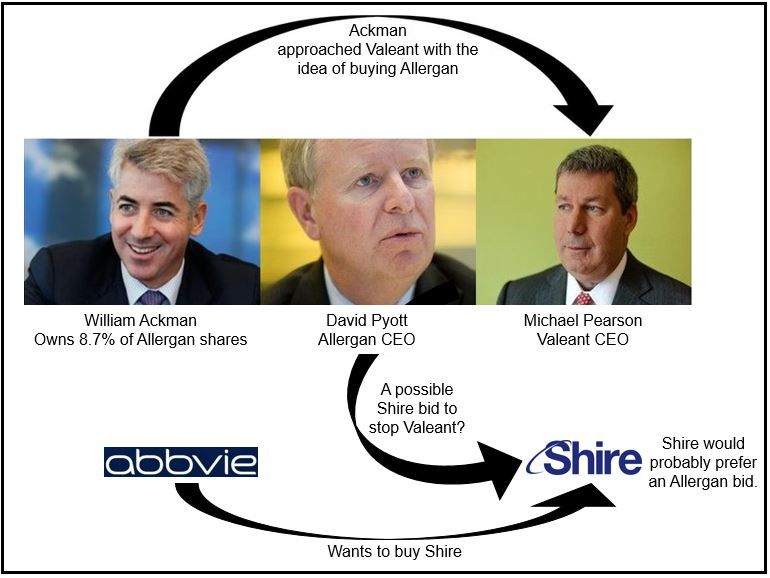

Since activist investor Bill Ackman together with Valeant have been aggressively pursuing an Allergan takeover, rumors are growing about a possible Allergan offer for UK company Shire, which Abbvie is after with a $51 billion bid.

Mr. Pyott made no comment when asked by the Financial Times whether it had any plans on acquiring Shire.

Major investors of both Shire and Allergan say that the UK drugmaker would view an approach from Allergan much more favorably than one from Abbvie, because Allergan’s growth prospects are better.

If Allergan does make a run for Shire it will need shareholder approval, which would then become a wall blocking Valeant’s next step.

Allergan fending off Valeant

After months of unsolicited bids, Allergan’s board flatly turned down Valeant last month, describing the deal as “grossly inadequate”. It cited BofA Merril Lynch and Goldman Sachs & Co, its advisers, who said the offer was inadequate from a financial point of view.

Without acquisitions, Valeant, which has virtually no research and development (R&D) activities, has no future. It has a history of buying companies with good current products and then virtually getting rid of its R&D department. Allergan has made it clear that it does not favor its pursuer’s acquisition-reliant business model.

Valeant bought Medicis Pharmaceutical Corp in 2012. Soon after buying the company, Medicis staff were gathered together and given either black or white envelopes. The black ones contained a letter telling them they were fired. Most of Medici’s R&D employees got black envelopes. Thirty (nearly all) of Medici’s research projects were cancelled.

Valeant has been responding by criticizing what it calls Allergan’s inefficient and expensive cost structure.

How will the Allergan-Valeant-Abbvie-Shire saga develop?

Long- versus short-term spending

While accepting that the company is spending too much on R&D, $1.1 billion in 2013, Mr. Pyott and the rest of the board see Valeant as a non-research extreme with a strategy that will eventually fall flat on its face. He says Valeant also depends too much on price increases and is far less transparent about its activities and performance than the rest of the pharmaceutical industry.

Mr. Pyott says Allergan needs to strike a balance between becoming more selective about which development products to pursue and not end up with projects that just deliver short-term results.

According to Bloomberg, Allergan will cancel unpromising pipeline medication projects and overhaul management incentives, people with knowledge of the matter have commented. The company will outline its restructuring plan during its earnings announcement later in July.

This is a complete change to Mr. Pyott’s plans at the beginning of this year. In an interview with FierceBiotech in January at the JP Morgan conference, he described his bullish plans to expand the company’s R&D wing, which at the time employed about 2,500 people. He said he wanted to employ hundreds more researchers and increase research spending to $1.5 billion over the next five years.

As far as Michael Pearson, Valeant’s CEO is concerned, his acquisition strategy has worked well. From 2008, when he became the Canadian company’s boss, Valeant’s annual sales reached $5.8 billion in 2013, a six-fold increase, while its shares rose in value by 848%.

On Wednesday, Allergan shares closed at $165.20, a 0.5% decline, and Valeant’s fell 1% to $120.94. Allergan shares are 16% up since the start of the hostile bid in April, while Valeant’s have dropped 5%. Allergan is currently trading below the cash-and-stock offer.

Allergan Inc. is based in Irvine, California, and employs 11,400 workers in more than 100 countries. Valeant Pharmaceuticals International Inc. is based in West Laval, Quebec, Canada, and has 17,200 employees. Abbvie is based in Chicago, Illinois, and has 25,000 workers. Shire PLC. is based in Dublin, Ireland, and has a workforce of 5,300.