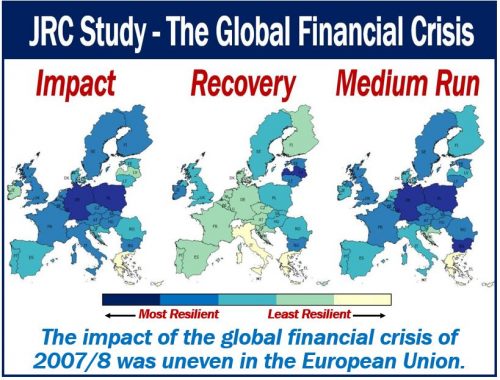

The global financial crisis that began in 2007 affected many countries across the world. According to the European Commission’s Joint Research Centre (JRC), countries across the EU also felt its damaging effect. However, its impact was uneven, a new JRC Study found.

Researchers in the HRC Study tried to determine why some economies were more resilient than others. They concluded that mere ‘shock absorption‘ might not be the best strategy looking forward. Also, it may not be the only strategy.

Adaptation and transformation, however, has helped some economies use the global financial crisis as an opportunity.

A Global Financial Crisis is an economic meltdown or financial crisis that affects the whole world. In other words, it does not just affect one country or region. The last one occurred in 2007/8.

What did the JRC Study measure?

The JRC Study measured each EU Member State’s degree of societal and economic resilience. Specifically, regarding the 2007/8 Global Financial Crisis.

The researchers identified particular country traits linked to resilience.

They also tried to determine which EU Member States used the opportunity to ‘bounce forward‘ and emerge even stronger.

They based their analysis on the JRC Conceptual Framework for Resilience. The framework places the well-being of individuals at its core. In other words, it does not only focus on economic growth.

Ranking country resilience not an easy task

Ranking economies according to their resilience is not an easy task for several reasons.

Resilience, for example, may not be homogeneous across the global financial crisis’ different stages. Some nations were more resilient in the short-term. In other words, they did well regarding vulnerability and absorption.

However, that does not mean that they necessarily fared better in the recovery (adaptation) or medium-term (adaptation).

The JRC Study showed that Bulgaria and the Baltics fared better in the medium- than short-term. Poland and Germany, on the other hand, were more resilient in the short- and medium-term.

JRC Study went beyond economy

The assessment of countries’ resilience changed significantly when the researchers broadened their perspective. Specifically, when their perspective included socioeconomic factors.

When social variables such as wages, health, happiness, and exclusion were included in the analysis, Bulgaria proved more resilient.

Hungary, on the other hand, became less resilient when the researchers factored in the social dimension.

Regarding the importance of factoring in the social dimension, the European Commission says:

“The importance of this broader perspective further reinforces the case for the European Pillar of Social Rights, and for strengthening the social dimension in the work of the European Semester.”

The true goal of resilience

The JRC Study researchers believe that resilience is not just about bouncing back to pre-crisis levels. The goal of resilience is to bounce forward and potentially transform things. In other words, reach a level that is better than before the crisis.

In this respect, country performance in the European Union is a very mixed bag. German, Slovakia, and Malta, for example, have managed to bounce forward in many areas.

Spain, Italy, and Greece, on the other hand, are still well below their pre-crisis performances across most socioeconomic dimensions.

Active labor market measures, R&D expenditure, and productivity have increased compared to pre-crisis levels in most countries.

Monetary and non-monetary perspectives

From a monetary perspective, countries have generally been able to bounce forward, says the JRC Study researchers. GDP, income, and consumption, for example, are monetary factors.

GDP stands for Gross Domestic Product. It is a measure of production that equals all the goods and services that a country produces.

This is not so much the case for non-monetary aspects of well-being such as social exclusion, inequality, and happiness. The share of young people in employment, training, and education is also a non-monetary factor.

The European Commission says:

“This latter finding again confirms the need to consider the social dimension in crisis response and economic management.”

Video – Income Inequality

This short video, by Market Business News, explains what income inequality is.