For many business owners, the decision to exit a company is one of the most personal and complex choices they will face. While starting and growing a business are often celebrated, the exit phase holds significant weight but tends to receive less attention. A new paper published in Journal of Business Research looked at how entrepreneurs approach this critical moment, particularly through stewardship exit strategies, which involve handing a business over to family members, employees, or external buyers. The research explores the balance between two decision-making styles: causation (a planned approach) and effectuation (an adaptive approach).

Causation vs. Effectuation in Exits

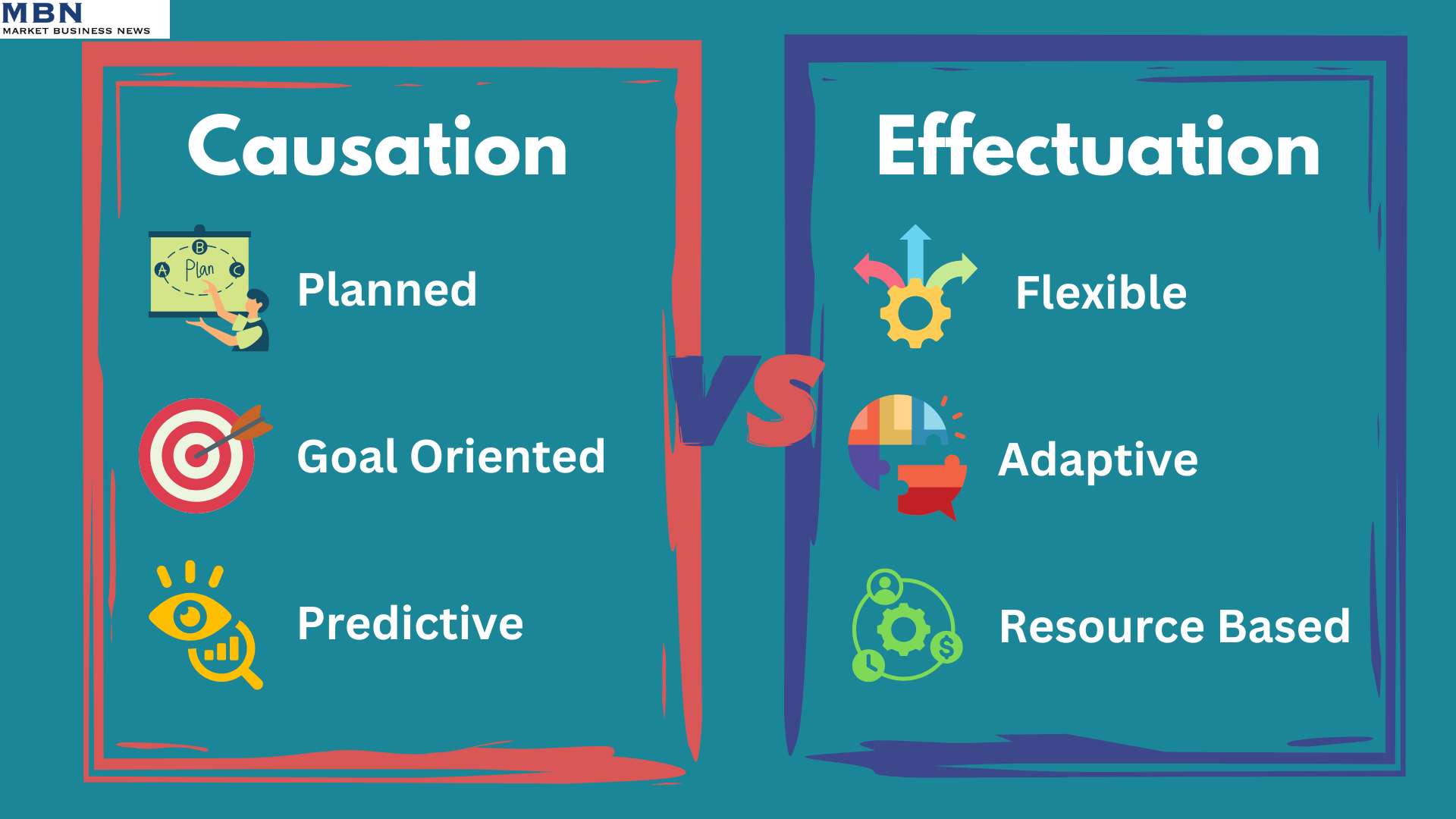

In business planning, causation involves setting specific goals and taking deliberate steps to achieve them. Entrepreneurs who prefer this approach may map out their exit well in advance, aiming for a structured transition, such as selling their business to a particular successor or partner. Effectuation, in contrast, is about adapting to circumstances and making decisions based on available resources, often leading to more flexible and evolving plans.

