Director pay has reached stratospheric levels, says the TUC (Trade Union Congress), a federation in England and Wales that represents most trade unions. The TUC was talking specifically about the remuneration of the directors at FTSE 100 firms.

FTSE 100 is an index that includes the one hundred companies listed on the London Stock Exchange with the highest market capitalization, i.e. the country’s 100 largest companies.

Stratospheric means the top part of our atmosphere. If remuneration has reached stratospheric levels, it means that it has gone ‘through to the top of our atmosphere’, which is considerably greater than ‘through the roof’.

Thousands of directors across the country have been asking workers to tighten their belts so that their companies can recover from the global financial crisis and the Great Recession that followed. However, those very directors have been raising their own incomes dramatically.

Thousands of directors across the country have been asking workers to tighten their belts so that their companies can recover from the global financial crisis and the Great Recession that followed. However, those very directors have been raising their own incomes dramatically.

Director pay leaving others behind

According to TUC research, top executives are paid one whole year’s worth of the minimum wage in just twenty-four hours.

Average pay among the FTSE 100 bosses is now 123 times greater than the average full-time salary in those companies. It is time for a ‘reality check in the boardrooms’, the TUC added.

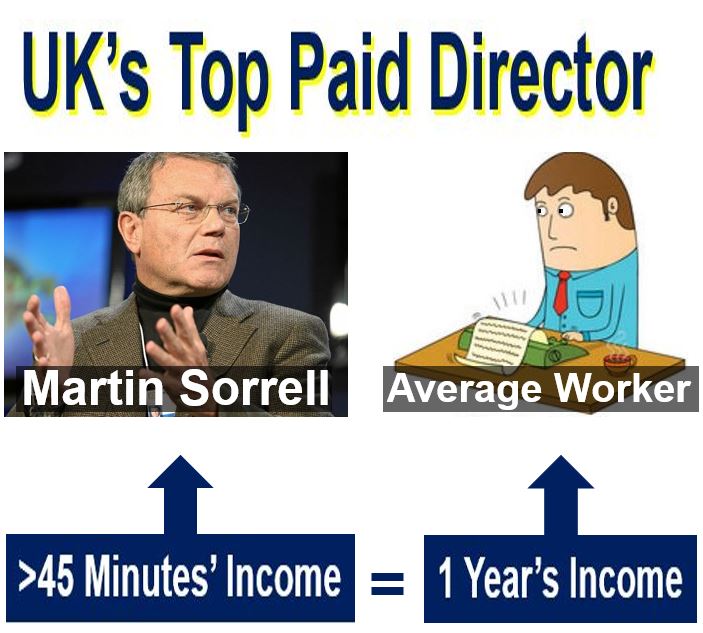

Sir Martin Sorrell, CEO of the multinational advertising and public relations company WPP plc., earns in less than 45 minutes what an average British worker does over an entire year.

In 2015, WPP’s CEO was paid £70 million, or 2,500 times the average salary in the UK. He earned the equivalent of £38,437 per hour. One year’s income would have paid the salaries of 4,479 teaching assistants, 1,920 nurses or 1,920 paramedics.

It takes the average British worker one year to earn what Sir Martin Sorrell receives in 45 minutes as CEO of WPP plc. (Image of Sorrell: Wikipedia)

It takes the average British worker one year to earn what Sir Martin Sorrell receives in 45 minutes as CEO of WPP plc. (Image of Sorrell: Wikipedia)

Some of TUC’s findings:

– The median total remuneration (excl. pension) of top FTSE 100 directors rose by 47% from 2010 to 2015 to £3.4 million, compared to a 7% increase in workers’ pay over the same period.

– British workers’ purchasing power is still considerably lower than it was before the global financial crisis struck. Top executives’ purchasing power is significantly higher than pre-crash levels.

– The difference between top executives’ and workers’ pay has been growing dramatically. In 2010, the average FTSE boss earned eighty-nine times the average full-time salary, compared to 123 times in 2015.

In a press release, the TUC wrote:

“The TUC says the findings highlight why Theresa May must deliver on her promise to tackle executive pay, by putting workers on company boards and remuneration committees.”

“The TUC also wants the government to compel firms to disclose full information about employee pay across the company, and the ratio between the CEO’s pay and the average worker in the business.”

Director pay & company performance

The gap between director pay and what average workers receive is inversely related to company performance – those with the greatest gaps perform less well, the TUC claims.

However, investors and employees to not have access to robust information with which they could assess the gap between the top directors and employees in the rest of their company.

TUC General Secretary Frances O’Grady said:

“While millions of UK families have seen their living standards squeezed, directors’ pay has reached stratospheric levels.

“These shocking new figures show why Theresa May must deliver on her promise to put workers on company boards.”

“This would inject a much-needed dose of reality into boardrooms and help put the brakes on the multi-million pay packages that have damaged the reputation of corporate Britain.”

“Other European countries already require workers on boards, so UK firms have nothing to fear. It improves performance and contributes to companies’ long-term success.”