Veteran importers are familiar with the requirements for filing the CBP’s necessary Customs form 7501 and navigating their way around them. However, first-timers may be confused. This article covers the basics of what you need to know to familiarize yourself with filing form 7501 to ensure the release of your goods from customs.

Form 7501 & customs clearance

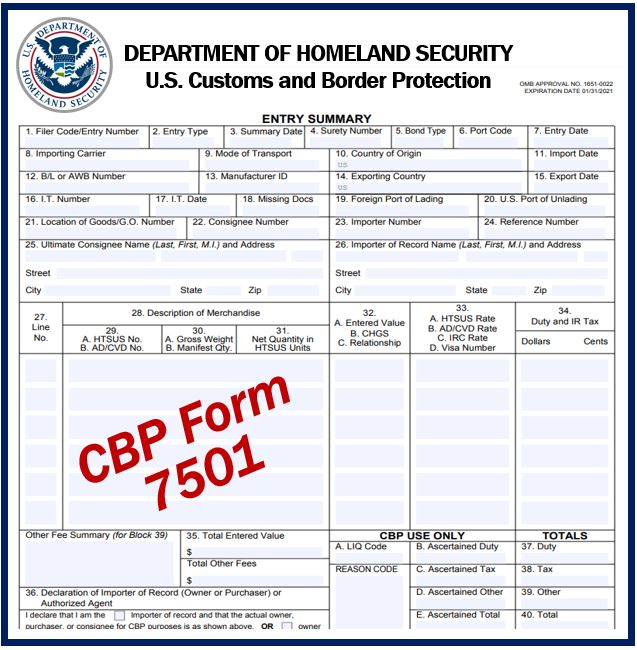

The Customs Form 7501, also called the Entry Summary, stipulated that every shipment entering the U.S. must adhere to customs clearance requirements. Importers must file the Entry Summary to achieve this.

The form isn’t meant to be an obstacle for importers but ensures the following for the CBP:

- Protect the U.S. from fraud, copyright infringements, illegal import of substances, and importantly, prevent arms trafficking. In addition, these requirements are there to protect the general public.

- Of course, the U.S. aims to boost its profits by evaluating imported merchandise to collect fees and taxes.

- Another purpose is to gather important information about commodities, such as appraisement, classification, and country of origin.

Who is responsible for Filing?

There are several ways to file the 7501 form. Some importers hire a customs broker to handle customs clearance on their behalf, including paying shipment fees, preparing and submitting documents to the CBP, and ensuring a smooth customs clearance. As digitalization advances, importers can become self-filers to save time and money by avoiding intermediaries.

7501 requirements

The 7501 form is a crucial document to file. The form helps the CBP achieve the purposes mentioned above and ensures that importers meet legal requirements and are not penalized. For instance, certain imports like drugs and foodstuffs need special permits from national agencies like the FDA. It is the importer’s job to clarify this.

Take note – filing the 7501 form is preceded by filing the Customs Release Form (CBP Form 3461). Therefore, if the CBP signs off on the shipment and your goods are released, you or your broker have eight days from the release date to file Form 7501 and pay duties.

Form 7501 has sections that must be filled out accurately in what are called “Blocks.” The Blocks describe the package’s contents, quantity, weight, buying price, and country of origin. Here are the first few sections to be filled out:

-

Block 1 – Entry Number

The filer presents an 11-digit number on the entry and corresponding Entry Summary. The format is ‘XXX-NNNNNNN-N’: ‘XXX’ is an entry filer code allocated by the CBP. The ‘NNNNNNN’ is a unique number allotted by the importer (of their broker). ‘N’ is a check digit calculated from the first ten characters based on a CBP formula.

-

Block 2 – Entry Type

This Block is a two-digit code that indicates the category of the entry being filed. The first digit is a general category, and the second establishes the type of entry in that category.

-

Block 5 – Bond Type

Importers must select an import bond. The two most common are a Continuous Bond for regular importers that covers all imports within a year. Alternatively, one-time importers are more suited to a Single Transaction Bond.

Block 5 is an obligatory 1-digit code that documents the type of bond chosen for the merchandise entering the U.S.:

– 0 is the U.S. Government or types of entry that do not require a bond

– Eight is for a Continuous Customs Bond

– Nine is for Single Transaction Bond

-

Block 7 – Entry Date

Generally, this is the date of release of goods from CBP custody. The format is MM/DD/YYYY.

-

Block 10 – Country of Origin

The country of origin is where the merchandise was manufactured, produced, or grown. If a product comprises materials made in several countries, its source would be where it last underwent the most substantial change.

-

Block 23 – Importer Number

This Block refers to an importer’s unique code of identification used by CBP for importing purposes.

Becoming a self-filer

A small to medium-sized business may consider becoming a self-filer. Self-filing entails cutting the middleman, saving time and money.

eezyimport has created a DIY Self Entry (7501) online platform for this exact purpose. Within minutes importers are guided by the eezyflow™ system through the Form 7501 filing process. The platform gives you complete autonomy and visibility and can be accessed anytime, anywhere (phone, desktop, tablet). Of course, if you prefer the help of a broker, we’ve thought of that too. With eezyimport’s DIY Broker Entry (7501) solution, a broker reviews your entry and ensures you meet all regulations and ready to file.

Our company aims to empower importers with pioneering solutions that remove obstacles and ensure growth.

Get in touch today, and let’s discuss your success!

Interesting related article: “What is International Trade?“