A team of researchers carried out a major international study on businesses and the environment. They found that companies that disclosed and addressed environmental concerns tended to perform better financially.

Siyu Shen, Jun Xie, Hidemichi Fujii, Alexander Ryota Keeley, and Shunsuke Managi, all from Kyushu University in Japan, gathered and analyzed data from 8,547 companies across thirty-four countries.

They wrote about their study and findings in the peer-reviewed, academic journal Corporate Social Responsibility and Environmental Management (citation below).

The authors explained that in business, sustainable practices are not just an ethical responsibility but also a strategic advantage; they are good for business. Companies with better environmentally friendly performance and transparent disclosures can lower their costs and bolster profits.

Investors and Environmental Performance

Investors today are increasingly recognizing companies’ contributions to carbon neutrality, which in turn drives the growth of environmental, social, and governance (ESG) investing.

The Sustainability Accounting Standards Board (SASB), which is based in San Francisco, California, has created an industry-specific framework to assist businesses in disclosing sustainability-related risks and communicating opportunities to stakeholders.

Today, many companies use SASB’s framework to disclose environmental information. In fact, in some countries, such disclosures or transparency have become mandatory.

Impact on Corporate Costs and Profits

Despite progress in corporate environmental strategies, before this study, the link between these practices and financial performance had been unclear.

To examine this, Professor Hidemichi Fujii and his team analyzed data, as mentioned earlier, from 8,547 companies across 34 countries, spanning from 2015 to 2022. They wanted to better understand how environmental performance impacts costs and profitability.

