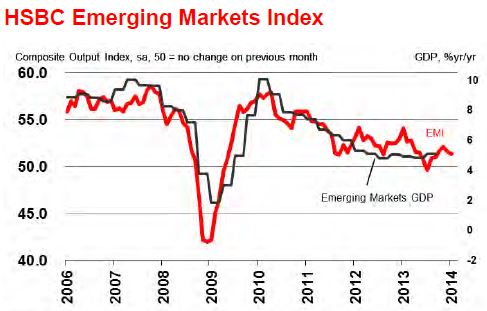

For the second successive month, the HSBC Emerging Markets Index fell in January to 51.4 compared to 51.6 in December, following slower growth.

The term ’emerging markets’ refers to countries like Brazil, Mexico, China and Russia, which are not as rich as the advanced economies, but richer that Sudan, Ethiopia, and other low-income nations (frontier markets).

January’s reading was the lowest since September and below the 51.7 average for 2013.

According to Pablo Golderb, who is HSBC’s head Emerging Markets Research:

“Although both the aggregate manufacturing and services EMI deteriorated in January, they remain in expansion territory. Interestingly, the future activity index shows a pick-up for manufacturing and a drop for services, suggesting expectations of an export-led recovery.”

Mixed results from emerging economies

While Brazil and China saw slower GDP (gross domestic product) growth and Indonesia and Russia experiences declining output, Mexico, Taiwan, India and Poland reported stronger growth.

Source: HSBC

Mr Goldberg said:

“Manufacturing PMIs are still showing economic resilience, although not without increasing divergence between countries.”

“Among the winners, we have countries in a clear cyclical recovery that are being lifted by the improvement in the developed markets: Mexico, Poland and the Czech Republic.”

The services sector saw a market slowdown in India and Brazil, while in Russia and China expansion was sluggish.

In the fourth quarter of 2013, new business growth was significantly slower than average. Employment remained generally flat, while backlogs of work fell considerably.

Although the Emerging Markets Future Output Index rebounded somewhat in January, it was still below the monthly average for last year. This index measures company expectations for the coming year.

Manufacturing sentiment reached a ten-month record, but the service sector outlook dropped to a record low.

The HSBC Emerging Markets Index (EMI) is derived from the HSBC Purchasing Manager’ Index, and includes data from 17 emerging economies. Any reading greater than 50 indicates growth, and below 50 signals shrinkage. The emerging markets studied are Brazil, China, Czech Republic, Indonesia, India, South Korea, Mexico, Poland, Russia, Turkey, Taiwan, Vietnam, Egypt, Hong Kong, Saudi Arabia, South Africa and the United Arab Emirates.

Emerging markets and the Fed tapering

Since the US Federal Reserve started reducing its $85-billion per month bond-buying stimulus program in December 2013, market analysts and investors fear a flight of capital from emerging markets towards the advanced economies.

In December, the Fed reduced the program to $75 billion per month, and in January to $65 billion. When they meet in March, a further $10 billion reduction is expected.

Janet Yellen, the new Fed chairman says the US central bank’s approach is aimed at helping the US economy and cannot be blamed for what happens in other parts of the world.