Nineteen British insurers had their capital calculation models approved by the Bank of England on Saturday, 5th December, among them the Society of Lloyd’s, Prudential Plc and Aviva Plc. This means that under the new rules they will be able to lower costs.

The Bank of England’s (BoE’s) approval means a company can use its internal model to determine how much capital it holds to make sure it is able to meet policyholder commitments under European Union Solvency II capital rules that will come into force in January, 2016.

The BoE said that today’s announcement marks a major step forward for the British insurance industry preparing for the arrival of the Solvency II regime.

Without the approval, the insurer has to use a standard calculation method of its solvency set out by regulators, which generally leads to bigger capital requirements. Higher capital requirements often means the company has to raise additional capital or reduce dividend payments to stockholders.

The Amsterdam-based insurer Delta Lloyd Group abandoned its model earlier this week and went for the standard formula. It is planning to raise €1 billion (₤720,000) in fresh capital.

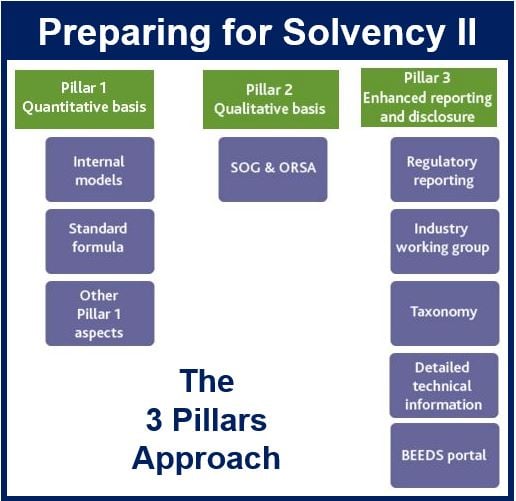

The ‘3 Pillars’ approach to Solvency II – a method which categorises the requirements of the Directive.

The ‘3 Pillars’ approach to Solvency II – a method which categorises the requirements of the Directive.

Approvals described as ‘a major milestone’

Andrew Bailey, Deputy Governor, Prudential Regulation, Bank of England and CEO of the PRA said today:

“Today marks a major milestone in the implementation of Solvency II in the UK. The PRA has approved 19 insurers’ internal models for use from day one of the new regime.”

“Going forward we will monitor insurers’ models carefully in order to ensure they continue to deliver an appropriate level of capital.”

The BoE approved the Solvency II internal models of the following insurers:

– Unum European Holding Company Ltd,

– The National Farmers’ Union Mutual Insurance Society Ltd,

– Standard Life Plc,

– Society of Lloyd’s,

– Scottish Widows Group,

– RSA Insurance Group Plc,

– QBE European Operations Plc,

– Prudential Plc,

– Phoenix Group,

– Pension Insurance Corporation Plc,

– Pacific Life Re Ltd,

– MBIA UK Insurance Ltd,

– Markel International Insurance Company Ltd,

– Legal & General Group Plc,

– Just Retirement Ltd,

– British Gas Insurance Ltd,

– Aviva Plc,

– Aspen Insurance UK Ltd,

– Amlin Plc.

All the FTSE 100 insurers that submitted their internal models in this round were approved.

The Prudential Regulation Authority has not disclosed whether an insurer’s application has been rejected or withdrawn.

The BoE said in a statement:

“A number of insurers are planning to apply for model approval later than 1 January 2016. These insurers are continuing to develop internal models to the standards required by the Directive, and are expected to apply for approval in due course.”

John Parry, Lloyd’s Director of Finance, and Sean McGovern, Chief Risk Officer & General Counsel, commented:

“This is an important milestone for Lloyd’s and required a great deal of collective effort from the Lloyd’s market and the Corporation of Lloyd’s over a number of years. We are extremely grateful for the work that involved so many across the market to help achieve this outcome. We would also like to note the widespread support and commitment to the Internal Model Application, which reflects the unique nature of Lloyd’s capital efficiency and security.”