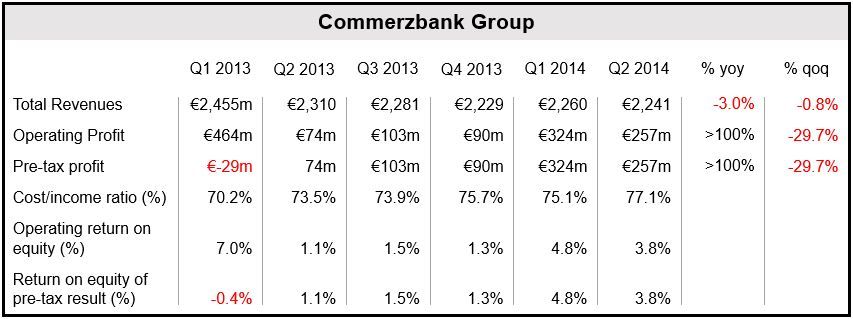

Commerzbank Q2 net profit more than doubled to €100 million compared to €40 million in Q2 2013, as the German bank continued to divest assets, put aside less money for risky loans, and benefited from a boost in its retail banking business.

Pre-tax profit increased from €74 million in Q2 2013 to €257 million in Q2 2014.

Martin Blessing, Chairman of the Board of Managing Directors of Commerzbank, said:

“In the second quarter, we increased revenues in the Core Bank over the previous year, in the operating segments we expanded business volume and raised the number of new customers.”

“All in all, we improved the operating profit in the Group, reduced risks further, and significantly increased our capital ratios in the first half of the year. We generated a good result overall.”

Core unit risks reduced

In Germany’s second-largest bank, which is 17% government-owned after an €18 billion euro government bailout in 2009, risks were reduced “faster-than-expected” in its non-core unit, with loan loss provisions reduced to €65 million, much less that the €347 million it had put aside one year ago.

The bank said it had divested itself of over €5 billion in property loans in Japan, Portugal and Spain in June, as it continues to trim down its non-core portfolio.

Its Core Tier Equity Capital Ratio – a measure of how well it could withstand a financial shock – increased to 9.4% at the end of Q2, compared to 9% in Q1. According to Stephan Engels, Chief Financial Officer, the bank’s aim is to push the ratio above 10% within the next two years.

Its stronger equity trading revenues were not enough to offset a 38% fall in fixed-income sales and trading, which were worse than those reported by competitors around the world.

Commerzbank’s retail division posted an operating profit of €115 million, more than double last year’s €54 million, bolstered by cost reductions and an inflow of new customers that yielded increased interest income.

Outlook

Mr. Engels said Commerzbank will continue along its growth path in the Core Bank, focusing on lending volume in the private customers and Mittelstandsbank segments.

It also plans to continue trimming down its non-core assets segments. Given that divestment has proceeded at a faster-than-expected rate, the company has increased its current reduction target of €75 billion for 2016.

(Data source: Commerzbank Group)

Mr. Engels said:

“By value preserving accelerated run-down the portfolios in the areas of CRE and ship finance together should be reduced to approximately €20 billion. The public finance portfolios will decrease to €47 billion according to natural maturities,” said Stephan Engels, Chief Financial Officer of Commerzbank.”

The bank downplayed any risks from its exposure to Russia, which dropped to €5.4 billion in Q2 2014 from €6.1 billion in Q1. It added that the region continues to be a particular focus for managing risk.

Most of its exposure to Russia involves trade financing for domestic companies which are covered by export insurance, or well- collateralized lending to Russian firms, Mr. Engels said.

The company wrote “The recessionary trends in Russia and Ukraine have not had a noticeably detrimental effect on exports.”