The European e-vehicle market is slowly gathering momentum, says the European Commission in a new press release. The majority of car brands now offer e-vehicles. Although electric vehicle prices have declined, the sector has been waiting for a ‘breakthrough moment’ in the European Union.

The terms ‘e-vehicle‘ and ‘EV’ mean ‘electric vehicle.’ In most texts, including this one, the term ‘e-vehicles’ includes both plug-in hybrid cars and battery-charged vehicles.

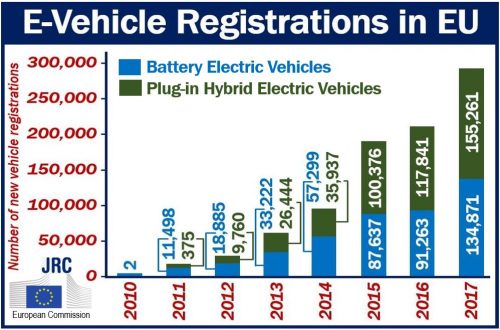

A new Joint Research Centre (JRC) analysis of the deployment of EVs in Europe concludes that between 2010 and 2017 the sector evolved considerably. Despite the seven-year evolution, progress has not been large enough to describe it as full-scale commercialization.

Eight years ago, e-vehicles still represented a niche market in Europe. Since then, there has been an increase in the number of brands offering EV models. European consumers today, therefore, have a wide choice of EV models, which cover every car type.

E-vehicle market has grown steadily

When compared to conventional passenger cars, the e-vehicle market in Europe is still small. However, it has been growing steadily, with some EU member states witnessing impressive growth.

In 2010, a total of 1,400 electric passenger cars were registered in Europe. In 2017, the number reached nearly 300,000.

Norway, the UK, France, Germany, and the Netherlands witnessed the largest number of electric car sales.

The European e-vehicle market is nearly equally divided between plug-in hybrid cars and battery-charge vehicles.

E-bus sector yet to experience full transition

Electric buses offer a transport alternative that is environmentally friendly, especially in large towns and cities.

However, the European Commission reports that Europe’s urban bus sector has not yet experienced a full transition to e-mobility.

In 2017, a European Commission study estimated there were 173,000 electric buses globally. Ninety-eight percent of them were in China.

In Europe, the following countries registered the highest number of electric buses between 2010 and 2017:

- UK ~200. (~ = approximately)

- The Netherlands ~175.

- Belgium ~140.

- Germany ~90.

- Austria ~75.

E-vehicle recharging infrastructure

The availability and development of e-vehicle recharging infrastructure is an important factor contributing to e-mobility development.

Recharging infrastructure, overall, has improved in Europe. Not only are there more charging points today than before, but they also recharge faster.

Infrastructure refers to all the systems and structures in a country that most of us take for granted. Roads, tunnels, airports, bridges, and street lights, for example, form part of our infrastructure. Infrastructure also includes schools, universities, and hospitals.

The infrastructure situation for e-vehicles is very different from one EU Member State to another.

The Netherlands, UK, France, and Germany have the most charging points. Top numbers range from 140,000 in the UK to approximately 325,000 in The Netherlands.

In the rest of the European Union, on the other hand, the number of recharging points are much lower (all fewer than 5,000).

E-vehicle mass market uptake – barriers

In spite of the growing numbers in market penetration, barriers to e-vehicle mass market uptake still seem to exist.

In some EU Member States, the lack of publicly accessible recharging points has probably undermined consumer confidence in EV viability.

Consumers also tend to worry about:

- E-vehicle prices.

- Their driving range.

- Their high maintenance costs.

E-vehicle misconceptions

According to the JCR Report, some consumers’ misconceptions could be harming EV sales. One misconception is that they are slower than cars with gasoline (UK: petrol) or diesel engines. Some people also believe that electric cars offer an inferior driving experience. They don’t.

According to the Report, e-vehicles are getting cheaper, and their performance is improving. They are also achieving faster speeds than people had expected.

Recommendations

According to the European Commission:

“Support policies remain important to help the transition to low emission mobility, and incentives can play a catalytic role in EV deployment at this stage.”

“At the moment, support measures stimulating EV demand are not harmonized in the EU Member States. This has led to market fragmentation both in terms of the number of EVs on the road and the availability of publicly accessible recharging infrastructure.”

“The JRC report recommends that support measures are harmonized to promote the use of e-vehicles as well as the development of accessible recharging infrastructures. Measures supporting interoperability and targeted infrastructure investments are also necessary.”

“Finally, policies targeting consumer behavior and raising awareness of low emission mobility can play a major role in the transition towards a near zero emission mobility.”