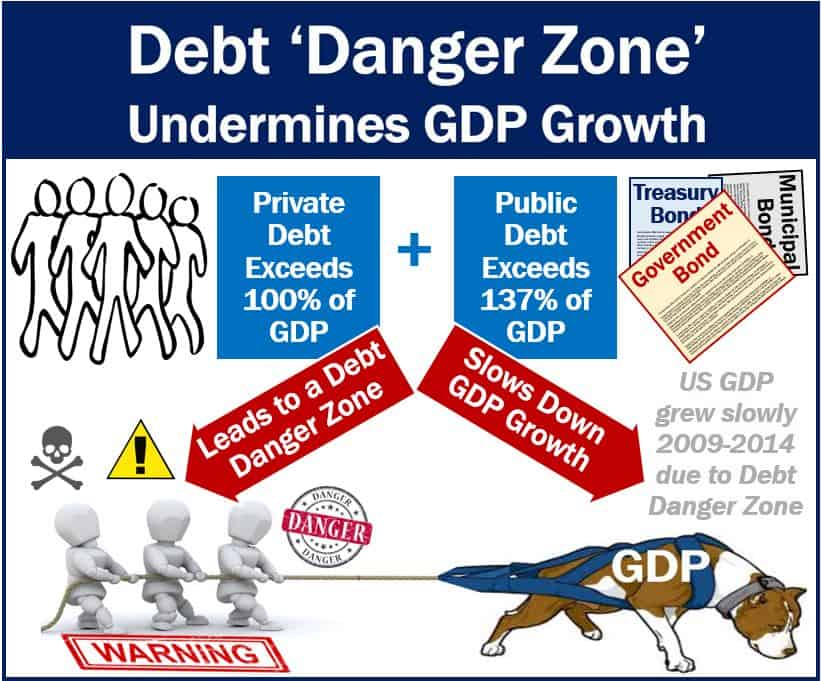

America landed in a debt ‘danger zone’ which reduced economic growth. From 2009 to 2014, being in the debt danger zone reduced economic growth by 0.43 percentage points. Additionally, high levels of private debt reduced GDP growth by a further 0.40 percent, taking into account public debt. This is what a team of researchers at The Ohio State University (OSU), North Carolina State University, and Xiamen University has found.

GDP stands for Gross Domestic Product. It is everything, i.e., all the goods and services, a country creates over a given period such as a year.

Debt danger zone GDP growth toll

Overall, debt dragged US GDP growth down by at least 0.83 percentage points between 2009 and 2014.

Mermet Caner, Qingliang Fan, and Thomas J. Grennes wrote about their study and findings in the journal Social Science Research Network. There is a citation at the end of this article.

Caner, Professor of Economics at OSU’s Department of Economics, said:

“The effect that debt is having on our economic growth is much larger than we expected. We were surprised.”

The United States’ GDP expanded by 4.1% in the most recent quarter. However, according to Prof. Caner, growth would have been greater without the country’s current level of debt.

Prof. Caner believes that we should be worried.

When two types of debt interact

Most studies have examined how either public or private debt affect GDP growth.

Fed San Francisco Vice-President Òscar Jordà and UC Davis Professor Alan Taylor first studied private and public debt interaction. They found negative effects.

This latest study pinpointed the level after which people should be concerned.

Regarding this debt interaction, Prof. Caner said:

“We were able to quantify the effects of this debt interaction and it is kind of scary.”

The study

Prof. Caner and colleagues gathered and analyzed data from twenty-nine countries from 1995 to 2014. They were all members of the OECD. OECD stands for the Organisation for Economic Co-operation and Development. Therefore, they were all advanced economies, i.e., rich countries.

The researchers found that when both private and public debt are relatively low, their interaction can boost GDP growth.

Even if debt rises, decreases in private debt can offset growth in public debt, or vice-versa.

What happens, however, if both types of debt are relatively high and also rising simultaneously? Results showed that their interaction can undermine GDP growth.

What is the danger zone?

When does the interaction of public and private debt reach a danger zone.? The study found this occurs when public and private debt respectively exceed 100% and 137% of a country’s GDP.

Of the 29 countries they studied, twelve were in the danger zone, including the USA, the researchers calculated.

During the 2009-2014 period, US public-private debt interaction stood at 203%.

Debt danger zone slows growth

Debt was shaving off one percentage point from America’s GDP growth each year from 2009 to 2014.

Being in the debt danger zone explains why the US economy grew more slowly after the Great Recession (2007/9).

After the Great Recession, US GDP grew by 2.2% per year, compared to 3.3% before.

Regarding public and private debt ratios in the United States since 2014, Prof. Caner said:

“Since 2014, both public and private debt ratios in the U.S. have increased, indicating that debt has become an even greater obstacle to growth.”

Not all debts have the same effect on GDP growth, the researchers found. Household debt, for example, had a significantly more negative effect than corporate debt, results showed.

Corporate debt is less harmful because it typically goes to more productive uses than household debt. Corporate debt leads to, for example, investments in machinery and plants. More of household debt, on the other hand, ends up as consumer spending.

Corporate means relating to corporations or companies. Therefore, corporate debt means debts that companies have.

Why is the interaction important

So, why is the interaction between private and public debt so important for GDP growth?

Prof. Caner said that one reason may be that much of private debt is guaranteed by the government. The US government even guarantees school loans and mortgages.

Greater private default, therefore, means larger public debt, Prof. Caner explained. Default occurs when a debtor fails to repay a loan.

The study results suggest that the US Congress should focus on controlling public debt. It is important to steer the economy away from the ‘danger zone.’

Prof. Caner points out that many political groups and commentates have been suggesting this.

Prof. Caner added:

“The other implication is that agencies responsible for regulating private debt should not ignore the interaction between public and private debt, especially mortgage debt.”

Citation

“Partners in Debt: An Endogenous Nonlinear Analysis of Interaction of Public and Private Debt on Growth,” Mehmet Caner, Qingliang Fan, and Thomas J. Grennes. Social Science Research Network 2018. https://ssrn.com/abstract=3186077.