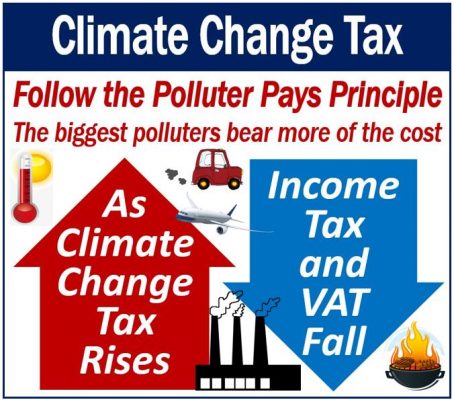

A climate change tax would charge businesses and individuals for the harm that their emissions caused. It would follow the polluter pays principle. The ‘polluter pays principle’ is the commonly accepted practice that pollution producers should pay for managing pollution. In other words, they should bear the cost of managing pollution to prevent damage to the environment and human health.

Is it time for a strong climate change tax? Should it be a comprehensive one that rises over time? The climate change tax could also allow other taxes to go down. Being able to bring other taxes down is important because nobody likes taxes.

Climate change tax – heatwaves

According to scientists, climate change made the 2018 heatwaves in Europe and Japan twice as likely. In 2003, a major heatwave in Europe killed thousands of people. Scientists tell us that the likelihood of the 2003 heatwave also increased due to climate change.

Our emissions of greenhouse gases are causing climate change. Methane, a common fuel source, and carbon dioxide, for example, are greenhouse gases.

Temperatures will continue rising

If we continue burning more fossil fuels and consuming more meat, our planet will be much warmer by 2100.

Scientists don’t know exactly how much temperatures will rise by. Children born today, when they are old, will probably experience temperatures 3°C to 5°C warmer than on the day their grandparents were born.

Would a climate change tax help bring down our greenhouse emissions? We are now seeing what a 1°C rise can do. Therefore, it is not surprising that we view the prospect of a 3°C to 5°C rise with horror.

If we are serious about reducing our greenhouse emissions, we will definitely need more legislation. Financial penalties tend to focus the mind. In other words, when faced with the prospect of a large fine or higher taxes, people and companies take measures.

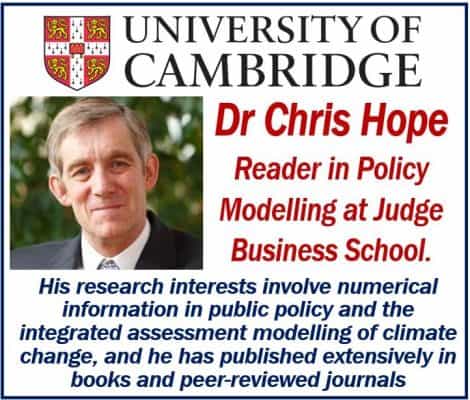

Dr. Chris Hope suggests a climate change tax should start at £100 per tonne of CO2. Dr. Hope is a Reader in Policy Modelling at Judge Business School, University of Cambridge.

The tax should apply to all emissions, Dr. Hope added. Also, the government should raise the tax by approximately 3% above inflation each year.

Climate change tax up – income tax down

A climate change tax would allow income tax and VAT to decline from 20% to 15% and 20% to 16% respectively. The government could use whatever tax revenue was left over to fund basic research and alleviate poverty

The government would move away from taxing things we should encourage to taxing things we need to discourage. We need to discourage, for example, pollution.

With this type of tax structure, the economy would not suffer. In fact, it would grow more strongly. Other nations would subsequently see this and follow the pioneering country’s lead.

With a climate change tax, we could prevent catastrophic global warming from occurring. It would not be expensive, and everybody would win.