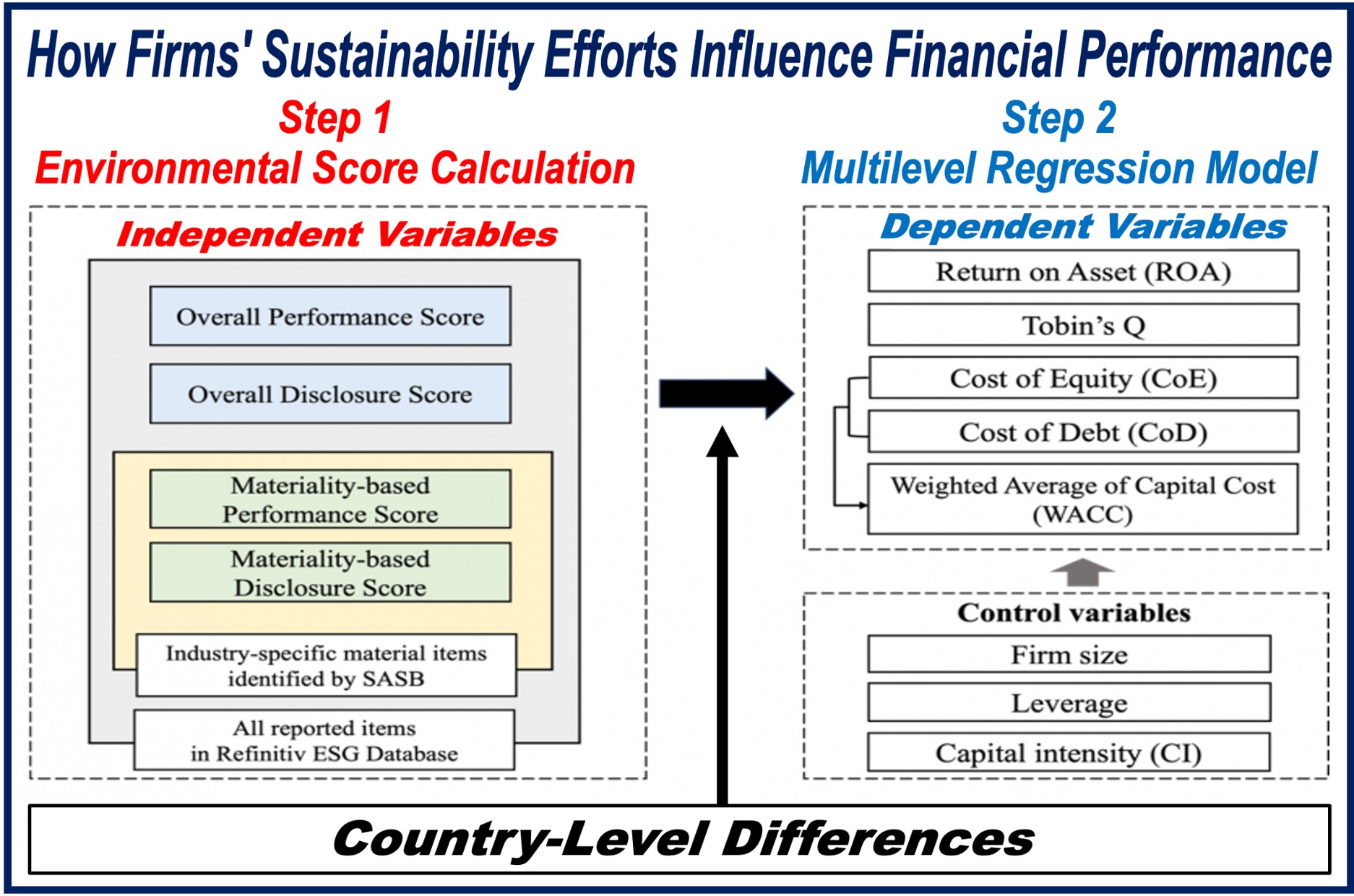

The team developed two quantitative indicators:

- One assessed corporate environmental data.

- The other examined overall environmental scores and materiality-based scores.

First author, Siyu Shen, a graduate student at Kyushu University’s Graduate School of Economics, explained:

“Financial materiality is a relatively new concept. Environmental priorities vary across industries, as different companies face different key environmental challenges.”

“Financial materiality helps investors assess whether disclosed information is relevant and supports informed decision-making.”

Six Areas of Environmental Issues

According to the SASB framework, environmental issues can be grouped into six main areas, which include:

- Greenhouse gas emissions

- Water and wastewater management

- Energy management

- Waste management

- Land use and biodiversity

- Air quality

Water management, for instance, is especially critical for industries like mining, whereas it may not be as relevant for sectors like finance.

Materiality-based scores focus on the issues that are most relevant to a company, assessing how effectively it tackles environmental challenges.

In contrast, overall environmental scores consider all the disclosed data to evaluate the company’s broader environmental efforts.

The team applied the scores from the two quantitative indicators to assess businesses’ disclosures and performance. Their findings revealed that companies with stronger environmental performance—compared to those that focused solely on disclosure—achieved better financial outcomes, including higher short-term and long-term profits and lower costs.

Of note, firms with superior environmental performance tended to attract greater investor interest as well.

Fujii said:

“Investors value what companies do for the environment more than what they say. By taking concrete action on environmental issues, companies signal sustainability and reliability to consumers and investors, lowering perceived risks, and strengthening their appeal as stable and ethical investments.”

Environmental vs. Materiality-Based Scores

Overall environmental scores had a stronger and more positive link to financial performance compared to materiality-based scores, which showed only a limited correlation.

This contradicted the researchers’ hypothesis, prompting them to gather and analyze data on environmental efficiency across several countries.

After examining the global data, they found that environmental efficiency is more strongly linked to financial performance in advanced economies, such as Japan and the US.

The link remained less significant in countries like Chile and Indonesia, that is, in developing countries.

Shen explained:

“This difference likely reflects variations in environmental regulations and public awareness across countries. In more economically developed countries, where companies have long been engaged in sustainability efforts, improving environmental efficiency can enhance profitability and market valuation.”

“Meanwhile, in developing regions, as the overall regulatory frameworks are still developing, the priority is placed on environmental performance and transparency rather than efficiency.”

The team is conducting further research into how macroeconomic variables, including regulatory frameworks and social conditions, impact corporate sustainability initiatives and financial performance across different countries.

Their aim is to provide scientific evidence showing how corporate environmental information disclosure and conservation efforts impact economic performance.

Fujii added:

“We expect our international comparative studies to offer useful information for promoting effective policy planning to promote proactive responses to environmental issues.”

Citation

Shen, S., Xie, J., Fujii, H., Keeley, A. R., & Managi, S. (2023). Does environmental materiality matter to corporate financial performance? Evidence from 34 countries. Corporate Social Responsibility and Environmental Management. https://doi.org/10.1002/csr.3062