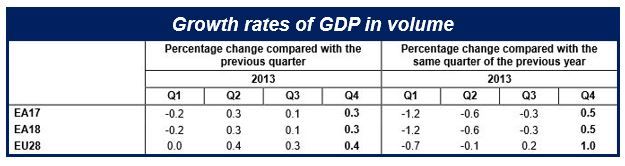

Eurozone GDP grew by 0.3% during the last quarter of 2013, compared to 0.1% in the second quarter, according to figures published today by Eurostat, the European Union’s statistical office.

It was the third successive quarter of economic growth since the end of a very long recession.

The figures apply to the Eurozone or EA17, the seventeen EU economies that use the Euro as their currency.

Since Latvia became a Eurozone country on January 1st, it is now called EA18. As the figures apply to Q4 2013, they only refer to the EA17. The whole of the European Union (EU) is also known as the EU28, and includes countries not in the Eurozone, such as the UK and Sweden.

In the EU28, economic growth in the fourth quarter of 2013 was 0.4%, compared to 0.3% in the third quarter.

Compared to the fourth quarter of 2012, seasonally adjusted GDP grew by 0.5% in the Eurozone and by 1% in the EU28 in Q4 2013. In Q3 2013, GDP shrank by –0.3% in the Eurozone and expanded by +0.2% in the EU28.

(EA 17 does not include Latvia, EA18 does. Source: Eurostat)

In the United States, GDP expanded by 0.8% in Q4 2013 compared to the previous quarter which had grown by 1%. GDP grew by 2.7% in Q4 2013 compared to Q4 2012.

Over the 12-month period of 2013, GDP shrank by 0.4% in the Eurozone and expanded by 0.1% in the EU.

Eurozone GDP grew more evenly

The BBC quoted Chris Williamson, chief economist of Markit, who said “Not only has the pace of growth picked up to the fastest since the second quarter of 2011, but the recovery is also becoming more broad-based, encompassing core and so-called ‘periphery’ countries alike.”

Even France, which has been fraught with economic problems, had some promising news. Its economy grew by 0.3% in Q4 2013, according to government figures (INSEE statistical office).

Euro rises against the dollar

The better-than-expected Eurozone growth figures helped raise the euro to its highest level in three weeks against the dollar and other major currencies. It now seems much less likely that the Central European bank will take action by reducing interest rates to avert deflation.

With the single currency area’s two largest economies, Germany and France, registering better-than-predicted growth, the euro rose to $1.3715 today. The dollar also weakened on some less positive data published yesterday.

In an interview with Reuters, Jane Foley of Radobank said “When you see better growth data the market quite simply thinks there’s less chance of deflation and less chance of Draghi taking action, which is currency-supportive.”

Last week the ECB decided to hold its benchmark rate at 0.25%. Mario Draghi, ECB President says he does not think deflation is a threat.

There have been growing fears of deflation in Europe after Eurostat reported that January’s inflation dropped to 0.7%, after posting 8% in December, moving further away from the central bank’s target of 2%.