Why are Canadians saving less today? Fifty-one percent of Canadian workers now say they are living from paycheck-to-paycheck, and would be in serious trouble if their pay were delayed by just one week, says the sixth annual National Payroll Week Research Survey, carried out by the Canadian Payroll Association.

The main reason for the growing financial squeeze is the low rate at which wages have risen – they have not kept up with inflation during the last few years.

The survey also reports that workers are spending significantly more on home renovations, education and their children.

A growing number of Canadian employees are also falling behind on their retirement goals.

Twenty-six percent of respondents said they would not be able to pull together $2,000 over the next four weeks for an emergency.

Canadians saving less

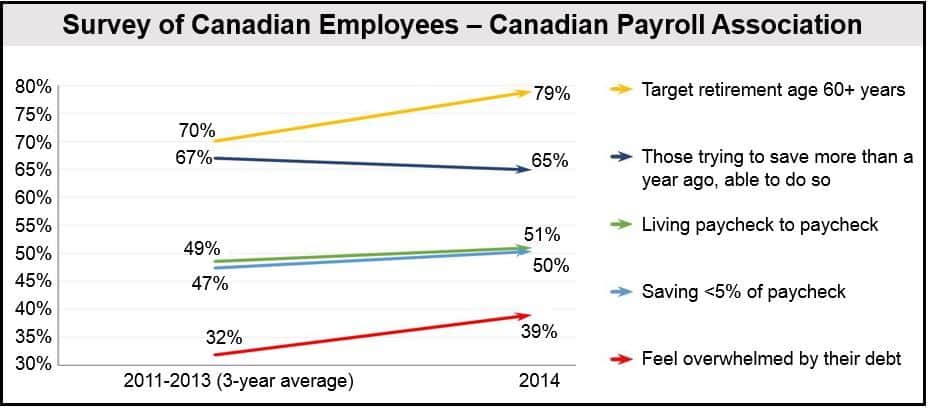

Half of all workers are saving 5% or less of their wages, compared to 47% over the past three years.

According to financial experts, we should put away about 10% of pay for retirement.

Of the respondents who say they are trying to save more now than one year ago, fewer find they can (65%, compared to an average of 67% over the last two years).

Below is a list showing the percentage of people spending all or more than they earn each month in three regions:

- Manitoba: 58%,

- Atlantic Canada: 58%,

- Saskatchewan: 54%.

Canadian Payroll Association President and CEO, Patrick Culhane, said:

“Those who are trying to save but finding it hard to succeed should consider directing a portion of net pay into a separate savings account and/or a retirement savings program. They can speak to their organization’s payroll practitioner to arrange this.”

Postponing retirement

Seventy-nine percent of respondents said they are postponing retirement until they are 60 or older, compared to 70% over the last three years. The vast majority say it is because they have not been able to save enough money.

The amount people feel they need in order to retire continues to rise:

- 18% today believe that savings below $500,000 would be enough to retire, compared to 21% during the last three years,

- 68% feel that they need from $500,000 to $2 million, versus 60% over the last three years.

Even though people believe they require greater nest eggs, most of them (75%) have put aside less than one quarter of what they require in retirement, compared to 73% over the last three years.

Even among older workers (aged 50+), forty-seven percent still have less than a quarter of the required amount, suggesting there is a serious savings gap in Canada today.

(Data source: Canadian Payroll Association)

Many Canadians heavily in debt

Thirty-nine percent of respondents say they feel overwhelmed by their debt levels, compared to 32% before. Twelve percent, in fact, believe they will be in debt for the rest of their lives.

One third of those surveyed report higher debts today compared to one year ago.

Twenty-seven percent of workers believe the best way to improve their financial situation is to earn more money. Spending less used to be the most popular solution – it is now in second place (after ‘earning more’), followed by reducing debt.

Mr. Culhane says that earning more is not always possible. According to the CPA, the best strategy for financial well-being is to have money automatically transferred into savings through the payroll.

Marie Lyne Dion, CPA Chairman, said:

“Even though the Canadian economy did well relative to other G7 countries in the past decade, many employed Canadians say they are having a difficult time making ends meet. They feel unable to put aside enough money to reach their retirement savings goal. That’s where payroll professionals can help, by assisting employees in setting up their contributions to a savings plan or retirement program.”