Home ownership in England is now at its lowest level since 1986, with 63% percent of households owning their property, according to the Government’s English Housing Survey published on Wednesday.

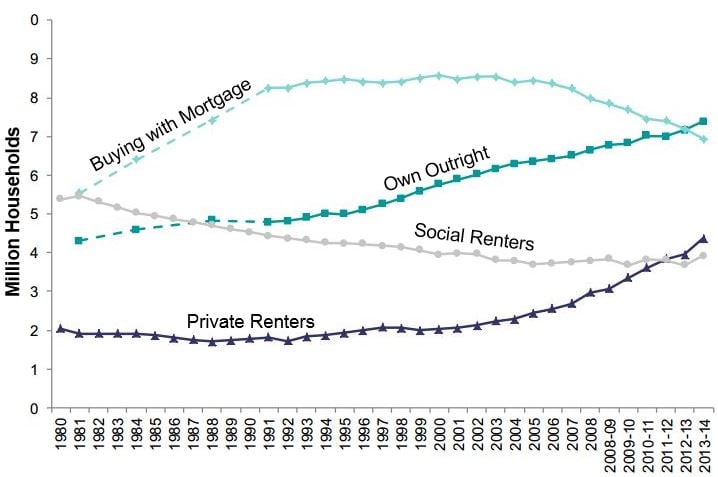

In the year 2013/2014, there were more home owners without any outstanding mortgage than those with mortgages still to pay, the survey reported.

For the past ten years, the percentage of England’s 22.6 million households who own their homes has been declining, figures show.

Sixty-three percent (14.3 million) of households are owner-occupiers, with 7.4 million mortgage-free and 6.9 million with mortgages.

Source: English Housing Survey

In the previous year (2012/2013), the numbers of outright owners and owners with mortgages were the same.

The proportion of owner occupiers peaked at 71% in 2003, and since then has been in decline every single year.

Campaigners for home ownership warn that England is sliding back into a nation of landlords and tenants.

Nineteen percent of households (4.4 million) in 2013/2014 were private tenants, compared to 18% in the previous year. The percentage of households renting social housing stood at 17% (3.9 million), unchanged from the previous year.

Houses too expensive for young adults

Young adults (aged 25 to 34) are much less likely to be buying a home today, compared to any time in the past three decades. With property prices booming and mortgage rules becoming stricter since the financial crisis, most 25-to-34 year-olds have had no choice but to rent privately.

In 2013/2014, forty-eight percent of people in this age group are in privately rented accommodation, which is double the proportion registered in 2003/2004.

From 2003/2004 to 2013/2014 the percentage of owner-occupiers in this age group has fallen from 59% to 36%.

Source: English Housing Survey

Chief executive of the National Housing Federation, David Orr, said regarding the Survey:

“People in their thirties are seeing their chance of home ownership slip through their fingers as they struggle to save for the enormous deposits and mortgage payments, no matter how hard they work. As house prices continue to rise we’re in danger of winding back the clock on homeownership, with only the privileged few having any hope of affording it.”

“At the moment people who can’t buy a home have little or no choice but to rent privately going from one short-term let to another at an ever escalating cost. We believe that everyone should have a home they can afford, which means having more affordable homes to rent or buy through shared ownership and a private rental market that’s fit for purpose.”

“We’ve had enough of short-term, gimmicky housing policies. The failure to build the homes we need is snatching away any hope of our younger generations having a home they can afford. The next government must produce a long-term plan for housing and commit to end the housing crisis within a generation.”

A YouGov study carried out for the National Housing Federation reported that 63% of private renters aged 25-to-44 in the UK said they thought they would have purchased their own home by now.

Fifty-six percent of private renters in the country said they had been renting for longer than originally planned because they had no choice.