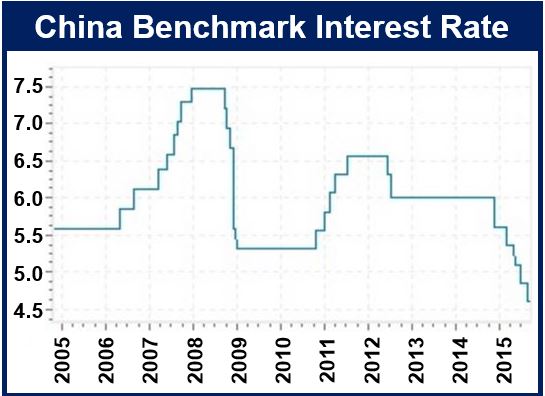

China, whose economy is rapidly slowing down, has reduced its one-year benchmark interest rate by 0.25 of a percentage point to 4.35%. This is the sixth time interest rates have been cut since November 2014.

Following the move, shares around the world gained, especially in the mining sector – commodities also rose.

The People’s Bank of China, the country’s central bank, also reduced the ratio of Chinese currency that it expects domestic banks to hold. This will inject Rmb560 billion ($90 billion) into the banking system, which it hopes will make up for the cash drain from capital outflows in recent months.

The changes will come into effect on October 24th.

Data Source: global-rates.com

Data Source: global-rates.com

Alarmingly slower economic growth

The Chinese communist party is doing everything it can to meet its growth target for 2015 of 7%.

While beating expectation, China’s GDP (gross domestic product) expanded by 6.9% in the third quarter of this year, which was the slowest pace since 2009.

Many economists across the world say that official statistics on the economy are unreliable, with some saying economic growth is probably growing at less that 4% annually.

For 2015, China is likely to post its slowest economic growth (for one year) in a quarter of a century, with growth drivers such as construction and manufacturing faltering rapidly, and new drivers like consumption failing to compensate.

Gabriel Wildau, writing in the Financial Times, quoted Eswar Prasad, a Cornell University professor and former China head of the International Monetary Fund, who said:

“The PBoC’s two-pronged monetary policy action signals an intensification of policy measures intended to combat the economic slowdown in China.”

China follows ECB announcement

China’s policy loosening followed the European Central Bank’s announcement yesterday that it may give a bigger policy boost to the economy as soon as December to combat falling prices.

Koh Gui Qing, writing for the Reuters in Beijing, quoted Joe Rundle, head of trading at ETX Capital in London, who said:

“We’ve got half the world’s central banks in easing mode. And we’ll probably see more easing from China to come.”

In an interview with Bloomberg Business, Louis Kuijs, head of Asia economics at Oxford Economics Ltd. in Hong Kong. said:

“The Fed may be considering raising interest rates, but in much of the rest of the world, China included, central banks are facing weak growth and a lack of inflation, and are thus more likely to ease rather than tighten monetary policy.”

Video – China’s sixth interest rate cut in 11 months