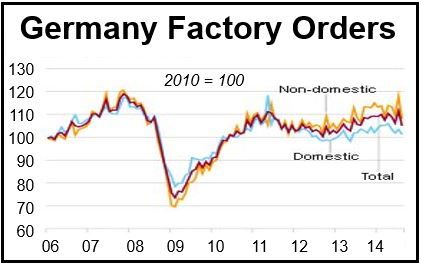

German factory orders sank -5.7% compared to July, says statistical agency Destatis. This is the largest decline since the peak of the global financial crisis in 2009. New orders in manufacturing had risen by +4.9% in July compared to June.

Orders from abroad fell by -8.4%, while domestic orders dropped by -5.7% in August.

Orders from the Eurozone declined by -5.7% and from the rest of the world by -9.9%.

While orders for consumer goods in August rose by 3.7%, they fell for manufacturers of intermediate- and capital goods by -3% and -8.5% respectively.

This is not just devastating news for Europe’s largest economy, but also for other nations within the European Union that have Germany as their number one export client.

German factory orders saw their biggest fall in August since 2009. (Data source: Destatis)

What next? More austerity or raise spending?

Pressure will now grow rapidly in Berlin to loosen fiscal policy and increase spending.

The German government faces increasing pressure from its neighboring countries as well as the ECP (European Central Bank) to raise expenditure to help kick start the economy of the Eurozone.

Angela Merkel, Germany’s Chancellor, said her government promised to balance the federal budget in 2015, and because of this has virtually no wiggle room to consider a looser policy.

The majority of German economists have revised down the country’s forecast for GDP growth in the fourth quarter. In the second quarter of this year, the economy actually shrank, after starting off the year moderately well.

If Q3 2014 posts another GDP contraction, Germany would technically be in an economic recession. For a country to be in recession, its economy must shrink during two successive months.

This decline is not only a consequence of the anti-Russian economic sanctions, it is also due to the Eurozone’s extremely weak economic performance this year and its grim outlook.

The IMF is about to downgrade Germany’s GDP growth forecast for this year to 1.5%, and for 2015 also to 1.5%, due to the turmoil in the Middle East and Ukraine.

According to the Ministry of the Economy, manufacturers in August received fewer-than-average bulk orders.

Opinions in Germany will split

Germany has been at the forefront of pushing austerity and fiscal discipline in the Eurozone, much to the dismay and fury of the currency bloc’s peripheral nations, which today include France.

The Eurozone’s Mediterranean nations say they are fed up with belt-tightening and the fiscal discipline imposed by Germany and some other northern European countries.

Since the ECB announced last week that it plans to purchase asset-backed securities and covered bonds to add liquidity to the system and hopefully stimulate growth, German economists and lawmakers have expressed opposition and alarm.

Hans-Werner Sinn, President of the Ifo Institute, a prestigious Munich-based think tank, said the ECB will become the Eurozone’s bad bank and bail-out authority. He added that it is not within the ECB’s mandate to buy risky assets; that comes within the realms of regional fiscal policy, he stressed.

He warned against maintaining the financial systems of insolvent nations with such subsidies, which will end up costing the taxpayer hundreds of billions of euros.

Mr. Sinn said:

“The ECB will presumably buy junk paper and thus increase the burden on taxpayers should defaults occur, since taxpayers will have to make up for the drop in the distribution of ECB profits to the respective treasury departments.”

Mr. Sinn criticizes the ECB for planning to buy securities in economies which are currently under the EU’s support programs.