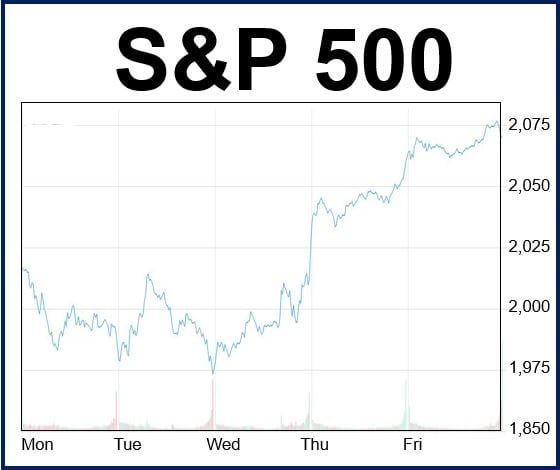

The S&P 500, which lists the stock prices of the 500 largest companies on the New York Stock Exchange, had its best weekly gain in about two years as energy shares recovered after sliding for several weeks.

Shares gained on Wednesday, Thursday and Friday, after a volatile Monday and Tuesday. Investors were encouraged by the Federal Reserve’s comments that monetary policy would remain easy for the foreseeable future.

The S&P 500 increased by 3.1% on Friday and closed the week with a 9.7% gain.

The Dow Jones Industrial Average rose 26.65 points (0.1%) on Friday to 17,804.80. It gained 3% during the week – the highest increase since October.

The Nasdaq Composite Index, which focuses on the stocks of technology firms and growth companies, was 16.98 points (0.4%) higher at 4,765.38.

Most analysts on both sides of the Atlantic believe interest rates in the US will not rise until the second half of 2015.

The S&P 500 had its best week since December 2012.

Stock markets in other countries

Most stock markets around the world had a very good week. The TSX, Toronto’s Stock Exchange, posted its highest weekly gain in three years, after increasing for four days running by the end of Friday. The oil price recovery helped rally energy stocks.

The S&P/TSX Composite Index gained 0.85% (121.51 points) on Friday, ending the day at 14,468.26.

Canadian stock markets tend to shadow the price of oil and commodities.

British shares had their best week since 2011, mainly in response to the Fed’s comments on interest rates, as well as the decline in oil prices. The FTSE 100 rose 79.27 points (1.2%) on Friday to 6,545.

France’s CAC 40 was 3.2% up on the week, while Germany’s DAX rose 2%.