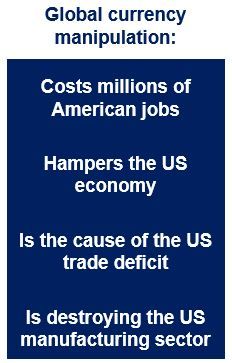

If currency manipulation were halted globally, the US deficit would be significantly reduced, 5.3 million jobs would be created over a period of three years, and the economy would grow much more rapidly.

Robert E. Scott, the Economic Policy Institute’s Director of Trade and Manufacturing Policy Research, writes in “Stop Currency Manipulation and Create Millions of Jobs“ that global currency manipulation could be halted through a system of penalties or offsets.

Scott explains that six years after the Great Recession started, the US is still 8 million jobs behind if it wants to return to pre-recession labor market health.

The creation of jobs should be the government’s number one priority.

Congress and the Fed won’t boost jobs

Unfortunately, prospects of any serious and effective fiscal policy to boost employment have disappeared “under the weight of congressional dysfunction and the Federal Reserve has begun to wind down monetary stimulus.”

Scott points out, though, that there is a very effective way of boosting the economy and employment.

If China, the largest currency manipulator in the world, and 19 other countries eliminated the practice, the US trade deficit would be cut by $200 billion to $500 billion over a 36-month period.

US GDP would grow by an extra $288 billion to $720 billion, creating 2.3 million to 5.8 million jobs, 40% of them in manufacturing.

The manufacturing sector was devastated by increasing trade deficits over the past 15 years.

Even though the overall US goods trade deficit declined slightly in 2012 to $741.5 billion in 2012, the deficit in manufactured goods rose by $10.2 billion.

Scott said:

“There are a number of steps that President Obama can take to end currency manipulation, which would reduce our trade deficit and bring millions of manufacturing jobs back to the United States.”

“This would not cost the taxpayers a dime; in fact, it would reduce the federal budget deficit by over a hundred billion dollars per year.”

According to Scott, there are many ways currency manipulation could be halted:

- Pending legislation could be passed by Congress which would allow the Commerce Department to treat currency manipulation as an unfair subsidy in countervailing duty trade cases.

- As insisted by the majority of the House, the Trans-Pacific Partnership trade agreement needs to include “strong, enforceable currency manipulation provisions.”

The Obama administration must employ strategies to offset purchases of foreign assets by governments involved in currency manipulation, which would make future attempts at manipulating the dollar or other currencies too expensive or ineffective.