While a prolonged period of cheap oil may harm many sectors of the Canadian economy, the Royal Bank of Canada (RBC) believes a weaker loonie plus extra consumer spending will more than make up for that loss.

In other words, RBC concludes that lower oil prices overall are good for Canada.

There has been a great deal of reporting regarding the devastating impact of cheaper oil prices on the Canadian economy, the report authors explain. This has been reinforced by anecdotal accounts of oil-related businesses reducing investment expenditure, particularly in the oil sands.

The authors added “However, as we have emphasized in earlier commentaries, there are offsetting positive outcomes from lower oil prices.”

A stronger US economy will import more Canadian goods

One major impact, which beneficially affects Canada, is the boost lower oil prices give the the US economy. The American economy will come out better, despite the recent growth of oil production in the US reflecting greater utilization of shale oil reserves. US oil & gas sector investments are tiny compared to the overall capital spending in the rest of the country.

Falling oil prices mean Americans will be spending less on gasoline, which will provide an enormous boost to the country’s overall economy, while lower energy costs will result in greater investment spending outside of the oil & gas sector. As the US economy grows, so will Canadian exports.

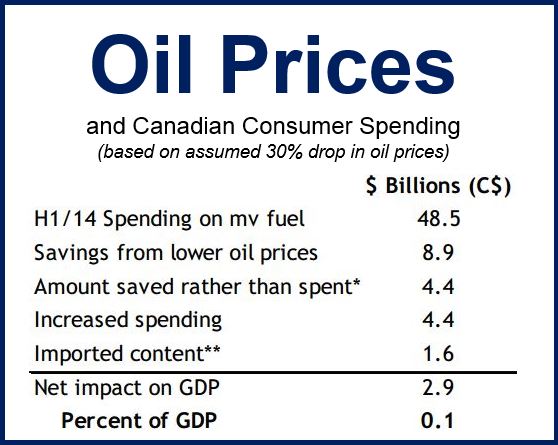

In the first half of 2014, Canadian consumers bought about $48.5bn of motor fuel. A 30% drop in oil prices typically leads to an approx. 18% fall in gas prices. This represents a $8.9bn savings on consumers’ motor fuel bills. The authors assume people will spend half of those savings. (Data source: “Accounting for the Impact of Lower Oil Prices on the Canadian Economy,” Royal Bank of Canada.)

Weaker loonie improves Canadian competitiveness

Canadian products will become more competitive in the US market because declining oil prices also mean a cheaper loonie (Candaian dollar). Canadians near the US border will find products less of a bargain when they consider shopping in the United States.

If Canadians are paying less to fill up their vehicles, they will have more spare cash to spend domestically, which will be a boost to the economy.

The authors point out that while business investment represents 13% of nominal GDP, consumer spending is a huge 54.3%. Hence, even a small increase in consumer spending can significantly offset a fall in investment.

The study concludes that if the WTI (West Texas Intermediate) price averages $65 in 2015 and $74 in 2016 “a rise in consumer spending and exports has the capacity to more than fully offset a likely drop in business investment.”

The authors add that their calculations assume that consumers will spend a proportion of the savings they make at the gas pumps, and that Canadian exporters, encouraged by a weaker loonie, will seek out markets for their goods more aggressively.

Regarding government revenue, the authors wrote:

“Lower oil prices, however, will also have a significant impact on government balance sheets, with the potential to create a significant revenue shortfall in government budgets.”

“Key here is that, similar to labour markets, the negative impact will largely be concentrated in oil producing provinces which, owing to significant earlier boosts to revenue from the run-up in oil prices over the last decade or so, are in an enviable position.”