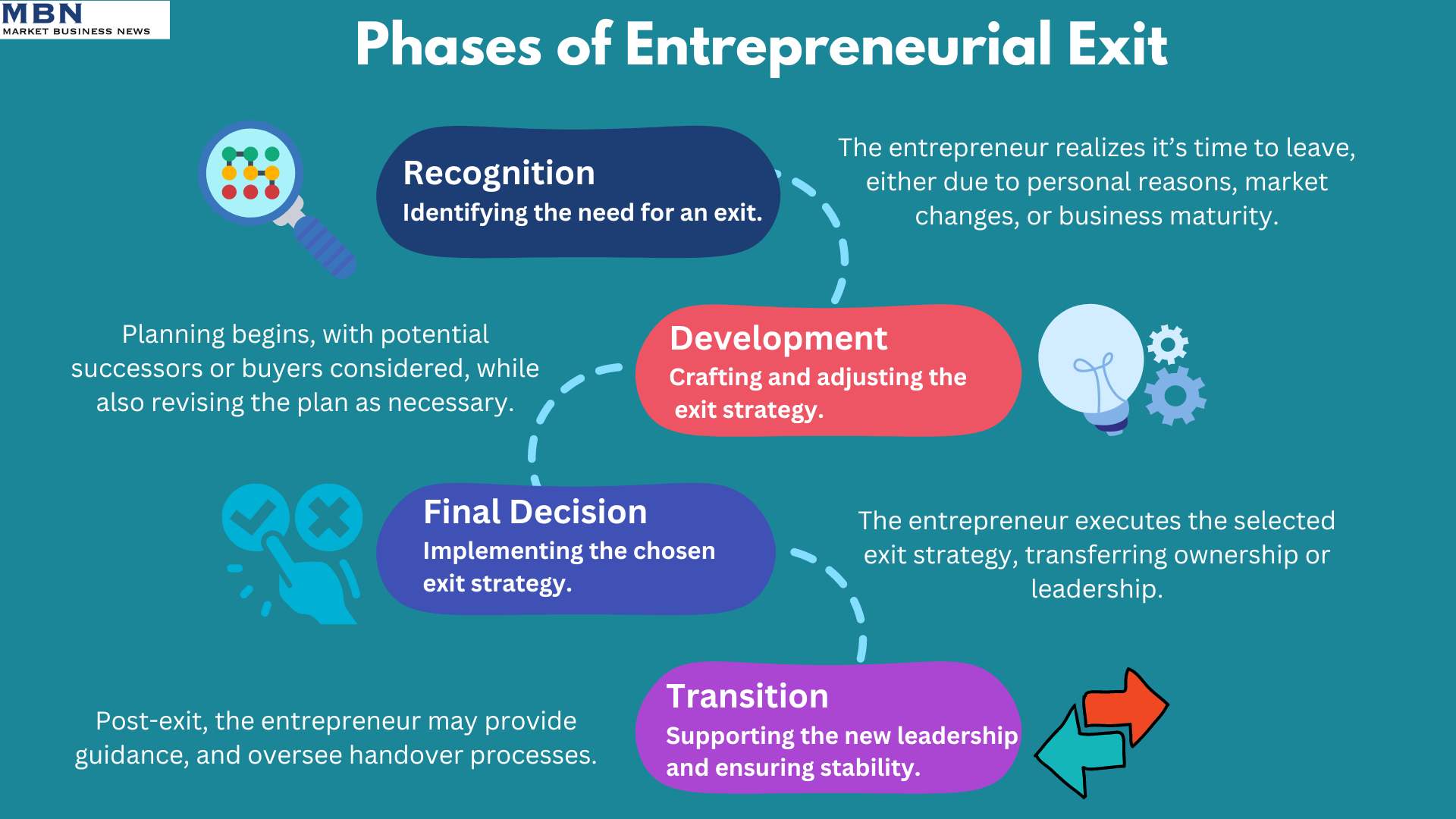

The study shows that while entrepreneurs often start with a causation mindset, they frequently shift toward effectuation as they encounter challenges or changes during the exit process. For instance, family expectations or market shifts may prompt adjustments that weren’t initially planned.

