The Great Recession began in December 2007 after severe financial liquidity problems in the interbank lending market.

The first sign of the crisis was when the French bank BNP Paribas suspended three of its funds because of the U.S. subprime mortgage sector preventing proper calculation of their value.

Causes of the great recession include:

The U.S. Financial Crisis Inquiry Commission concluded that the crisis was avoidable.

Ravi Jagannathan, a professor of finance at the Kellogg School of Management, argues that one of the main causes of the great recession comes down to “massive shifts in the labor supply in developing countries” and “the inadequate responses to these shifts are the real culprits behind the recession.”

Red = countries affected by the great recession as of March 2009

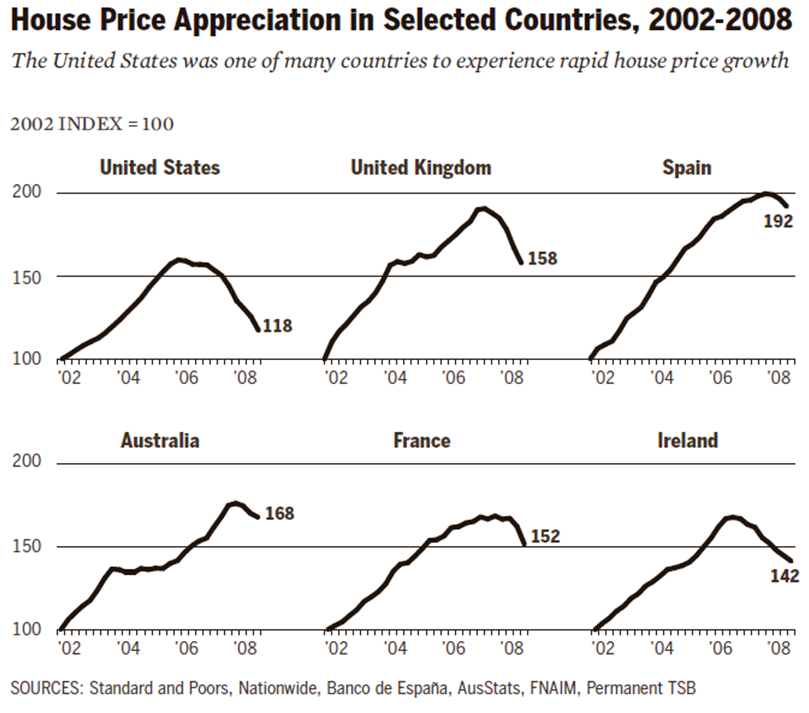

How the real estate bubble caused the great recession

In 2008 major financial institutions were at a serious risk of failure because of risky investments made in securities that lost nearly all their value when U.S. and European housing bubbles began to burst. An excellent example of this would be the collapse of the investment bank giant Lehman Brothers Holdings Inc.

The two factors that led to the housing bubbles were:

- Low interest rates in the U.S. and Europe after the U.S. recession in 2001.

- Major growth in savings from developing countries because of ongoing trade imbalances.

While housing prices increased so did household debt levels. People began to refinance their mortgages. However, in late 2007, credit markets put funding mortgage-related investments on hold and as a result American homeowners weren’t able to refinance and borrowers started to default.

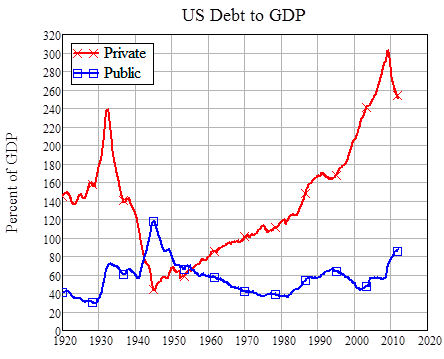

Private debt

In 2008 total American Private Debt was at 310% of Gross Domestic Product (the highest since 1929). As you can see in the chart below private debt soared after the Great Depression up until 2007 (when the U.S. recession started).

Many economists say the housing boom-bust cycle is linked to the higher frequency of credit crunches over the past fifty years, which tend to either exacerbate, prolong or cause economic recessions.