Canadian GDP shrank by 0.1% in August, caused by a particularly weak goods-producing sector and lower energy output, Statistics Canada announced on Friday, surprising economists.

The Royal Bank of Canada had expected zero growth for August, not a contraction. As soon as the figures were published, the Canadian dollar fell.

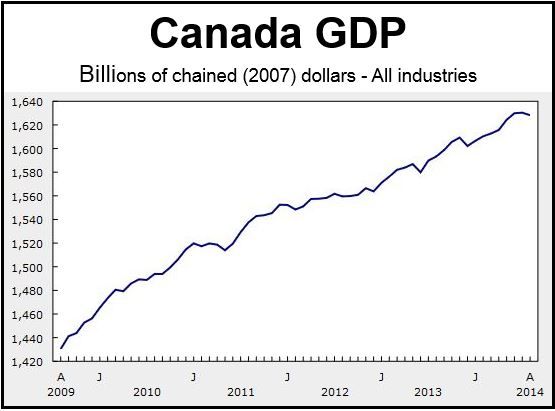

The Canadian economy had posted zero growth in July, 0.3% and 0.5% growth in June and May respectively. In every of the first six months of this year the country posted positive growth.

Goods production declined by -1% in August as the majority of subsectors posted falls, led by oil & gas extraction and manufacturing.

Utility industries grew by 0.2% in August. The most notable gains were seen in the public sector, i.e. public administration, health and education.

The insurance, finance and wholesale trade sectors posted gains, while warehousing services, transportation and retail fell.

Oil & gas extraction, quarrying and mining fell by -1.7% in August, the second successive monthly decline.

The Bank of Canada had forecast 2.3% annualized GDP growth for the third quarter. The result will probably be lower, maybe just 2%.

For those trying to guess when interest rates start to rise, most bets are now on for the second half of 2015, and probably during the last quarter.

Weak business investment and exports are holding back economic growth in Canada, which Stephen Poloz, Governor of the Bank of Canada, says are vital for building a recovery.

October marked Canada’s longest period without any interest rate hikes since the 1950. Mr. Poloz says it will be at least 24 months before the country returns to full output.

It is hoped that some kind of economic rebound may occur later this year with higher exports on the back of accelerating US growth and a weaker Canadian dollar.

The Department if Finance announced on Friday that Canada’s federal deficit in August declined to $300 million from $2 billion in August 2013. The government will probably have a budget surplus next year.