A Citigroup mortgage probe settlement has been agreed with US authorities. America’s third largest bank will pay a total of $7 billion to various government departments as well as a payment for “consumer relief”. The resolution coincided with publication of Citigroup’s Q2 2014 financial results.

Most stock analysts were surprised at the size of the settlement, having expected a much lower sum.

The US Attorney’s Offices for the Eastern District of New York and the District of Colorado had carried out probes into Citigroup’s activities related to the sale and issuance of residential mortgage-backed securities between 2006 and 2007.

A sub-prime mortgage is a type of loan given to borrowers with bad credit ratings who cannot get a conventional mortgage. As the lender believes the borrower is at a greater risk of not being able to pay back the loan, he or she is charged a higher interest rate than on a conventional mortgage.

Breakdown of settlement

According to the US Department of Justice, the resolution was detailed as follows:

$4.5 billion to settle federal and state civil claims by a number of entities related to residential mortgage-backed securities (RMBS).

- $4 billion to the Justice Department to settle claims under FIRREA,

- $208.25million to settle federal state securities claims by the FDIC (Federal Deposit Insurance Corporation),

- $102.7 million to the state of California,

- $92 million to the state of New York,

- $44 million to the state of Illinois,

- $45.7 to the Commonwealth of Massachusetts,

- $7.35 million to the state of Delaware.

The remaining $2.5 billion is to be paid in the form of relief to help consumers who were harmed by “the unlawful conduct of Citigroup”.

$20 billion paid out so far

Since President Barak Obama launched an investigation into mortgages, two banks (including Citigroup) have had to pay a settlement.

In November 2013, JPMorgan agreed to a $13 billion settlement with the Department of Justice regarding serious misrepresentations to customers about many RMBS transactions. In the settlement, JPMorgan emphasized that it had not broken the law. It was the largest ever settlement made by a corporation.

About $4 billion of the resolution went to borrowers (homeowners) who were harmed by JPMorgan’s practices, the aim being to help them remain in their homes. Seven billion went to settle federal and state civil claims. Some of that money also went to investors who lost money. The other $2bn was a fine which was paid to the US government.

Regarding this latest resolution, Eric Holder, the US Attorney General, said the fine is appropriate given how compelling the evidence of wrongdoing is. Even though Citigroup knew how serious and widespread the defects were in the loans they were securitizing, it concealed those defects, misrepresented facts, including the level of risk.

Countless investors were sold defective loans, Mr. Holder added, including federally-insured institutions. False statements were made in documents filed with the SEC (Securities and Exchange Commission), in marketing materials, and in statements to investors.

Citigroup admitted misconduct

“They (Citigroup and its employees) led investors and the public to believe that these financial products had been originated in compliance with the law and key underwriting guidelines when this was often not the case.”

“The bank’s misconduct was egregious. And under the terms of this settlement, the bank has admitted to its misdeeds in great detail. The bank’s activities shattered lives and livelihoods throughout the country and around the world. They contributed mightily to the financial crisis that devastated our economy in 2008.”

The US Attorney General pointed out that Citigroup and its employees may still face possible criminal charges in future, despite having agreed to this settlement.

Citigroup Inc. is based in Manhattan, New York. The bank has 251,000 employees.

Citigroup 2nd quarter 2014 financial results

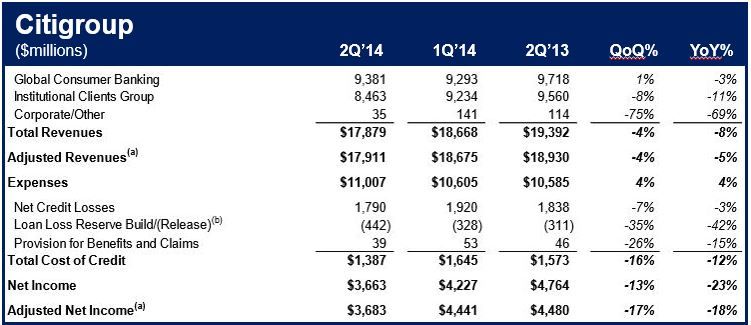

Citigroup reported Q2 2014 net income of $181 million, or $0.03 per diluted share, and revenues of $19.3 billion. In Q2 2013, its net income was $4.2 billion ($1.34 per diluted share), and revenues totaled $20.5 billion.

The Q2 2014 results included the impact of a $3.8 billion charge ($3.7 net of tax) to settle RMBS and CDO-related claims, consisting of $3.7 billion in legal fees and a $55 million loan loss reserve build.

(Source: Citigroup)

Citigroup’s CEO, Michael Corbat, said:

“Our businesses showed resilience in the face of an uneven economic environment. During the quarter, we continued to grow loans in our core businesses, reduce operating expenses by simplifying our products and processes and utilize our deferred tax assets.”

“Despite the significant impact of today’s settlement on our net income, our capital position strengthened to an estimated Tier 1 Common ratio of 10.6% on a Basel III basis, and our tangible book value increased.”