The Bank of Canada’s winter Business Outlook Survey predicts continued strengthening demand, especially among exporting companies and manufacturers. However, for firms linked to the energy sector, the outlook has deteriorated.

The central bank said:

“Business sentiment remains positive, but falling prices have significantly dampened the outlook for firms tied to the energy sector.”

Since the survey of about 100 companies was carried out (Nov 17 to Dec 11), oil prices have fallen even further.

Overall, companies are expected to see sales growing at a marginally faster pace over the next 12 months. Forty-three percent see sales increasing compared to 35% that predict a decline. The 8% difference is the lowest since Q3 2012.

Percentage of respondents expecting faster growth minus the percentage expecting slower growth (Image: Bank of Canada).

Companies expecting a positive impact from the economic outlook in the United States are more optimistic than others, the report informs.

Canadian companies that export to the United States see a weakening loonie boosting their competitiveness. Seventy-five percent of Canadian exports go to the US.

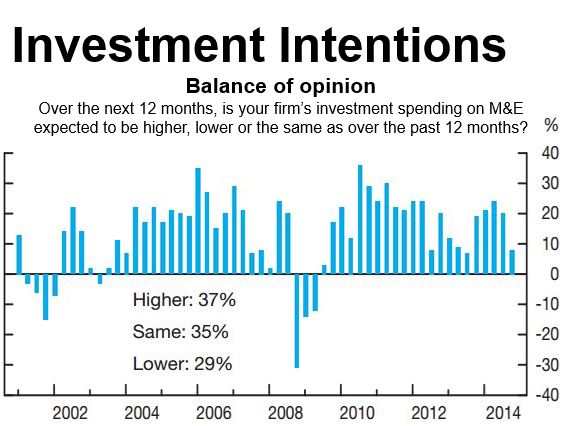

Hiring intentions and investment plans are stronger among manufacturers than businesses in other sectors. For most manufacturing companies, investment projects are aimed at raising production. The balances of opinion on investment and employment overall, however, have declined.

Thirty-seven percent of respondents expect higher expenditure on equipment and machinery, compared to 29% that predict lower investments, leaving a positive balance of 8%.

Percentage of respondents expecting higher investment minus the percentage expecting lower investment (Image: Bank of Canada).

Canadian business’ overall inflation expectations have also declined, with the majority of firms predicting price rises of 1% to 2%, which is below the Bank of Canada’s 2% inflation target.

Most respondents reported no change in credit conditions over the past quarter, and the balance of opinion was close to zero. Among those reporting a tightening, the majority were large firms that source their financing from capital markets. “Overall, however, most businesses continue to characterize credit as easy or relatively easy to obtain,” the survey informed.

The report bolsters expectations that Canada’s central bank will postpone considering raising interest rates. Analysts believe it will also revise down its GDP growth forecasts.

Canada is more sensitive to oil and commodity prices than other advanced economies. About one-third of all its private non-residential capital spending comes from the oil & gas sector.

Citation: “Business Outlook Survey. Results of the Winter 2014–15 Survey“ | Vol. 11.4 | 12 January 2015. Bank of Canada.