A new outlook report from Deloitte predicts the global aerospace and defense sector is likely grow more strongly in 2017, following several years of subdued – albeit still positive – growth.

The 2017 global aerospace and defense sector outlook reviews how the sector performed last year and how it is likely to perform this year.

Concerns about global security threats are driving growth in the defense sub-sector, says the new report. Image: F16 Falcon fighter jet, pixabay-63028

Concerns about global security threats are driving growth in the defense sub-sector, says the new report. Image: F16 Falcon fighter jet, pixabay-63028

The report forecasts an overall growth in revenues for aerospace and defense of 2 percent for the year, with the defense sub-sector expected to grow at 3.2 percent.

The increase in the defense sub-sector “is due to continued concerns about global security threats, growth in US defense budgets, as well as higher defense spending in the Middle East, Japan, South Korea and India, ” says Tom Captain, global aerospace and defense leader at Deloitte.

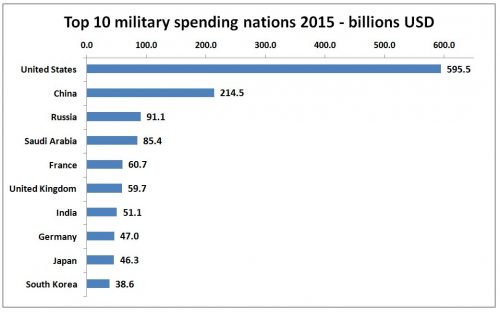

The total global military spend in 2015 was 1,760 billion USD. The United States was by far the biggest military spending nation accounting for a third (595.5 billion USD) of the total spend. China was second (214.5 billion USD), and Russia was third (91.1 billion USD).

The chart shows the top 10 military spenders in 2015, which altogether accounted for nearly three quarters of global spend. Data from Deloitte.

The chart shows the top 10 military spenders in 2015, which altogether accounted for nearly three quarters of global spend. Data from Deloitte.

Marginal growth in commercial aerospace sub-sector revenues

In the commercial aerospace sub-sector, 96 new large aircraft are expected to be produced in 2017 – showing a resumption of growth that had slowed down in 2016. Major aircraft manufacturers Airbus and Boeing have indicated they will increase production in 2017 and 2018.

Lower fuel costs, continued airline profitability, and stable global gross domestic product growth are expected to drive growth in this sub-sector, as is strong passenger travel demand, especially in the Middle East and Asia Pacific region, notes the report.

Cheaper tickets and the choice of more routes have resulted in huge growth in air travel. The number of people flying on commercial airlines every year has more than quadrupled between 1981 and 2016.

However, pricing pressure and changes in product mix will exert a squeeze on 2017 revenues, which Deloitte anticipate will show only a marginal 0.3 percent growth in 2017.

The new report follows last month’s revised figures from Fitch Ratings, the credit rating agency, who changed their outlook for the global aerospace and defense sector from stable to positive in 2017.

Fitch said the new outlook reflects a projected 8 percent increase in large commercial aircraft deliveries and a 3 percent growth in relevant defense markets.