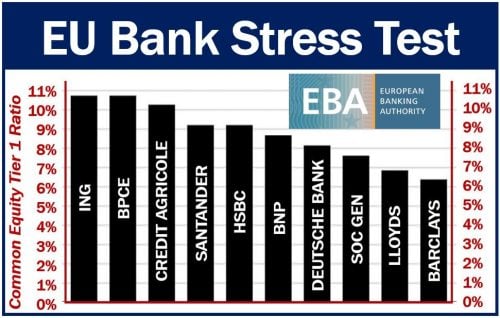

In the EU bank stress test, British high street banks Lloyds and Barclays were among the worst performers. They ranked lowest among Europe’s largest banks. The EU-wide stress test involved 48 banks from fifteen EU and EEA countries. The 48 banks cover approximately seventy percent of total EU banking sector assets.

The EU bank stress test aimed to assess, in a consistent way, banks’ resilience to a common set of adverse shocks. In other words, assess how well or badly banks would fare in a major financial crisis.

EU bank stress test – two UK banks

Barclays and Lloyds were among the worst performers in the EU bank stress test. Even though none of the 48 fell below the major capital threshold, Lloyds and Barclays were close to the minimum. The minimum, that is, to survive an economic crash simulation.

City A.M. quoted Rob Smith, a banking partner at KPMG UK, who said:

“In a surprise set of results, UK banks have fared worse than their European counterparts as IFRS9, combined with high levels of unsecured debt, took its toll on capital.”

“However, you have to consider that the UK was tested against a far more severe scenario than most other countries. In spite of the heavy losses, UK banks still withstood the incredibly tough test.”

All the forty-eight banks remained above the 5.5% capital level. Specifically, the unofficial amount of capital necessary to withstand emergency shocks such as extreme political volatility or a recession.

EU bank stress test toughest yet

This latest EU bank stress test was the toughest since the Global Financial Crisis of 2007/8.

German state-owned NordLB and Italy’s Banco BPM fared especially badly.

The EU bank stress test determines how well banks might withstand an economic crisis such as the one that struck in 2007/8. Most bank stress tests evaluate whether banks have enough capital to withstand adverse events.

Apart from looking at numbers, tests also look at staff training to determine whether they know what to do in a crisis.

The EU bank stress test has no pass or fail grade. Even so, its outcome is important because it helps the European Banking Authority determine whether banks need more capital.

EU bank stress test – Bank of England comment

The Bank of England made the following comment about the EU bank stress test in a press release:

“The severity of the downturn in the UK economy assumed in the EBA stress scenario was, for the first time, similar to that assumed since 2014 in the Bank of England’s own annual stress test of major UK banks. ”

“The scenarios for most other European economies were not as severe as for the UK.”

“The EBA stress test covers a wide sample of 48 banks across 15 countries. Unlike the Bank of England stress tests it uses a constrained methodology that does not take account of actions banks would take in a real stress, such as cutting employee remuneration.”

“Despite these constraints, UK banks show they could absorb the effect of the EBA stress scenario in their capital buffers.”

Britain’s central bank will publish the 2018 Bank of England stress test on Wednesday 5th December 2018.