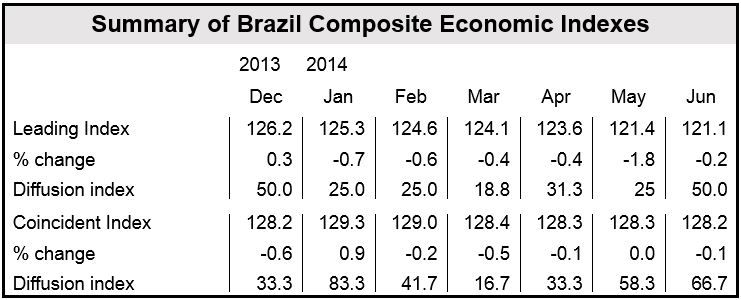

The Brazilian Leading Economic Index (LEI) fell 0.2% in June, after declining in May (-1.8) and also in April (-0.4). The index has fallen for six successive months. The country’s LEI now stands at 121.1 (2004 = 100). Of the eight components that make up the LEI, four contributed positively.

Update August 19, 2014: In July, Brazil’s LEI and CEI both increased.

A steep fall in manufacturing more than offset the positive contributions from the terms of trade index, the inverted interest rate, and stock prices.

During the first half of this year, the LEI has declined by -4% (c. -.7.9% annual rate), a greater fall than during the previous six months (-0.9% or -1.7% annually).

In recent months, the weaknesses among the leading indicators have been widespread.

Below is a breakdown of the positive/negative contributions made by the eight components to June’s LEI:

- stock prices (positive),

- the swap rate (inverted) (positive),

- the terms of trade index (positive),

- the consumer survey: expectations index (positive),

- the manufacturing survey: expectations index (negative),

- the exports volume index (negative),

- the consumer durable goods production index (negative),

- the services sector survey: expectations index (negative).

Paulo Picchetti, an Economist at FGV/IBRE, said:

“The Leading Economic Index (LEI) for Brazil deteriorated further in June, with unfavorable expectations continuing to play a large role in the LEI’s lackluster performance. However, current economic conditions – as measured by the CEI – have remained relatively stable recently, with resilient labor markets offsetting the weakness of output.”

“Moreover, the decline in the LEI during the first half of 2014 has not yet been as steep as during previous economic downturns.”

Ataman Ozyildirim, an economist at The Conference Board, believes that the six months of consecutive decline suggest weakening economic conditions for Brazil in the second half of 2013. “Even though financial indicators improved in June, the deterioration in the overall performance of the LEI suggests that the current below-trend growth will continue through the end of 2014,” he said.

(Data source: The Conference Board)

Coincident Economic Index

The CEI (Coincident Economic Index) for Brazil slid 0.1% in June to 128.2, after no change in May and a 0.1% fall in April. Of the six components that make up the CEI, three contributed positively in June.

The CEI has remained unchanged over the first six months of this year, compared to a 0.1% increase (c. 0.2% annually) during the previous six months.

Below is a breakdown of the positive/negative contributions made by the six components to June’s CEI:

- the occupied employed population (positive),

- the volume of sales of the retail market index (positive),

- the average income of workers (positive),

- shipments of corrugated paper (negative),

- industrial production (unchanged),

- industrial electric energy consumption (unchanged).

Brazil’s real GDP (gross domestic product) grew by 0.7% (annually) in Q1 2014, compared to 1.8% in Q1 2013.

According to The Conference Board and the Fundação Getulio Vargas, the joint publishers of this report, with Brazil’s LEI declining throughout this year and its CEI registering no growth, the country’s “current modest rate of economic expansion is unlikely to accelerate in the second half of this year.”

According to the Brazilian Institute of Geography and Statistics, Brazil’s GDP grew by only 0.2% in the first quarter of this year.