The United Kingdom has registered its fastest wage growth rate since 2008. According to the Office for National Statistics, wages rose by 3.3% for the three months to October 2018, the greatest increase in a decade. The increase excludes bonuses.

A bonus is extra money that an employer pays a worker because he or she performed well. Sometimes, employees may also get a bonus because the employer has performed well.

The average weekly wage in the UK today stands at £495. When adjusted for inflation, it is at its highest level since 2011.

Wage growth and other highlights

Below are some highlights from the Office for National Statistics’ press release today:

- Employment rose by 79,000 compared to the previous quarter. Employment reached a record 32.48 million in the three months to October 2018.

- Unemployment rose by 20,000 to 1.38 million.

- Economic inactivity declined by 95,000 to 8.66 million.

- Regular average weekly wages rose by 3.3% on the year. Weekly earnings reached £495 in October 2018.

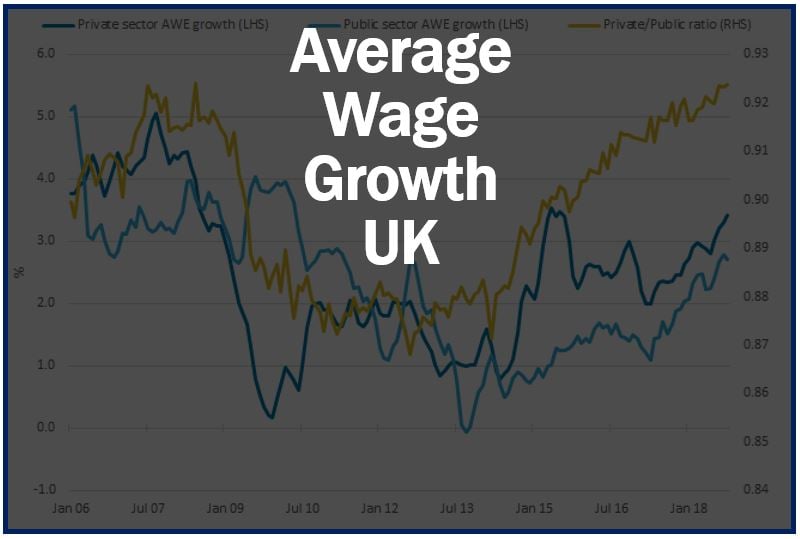

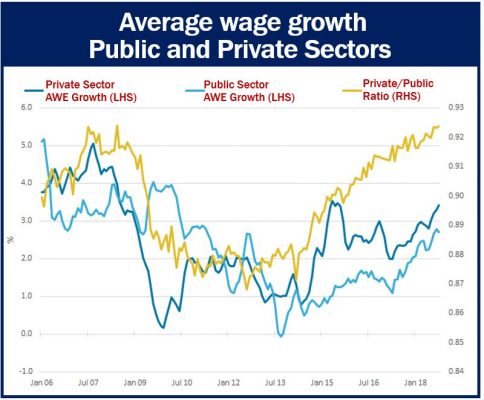

- The gap between private sector and public sector earnings is narrowing.

Wage growth since global financial crisis

Since the global financial crisis of 2007/8, wage growth has been a persistent problem. Even when the UK economy began expanding again after the Great Recession, wage growth was extremely weak. In fact, for most of the time, until recently, it had not managed to keep up with inflation.

The Office for National Statistics says the following regarding average earnings (wages):

“Our employment earnings analysis is based on average weekly earnings (AWE) paid to workers in Great Britain.”

“The average weekly earnings measure the amount of money paid to each worker per job per week, excluding benefits in kind, unearned income and arrears of pay. The estimates exclude earnings of people who are self-employed, and are calculated before tax and other deductions.”