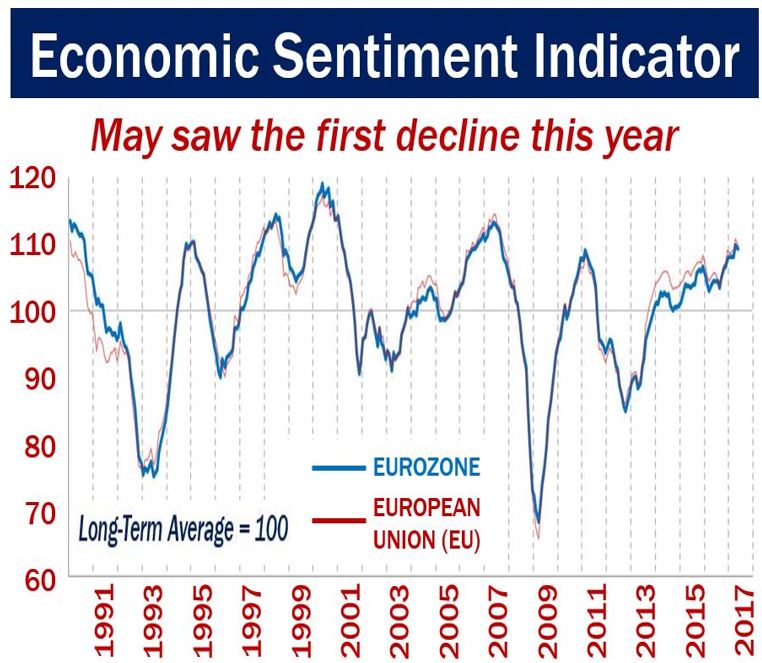

Eurozone economic confidence slipped for the first time in 2017, while the outlook by consumers for inflation weakened, indicating a softening of price pressures.

The Business and Consumer Survey Results, issued by the European Commission, showed that following steep increases in April, the ESI (Economic Sentiment Indicator) weakened in May, in both the Eurozone and the European Union, by 0.5 points to 109.2 and 1 point to 109.7 respectively.

In this article, Eurozone refers to just the EU (European Union) member states that use the euro as their national currency, while the term EU refers to all member states – both those that use the euro as their national currency and those that do not.

This latest report may reinforce ECB (European Central Bank) President Mario Draghi’s view, expressed on Monday, that the Eurozone continues to require “an extraordinary amount of monetary policy support.”

Although the Economic Sentiment Indicator has dropped a bit this month, it is still in positive territory. Any index number above 100 is positive. (Data source: ec.europa.eu)

Although the Economic Sentiment Indicator has dropped a bit this month, it is still in positive territory. Any index number above 100 is positive. (Data source: ec.europa.eu)

Mr. Draghi has urged reporters, analysts, economists, and lawmakers to be patient regarding the outlining of an exit strategy from a €2.3 trillion ($2.6 trillion) bond-purchasing program and negative rates, despite the upswing, which he acknowledges is becoming more and more solid and broad based.

Where did Eurozone sentiment fall?

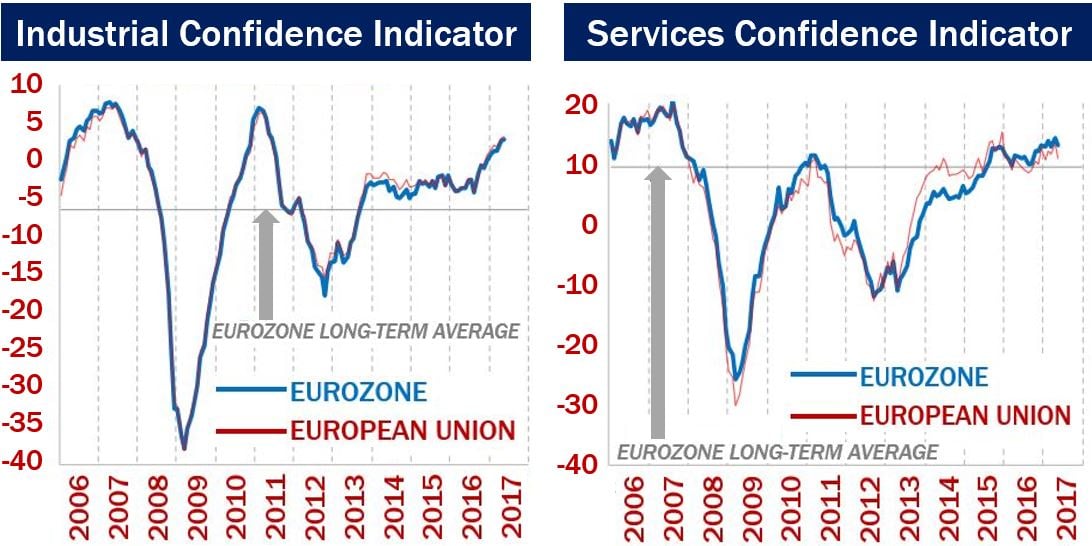

According to the European Commission, the weakening in Eurozone sentiment resulted from declines in services and retail trade confidence, while confidence in construction, industry, and among consumers remained “broadly stable and at high levels.”

Among the largest Eurozone economies, the ESI weakened in the Netherlands, Germany and Italy, by -2.1, -1.5, and -0.9 respectively. In France and Spain, the index rose by +1.5 and +0.5 respectively.

Regarding employment plans, there was a marked upward revision in construction, while employment plans in industry remained the same, and worsened in the service and retail trade sectors.

Selling price expectations in construction, retail trade, and services weakened considerably, but remained stable in industry. Consumers’ price expectations also declined in May.

European Commission economists believe that the May marginal downturn is a temporary blip, and that figures will continue rising in the months to come. (Data source: ec.europa.eu)

European Commission economists believe that the May marginal downturn is a temporary blip, and that figures will continue rising in the months to come. (Data source: ec.europa.eu)

What about the EU?

Regarding employment plans, there was a marked upward revision in construction, while employment plans in industry remained the same, and worsened in the service and retail trade sectors.

Selling price expectations in construction, retail trade and services weakened considerably, but remained stable in industry. Consumer’s price expectations in the EU, as within the Eurozone, declined in May.

A steep decline (-2.3) in the United Kingdom as well as Poland (-.09) were the main drivers of a headline indicator decline in the EU of -.1.0,.

The Report authors wrote:

“In line with the euro area, confidence remained broadly stable in industry and among consumers. Confidence worsened more markedly than in the euro area in services and retail trade, and decreased also in the construction sector. Yet, financial services sector confidence deteriorated only slightly.”

Managers’ employment plans were generally more promising (less pessimistic) in the EU than in the Eurozone. However, in contrast to the Eurozone, EU employment plans deteriorated in the construction sector.

While selling prices in the EU were expected to decline in construction, retail and services, unlike the Eurozone they were also expected to decrease in industry. Consumers’ price expectations in the EU edged down marginally.