Three major headwinds could undermine America’s chances of continuing its economic recovery that began two years ago. The three headwinds are high inflation, Russia’s invasion of Ukraine, and rapid interest rate rises.

Mark Zandi, Chief Economist at Moody’s Analytics, told CNN that the US economy has at least a 33% chance of sliding into a recession by March 2023. He described the risk of recession as “uncomfortably high — and moving higher.”

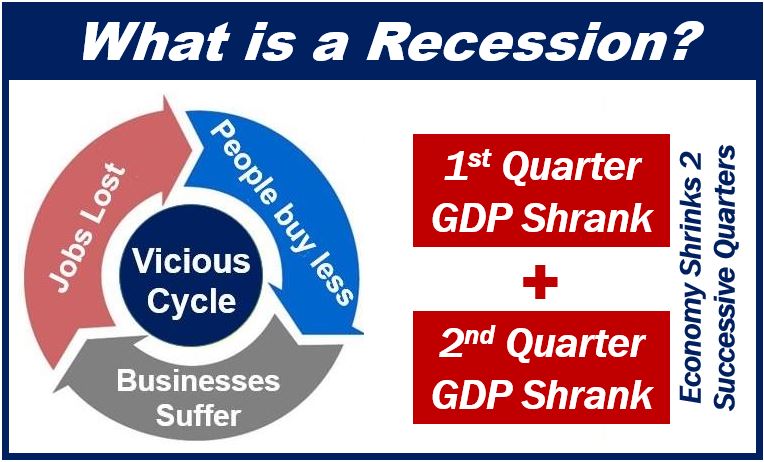

A recession is a major decline in economic activity that continues for several months. Most news sources today define a recession as a period of at least two consecutive quarters (six months) of negative GDP (gross domestic product), i.e., the economy shrinks for at least six months.

Inflation expectations before the war

Economists had expected overall inflation and energy prices in America to ease off in the spring or summer of this year. However, that was before Russia invaded Ukraine.

Since the invasion, inflation forecasts have changed significantly. Over the past 4 weeks, the price of gasoline has risen sharply, as well as that of raw materials, metals, and groceries.

Regarding the overall sentiment of economists, investors, and the general public, Zandi added:

“It’s reasonable to be nervous here. The Russian invasion and the spike in oil and commodity prices really changed things.”

Interest rates may have to go up a lot

If inflation heats up, the Federal Reserve (US central bank) will have to raise interest rates even higher than they currency plan to. Last month, consumer prices rose by 7.9%, which was the greatest year-on-year rise in four decades. The Ukraine war did not begin until February 24th, which means the US’ current inflation rate is probably higher still.

The Federal Reserve, as well as other central banks across the world, get jittery when the business community and general population expect prices to keep rising, because that expectation can become the driver of higher inflation, i.e., it becomes a self-fulfilling prophesy.

Oil prices and recessions

Over the past half century, every recession has been preceded by a major rise in oil prices. Chris Lafakis, Director at Moody’s Analytics, told oilprice.com that it is déjà vu all over again.

Billionaire investor Carl Icahn, in an interview with CNBC, said:

“I think there very well could be a recession or even worse. I am negative as you can hear. Short term I don’t even predict. Soaring inflation and the high uncertainty about the global economy with the Russian war in Ukraine could threaten economic growth.”

“I really don’t know if they can engineer a soft landing. I think there is going to be a rough landing… Inflation is a terrible thing when it gets going.”