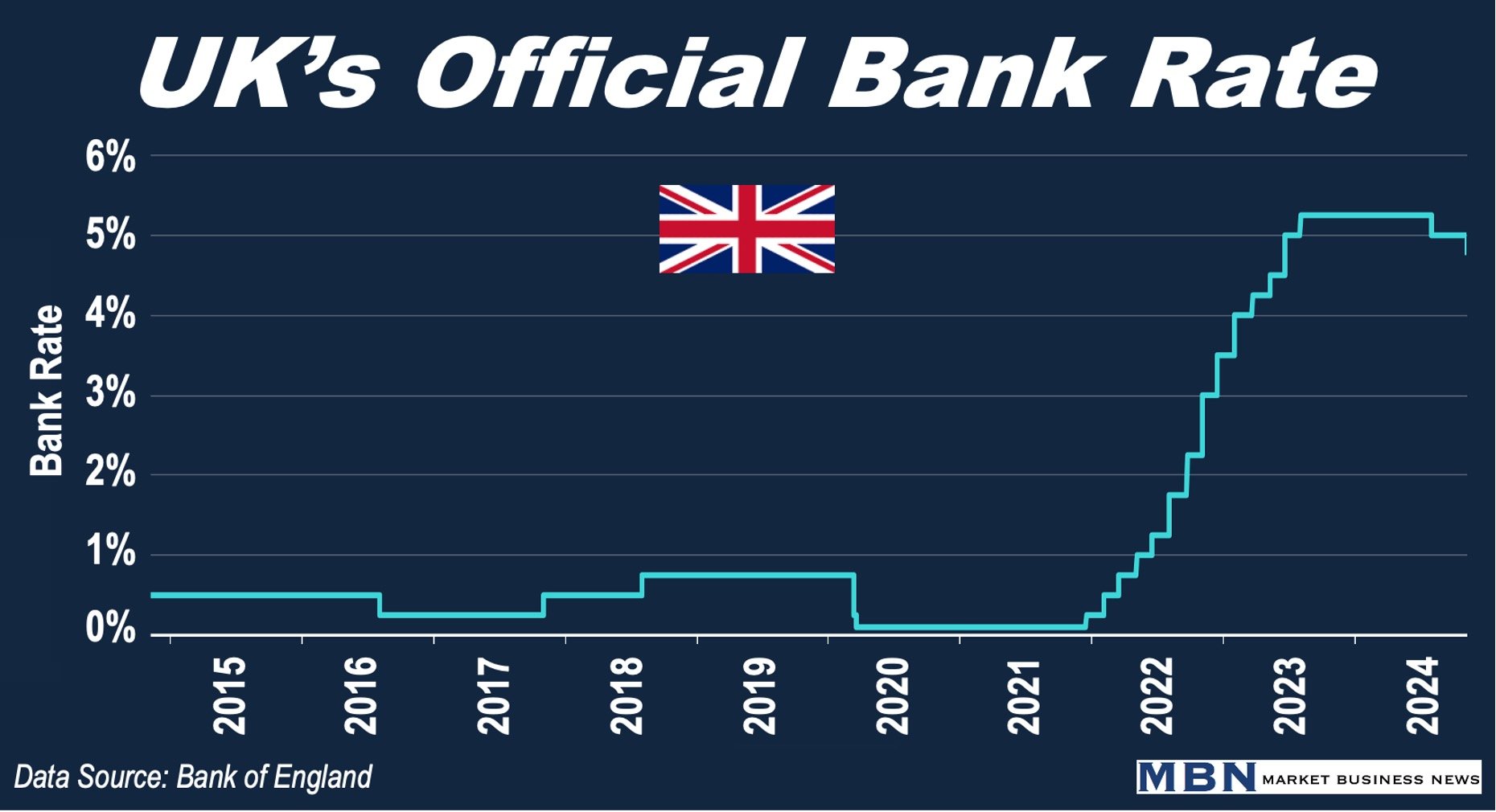

The UK’s central bank, the Bank of England, announced today that it has cut interest rates to 4.75% from 5%. This is the lowest level in over a year. The Bank of England is often referred to as the BoE or simply the Bank.

The Bank’s Monetary Policy Committee (MPC) voted to bring down interest rates by a majority of eight to one. The single opponent voted to keep interest rates at 5%.

In its latest Monetary Policy Report, the BoE informed that in September, inflation fell to 1.7%, which is well below the Bank’s target of 2%.

However, as the impact of lower energy prices falls out of the annual comparison, inflation should increase to approximately 2.5% by the end of this year.

Regarding inflation, the BoE wrote:

“We expect inflation to rise slightly again over the next year, to around 2¾%. Inflation is expected to fall back to the 2% target after that.”

“If inflation remains low and stable it’s likely that we will reduce interest rates further. But we have to be careful not to cut interest rates too quickly or too much. High inflation has affected everyone, but it particularly hurts those who can least afford it.”

The Bank added that the *Chancellor of the Exchequer’s increasing the rate of national insurance contributions and the national living wage risked pushing up inflation if sellers passed on the cost in the form of higher prices in the shops and lower pay rises for workers.

* The “Chancellor of the Exchequer” is the UK’s equivalent of Secretary of the Treasury in the US or Finance Minister in other countries.

The Economy

Britain’s economic growth is expected to slow down but will continue to expand. It will eventually get a tiny boost from the Budget.

Gross Domestic Product (GDP) growth should slow down to 0.2% and 0.3% in the third and fourth quarters, respectively. The economy is projected to grow by 1.7% in 2025, 1.1% in 2026, and 1.4% in 2027, the Bank added.

Regarding GDP growth, the BoE wrote:

“The combined effects of the new measures announced in Autumn Budget 2024, including the additional funding for previous spending pressures, are provisionally expected to boost the level of GDP by around ¾ per cent at their peak in a year’s time relative to the August Report projections.”

“This reflects the stronger, and relatively front-loaded, paths for government consumption and investment more than offsetting the impact on growth of higher taxes.’

The Chancellor of the Exchequer

Britain’s Chancellor of the Exchequer, Rachel Reeves, welcomed the rate cut, adding that it is good news for millions of families.

Ms. Reeves said:

“Today’s interest rate cut will be welcome news for millions of families, but I am under no illusion about the scale of the challenge facing households after the previous government’s mini-budget.”

“This government’s first budget has set out how we are taking the long-term decisions to fix the foundations to deliver change by investing in the NHS and rebuilding Britain, while ensuring working people don’t face higher taxes in their payslips.”

Interest Rates in the US

In the US, the Federal Open Market Committee, which is part of the Federal Reserve Board (the Fed), lowered its benchmark overnight borrowing rate one-quarter of a percentage point (or 25 basis points) to a target range of 4.50%-4.75%.

The vote was unanimous. This follows a larger half-percentage-point reduction in September.

The benchmark overnight borrowing rate sets what banks charge other banks for overnight borrowing. It influences interest rates on mortgages, credit cards, personal loans, auto loans, and other consumer debt instruments.

Summary

The Bank of England has cut interest rates from 5% to 4.75%. The Monetary Policy Committee voted 8 to 1 to cut rates, with the single opponent preferring a hold at 5%.

The Bank attributed expected inflation rises to policies announced by the Chancellor in the October Budget. However, it stressed that the underlying trend was continued progress on disinflation.

The UK’s economy will continue growing, but at a slower rate, the Bank added.

In the United States, the benchmark overnight borrowing rate was cut by one-quarter of a percentage point.