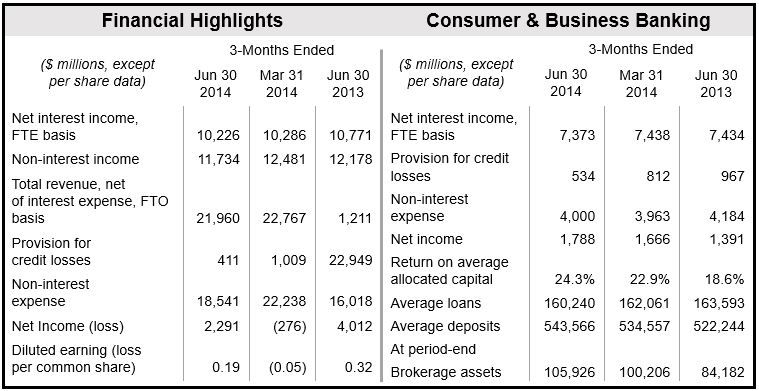

Bank of America Q2 profits plummeted due mainly to a rise in legal costs and a decline in mortgage income. Net income fell 43% from $3.4 billion in Q2 2013 to $2.3 billion in Q2 2014 (19 cents a share). The bank is having to consider a massive settlement with the Justice Department to prevent a new lawsuit.

The second largest bank in the United States has had to pay out huge amounts of money to authorities to repel accusations of illegal practices.

Legal expenses totaling $4 billion during the second quarter wiped out a large slice of its profits.

Excluding legal costs, profits have risen in several of the bank’s main businesses. Earnings from retail banking including credit cards increased $1.79 billion (+28.5%). Even in commercial and investment banking, segments which have done badly in most other banks in the second quarter, profits increased to $13.5 billion (+4.3%).

In March this year, Bank of America, which had been charged with misleading two major mortgage lenders before the global financial crisis, agreed to pay Freddie Mac and Fannie Mae $9.5 billion in the form of a cash payment of $6.3 billion and a $3.2 billion mortgages securities buy-back.

CEO’s optimistic sentiment

Bank of America’s Chief Executive Officer, Brian Moynihan, said:

“The economy continues to strengthen, and our customers and clients are doing more business with us. Among other positive indicators, consumers are spending more, brokerage assets are up by double digits and our corporate clients are increasingly turning to us to help finance business expansion and merger activity. We are well positioned for further progress.”

Chief Financial Officer Bruce Thompson said that during Q2 2014, the bank’s Basel 3 capital ratios improved and credit losses remained close to record lows. “In addition, we did a good job managing expenses. Although litigation expenses were higher than the year-ago quarter, total noninterest expense, excluding litigation, declined 6 percent from the second quarter of 2013,” he added.

The bank says it has reached a $650 million agreement with AIG (American International Group) to settle mortgage securities litigation. When AIG filed the lawsuit in 2011 it had sought $10 billion in losses.

(Data source: Bank of America)

BoA likely giant settlement with Justice Department

A potentially much more difficult hurdle to overcome is a Department of Justice probe into Bank of America’s role in selling faulty mortgage securities before the financial crisis. The bank’s legal representatives met with Justice Department officials on Tuesday. According to The New York Times, unnamed persons who claim to be familiar with the matter said the two sides are nowhere near reaching an agreement.

The Department of Justice had sought up to $17 billion in penalties and customer relief payments. If the bank does not significantly raise its offer, prosecutors have threatened to file a lawsuit.

In afternoon trading today, shares fell by 1.9% as investors tried to process the mixed data, i.e. looming mega settlements and promising performance.

Bank of America’s results came soon after those of the three other giant US banks:

- Wells Fargo: The first major bank to post Q2 results reported an increase in net income of 4%.

- JPMorgan reported an 8% drop in earnings as it struggled with declining incomes from trading and poor mortgage lending. The bank described the second quarter as a period with near-record low levels of volatility and slow client activity across products.

- Citigroup posted net income of $181 million compared to $4.2 billion in Q2 2013. Its results included the impact of a multi-billion charge to settle RMBS and CDO-related claims.