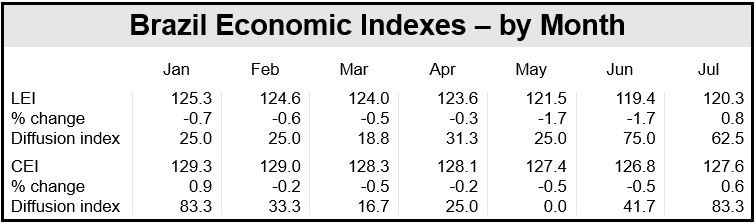

After declining for six months running, Brazil’s economic outlook improved in July, according to The Conference Board. The country’s Leading Economic Index increased by 0.8% in July, and its Coincident Economic Index rose 0.6%.

Brazil’s LEI (Leading Economic Index) and CEI (Coincident Economic Index) is published by The Conference Board together with the Fundação Getulio Vargas.

The LEI forecasts future economic activity – a rising index suggests a positive outlook. The CEI reflects current economic conditions; it helps economists and investors pinpoint where exactly in the business cycle the country’s economy is.

Brazil’s LEI

Of the eight components that make up the LEI, five contributed positively to July’s figure. Below is a list of the eight components and how they contributed:

- Consumers Survey: Expectations Index (positive).

- SWAP Rate (positive).

- Exports Volume Index (positive).

- Services Sector Survey: Expectations Index (positive).

- Stock Prices: BOVESPA Index (positive).

- Manufacturing Survey: Expectations Index (negative).

- Terms of Trade Index (negative).

- Consumer Durable Goods Production Index (negative).

After July’s 0.8% increase, Brazil’s LEI currently stands at 120.3 (2004 = 100), after declining by -1.7% in May and -1.7% in June.

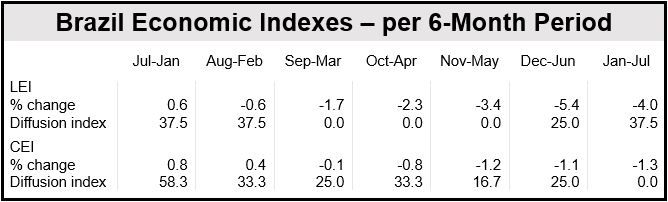

Brazil’s LEI over a six-month period ending on July 31 fell -4%, with just three of the eight components contributing positively.

(Data source: The Conference Board)

Brazil’s CEI

Of the six components that make up the CEI, four contributed positively to July’s result.

Below is a list of the six components and how they contributed:

- Shipments of corrugated paper (positive).

- Volume of sales of the retail market index (positive).

- Occupied employed population (positive).

- Industrial production (positive).

- Average real income of workers (unchanged).

- Industrial electric energy consumption (unchanged).

After July’s 0.6 increase, Brazil’s CEI currently stands at 127.6 (2004 = 100), following a -0.5% decline in May and -0.5% fall in June.

Over the six-month period ending on July 31, CEI declined by 1.3% – none of the components made a positive contribution.

(Data source: The Conference Board)

Too early to declare a rebound

Paulo Picchetti, Economist at the Fundação Getulio Vargas, said:

“The July gains in both the LEI and CEI are noteworthy given six months of consecutive declines, however it’s still too early to suggest a pickup in economic activity. July’s improvement was accompanied by decelerating prices which in turn helped improve expectations concerning future monetary policy, and consumers and service sector expectations also improved.”

Jing Sima, Economist at The Conference Board, said:

“July’s increase in the LEI for Brazil was mainly driven by improvements in exports, the service sector, and stock prices. Nevertheless, domestic demand remains sluggish and manufacturing indicators have been declining persistently. Despite July’s improvement, the growth in the LEI continues to suggest that the Brazilian economy is unlikely to gain much traction in the coming months.”