Take the case of a fictional small-town restaurant owner who initially planned to pass the business on to her children. She had always viewed the restaurant as a family legacy and assumed her children would step in when the time came. However, during the transition process, it became clear that her children were not interested in taking over. This forced her to rethink her exit strategy. Rather than selling the restaurant to an outside buyer, she decided to train a long-time employee to take over the business, ensuring that the restaurant would continue to serve the community.

This shift from a pre-planned (causation) strategy to a more adaptive (effectuation) approach highlights how entrepreneurs must be open to changing circumstances when exiting their businesses. It also shows the emotional complexity of passing on a business, particularly when family expectations are involved.

Stewardship and Legacy

For many entrepreneurs, stewardship strategies are driven by a desire to leave behind a lasting legacy. This often means selecting a successor who will preserve the company’s values, culture, and role within its community. While entrepreneurs might initially aim to sell their business for financial gain, many ultimately prioritize finding a successor who will protect the long-term future of the company.

The research reveals that despite this desire to leave a legacy, entrepreneurs often delay their exit. Emotional attachment to the business can lead to procrastination, and they may hesitate to relinquish control. This tension between wanting to retire and struggling to let go is a key factor in extending the exit process.

Imagine a fictional medium-sized manufacturing company in a rural town where the founder decides to retire. Initially, the founder planned to sell the company to an outside investor, but after considering the potential consequences—such as layoffs and loss of company culture—he opted for an employee buyout instead. This decision helped preserve the company’s independence and protected the jobs of over 100 employees, many of whom had been with the company for decades.

In this scenario, the founder shifted from a causation strategy (selling to the highest bidder) to effectuation (finding a solution that kept the company intact). The employees were not only invested in the company’s future but also worked hard to ensure its continued success, benefiting both the workers and the surrounding community.

Broader Impacts of Stewardship Exits

The choice of exit strategy has broader implications beyond the entrepreneur and the business itself. A well-managed stewardship exit can help maintain economic stability, particularly in smaller communities where the company may play a significant role. Conversely, a poorly executed exit can lead to business closures, job losses, and economic strain.

Fictional examples like the employee buyout demonstrate how these decisions affect not just the entrepreneur but also the livelihoods of employees and the community. In the long term, choosing a successor who values the company’s legacy can ensure its sustainability.

Practical Insights for Entrepreneurs

The study’s findings offer important lessons for entrepreneurs considering their exit strategies:

- Start Planning Early: Even if the exit seems far away, early preparation allows for more flexibility. Entrepreneurs who begin planning their exit sooner can better handle unexpected developments, such as shifts in family interest or changes in market conditions.

- Stay Flexible: While having a clear goal is important, adaptability is key. Entrepreneurs who are willing to adjust their plans—whether by considering different successors or exploring new exit strategies—are more likely to achieve a satisfying outcome.

- Embrace Emotional Challenges: Recognizing the emotional complexity of letting go is crucial. For many entrepreneurs, their business is more than just a source of income—it’s a part of their identity. Preparing emotionally for the transition is as important as planning the financial and logistical aspects of the exit.

Conclusion

The entrepreneurial exit process is as nuanced and personal as the journey of building a business. The study by Drapeau, Tremblay, and Pepin highlights the importance of balancing structured planning with adaptability, particularly when pursuing stewardship exit strategies. Entrepreneurs who can remain flexible while preparing for the emotional challenges of stepping away are more likely to achieve an exit that aligns with their values and goals.

Reference:

Drapeau, M.-J., Tremblay, M., & Pepin, M. (2024). The entrepreneurial exit process: Exploring the interplay between causation and effectuation in designing stewardship exit strategies. Journal of Business Research.