According to a new report, if the US were to eliminate corporate tax, gross domestic product (GDP), real wages, domestic investment and national saving would increase. The author believes that America’s high corporate tax rate, the highest in the world, discourages both domestic and foreign companies from investing or operating within the country.

Corporate tax, also known as corporate income tax, is the tax that companies pay their government on their profits.

Study author, Laurence J. Kotlikoff, Senior Fellow at the National Center for Policy Analysis and also director of the Tax Analysis Center, says that either the elimination or even the reduction of the current corporate tax rate would benefit workers, the national economy and businesses.

According to Kotlikoff’s study – “Abolishing the Corporate Income Tax Could Be Good for Everyone“ – if America were to eliminate corporate income tax:

- There would be a 23% to 27% increase in capital stock, with most of the addition coming in from abroad.

- Real wages would rise by between 12% and 13%.

- GDP would grow by 8% to 10%.

Even a tax reduction would boost GDP and wages while at the same time producing just as much revenue, he adds.

(Source: National Center for Policy Analysis)

Tax reduction or elimination would benefit the US

Kotlikoff said:

“A substantial, but still limited, roughly revenue-neutral reduction in the U.S. corporate tax rate produces growth effects that are pretty close to those arising under the complete elimination of the U.S. corporate income tax.”

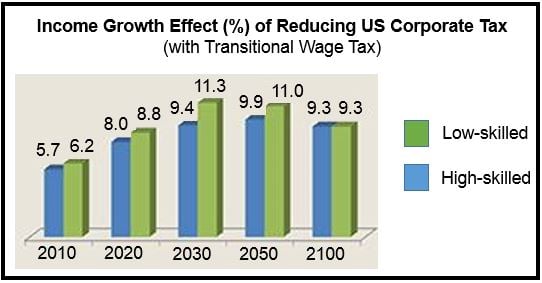

Kotlikoff explains that if America’s corporate tax rate were reduced to 9%, and certain loopholes were plugged, the result would be:

- A short-term increase in wages for both high- and low-skilled workers of 6%.

- A long-term wage increase of 9% for high- and low-skilled workers.

- An instant and permanent increase of 6% to GDP.

- Growth of capital stock of 17% in the short-term and 30% more by 2040.

The current tax system drives investment out of America “with surprisingly small benefit in terms of government revenues,” Kotlikoff points out. “Eliminating the U.S. corporate income tax has great potential to make all Americans better off,” he said.

America today is a high-tax nation

Several studies have argued that the current US corporate tax system encourages companies to keep their money abroad. In May, the Council of Foreign Relations showed that American companies are motivated to either not repatriate their profits made abroad or move their headquarters to a foreign country.

(Source: KPMG) The US has the highest corporate tax rate in the world, higher even than in left-wing France.

In May, Google told regulators that its $30 billion acquisition fund would stay abroad. By keeping it overseas the company avoids paying hefty US taxes on it.