House prices in Canada may be overvalued, warns the Bank of Canada, and by up to 30%. However, Stephen Poloz, the central bank’s governor, believes the country’s property market is in for a soft landing rather than a bursting bubble.

As the economy improves. Mr. Poloz says the market will unwind gradually, despite homes being overvalued.

After releasing its review, Mr. Poloz said at a news conference:

“We believe the economy is gathering strength. It’s beginning to rebuild itself. It’s going to create new jobs and income is going to go up. And all those kinds of metrics are going to start to look better, and so the sustainability of the housing market will be buttressed by that. So, that’s our main source of reassurance from this.”

In its semi-annual financial system review, Canada’s central bank estimated that the housing market may be overvalued by between 10% and 30%.

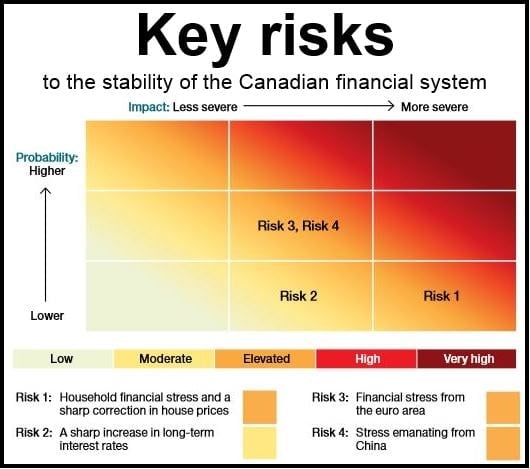

Source: “Financial System Review, December 2014,” Bank of Canada.

Despite the broadening of the economic recovery, the review informed there are three key vulnerabilities in the system: 1. Increased investor risk taking. 2. High household indebtedness. 3. Imbalances in the housing market.

“To some extent, all three are normal side effects of stimulative monetary policy. However, the post-crisis recovery has been frustratingly slow – we have called it serial disappointment – and bond yields and policy interest rates have been unusually low for a long time. In this context, these financial vulnerabilities have built up over time.”

Canada’s major financial Achilles heel is its growing household debt, most economist say. Even older Canadians are entering retirement with growing levels of debt.

Last week, Mr. Poloz said the bank expects to keep interest rates at their ultra-low levels until at least the second half of 2015.

Low interest rates, which have been frozen for over four years, have encouraged people to accumulate debt, a trend that has helped boost the economy. However, personal debt has reached alarming levels and shows no signs of slowing down.

Fierce competition among lenders has helped push Canada’s household debt-to-income ratio to a near-record high, the Bank of Canada informed. Perhaps consumers have been encouraged to borrow too much, resulting in financial institutions making deals with riskier clients.

Twelve percent of Canadian citizens are “highly indebted,” nearly double the level recorded at the beginning of this century. Those 12% currently carry approximately 40% of Canada’s overall consumer debt load.

According to the review:

“Among the current generation of young households, those who own homes carry more mortgage debt relative to income than previous generations did at the same age.”