There are many different types of people. There is no one-size-fits-all solution, however, psychologists have come to the conclusion that most of the people prefer staying on the safe side rather than on a high-risk high reward road. It is quite apparent in the gambling business as well as the general foreign exchange market or any other type of trading.

These aspects are usually dictated by the overall feel of confidence at that moment and time. This can even influence how we perceive the situations and overall “luck” factor as well. Have you ever felt lucky? Have you ever felt like something would work for sure and it did? This is the power of motivation and belief in oneself.

Promotion-focused

Promotion-focused people set their goals according to their expectations of the reward. This means that their attention and focus is shifted to the outcome of the ordeal rather than the process. These are the types of people who “play to win” and are the most dangerous competitors. You will recognize them as people who always take their chances and play on a high-risk high-reward odds. Fast thinking, emotional spectrum, as well as positive thinking, and most of all chance-taking make these people most prone to making errors.

All of this ends up with them being wet in the water without a plan B to substitute if something goes wrong. However, it is a price they are absolutely willing to pay because for them losing out on a chance to achieve something is more damaging than the loss caused by this undertaking.

Bull traders

These are the types of people who either come out of a casino with full stacks of riches or lose everything they had. In trading, these people exhibit a more aggressive type of strategy and are called bull traders. Companies like Axiory, which is one of the most popular brokerage firms in the world, adore bulls. They believe that working with these types of people is the most exciting and usually the most profitable one as well.

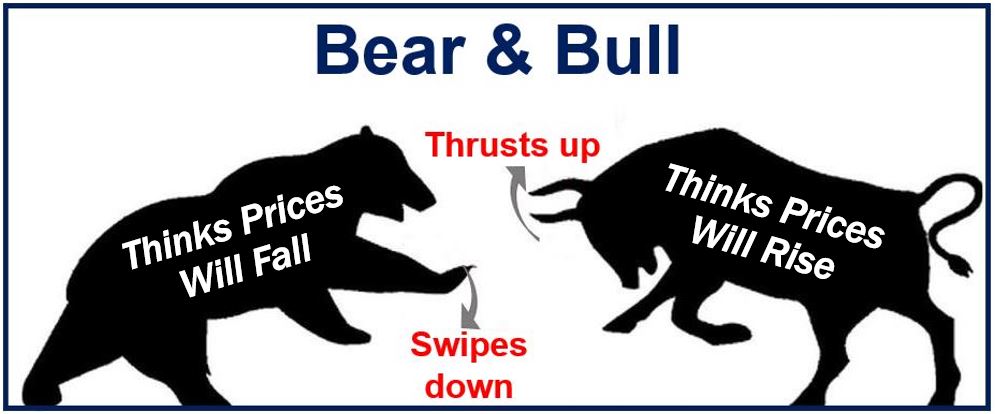

A bull is an investor who works on the part of the market they believe is poised to rise. To put it into simple terms, the bull is an investor who buys assets under the assumption that the prices will rise and they will sell them later. It is one of the most popular ways of trading out there due to the sheer excitement factor and active playstyle.

Risk takers

Bulls are very optimistic and aggressive investors taking risky assumptions. The way they regulate the losses is by using the stop-loss orders, which means that they will close the trade as soon as the asset hits the set amount of low price. This is when they usually get rid of the asset to avoid losing as much money as possible.

These people are very promotion-focused and are always looking out for the high reward trades like back in 2010 when a lot of bulls made huge winnings on Caterpillar, Inc. stocks. However, it is not as easy as just jumping on the bandwagon buying up something and hoping it will increase in value. A bull has to know how to use charts for FX trading with maximum efficiency to make sure that the information gained from dissecting these very charts is accurate to make their trade as safe as possible because in the end, who likes losing money.

Prevention-focused

Prevention-focused people are an absolute opposite of promotion-focused counterparts. The way this works is that these people view their goals as responsibilities and thus are concentrating on staying safe rather than aggressive and risky moves.

Risk averse

These are the people who constantly worry about what can go wrong and are trying to avoid as many risks as possible. This results in a careful trader, who always works on the advancement of their project but keeps a plan B active to make sure that even if something goes wrong they have another option to fall back to.

Prevention-focused people are very vigilant and play not to lose. This means that their work is usually more thorough, accurate, and planned out. In foreign exchange market terms, these are called bears.

Bears

A bear is an investor who thrives during pessimistic times, like now due to the novel coronavirus pandemic. The bearish trader believes that the asset they are trading is going to lose value. The main profit comes from exactly these patterns where the trader tries to benefit from the falling prices of the currency pairs or other types of commodities, securities, or what have you. For example, if an investor is bearish, this means that if Standard & Poor 500 (S&P 500) they would anticipate the fall of the prices and try to profit from the decline in the market index.

Axiory believes that the bearish nature of trading can be very meticulous, but judging from the trend that over the past 100 years the United States stock market has increased by 10%, every bearish trader has lost money in the long term.

Final thoughts

This is not to get you down or discourage you from using certain strategies. The main draw from all of this information should be that there is no one way one can act. Since we used trading as an example for everything lets continue on that point with this last example. Ideally, no successful trader has ever been only bullish or bearish. Basically the more success can be found if one switches around these two in different case scenarios.

Sometimes it is better to be more promotion-focused as it grants the ability to make faster decisions, however, other times it’s better to focus on prevention due to the nature of work. If you have enough time and energy to deal with something meticulously then you should always opt for it. Overall, do not back down and be afraid as that is a surefire way to failure.

Interesting related articles: