Global financial crisis – definition and meaning

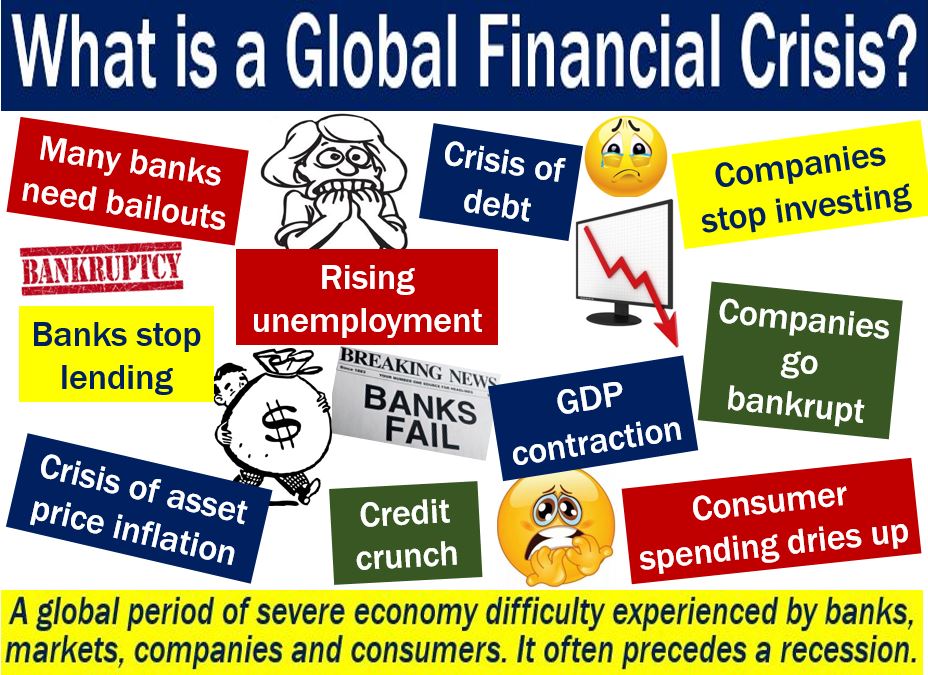

A Global Financial Crisis is a financial crisis that affects many countries at the same time. It is a period of severe difficulties which financial institutions, markets, companies, and consumers experience simultaneously. During a global financial crisis, financial institutions lose faith and stop lending to each other and traders stop buying financial instruments. Eventually, most lending stops and businesses suffer significantly.

In most global financial crises, parties to financial contracts in many countries fear that their counterparties will not honor them.

They also conclude that the financial assets they own will be worth less than they had previously thought.

Eventually, banks stop lending and demand early settlement of loans and other financial instruments. Banks also start selling all the financial assets that they can.

Globalization of finance, while beneficial in facilitating international investment, also means that financial shocks can propagate more swiftly and widely across borders.

Most people, if you mention the term “global financial crisis,” think of the last one, which occurred in 2007/8.

According to the Reserve Bank of Australia:

“The global financial crisis (GFC) refers to the period of extreme stress in global financial markets and banking systems between mid 2007 and early 2009. During the GFC, a downturn in the US housing market was a catalyst for a financial crisis that spread from the United States to the rest of the world through linkages in the global financial system.”

Financial crisis – features

Financial crises come in many forms. However, they have common elements. The information below comes from an IMF Working Paper, written by Stijn Claessens and M. Ayhan Kose.

The authors say that at least one the following phenomena are present during a global financial crisis:

- Credit volumes change significantly.

- Asset prices decline considerably.

- There are serious disruptions in financial intermediation.

- There is a severe disruption in the supply of external financing to many players in the economy.

- Households, companies, financial intermediaries, and sovereigns experience large scale-balance sheet problems.

- There is large scale government support, i.e., bailouts.

The authors add:

“As such, financial crises are typically multidimensional events and can be hard to characterize using a single indicator.”

If a financial crisis spreads, it becomes an economic crisis. An economic crisis occurs when the whole economy is in trouble, not just the banking and finance sectors.

The 2007/8 global financial crisis

When talking about the financial crisis of 2007/8, people often say the ‘Global Financial Crisis’ or the ‘2008 Financial Crisis.’ It was the worst global crisis since the Wall Street Crash and the subsequent Great Depression in the 1930s.

The 2007/8 financial crisis was followed by the Great Recession, which lasted until 2012. It was a period of general economic decline in most countries’ economies and global markets. If there are two successive quarters of economic contraction, there is a recession.

When a recession lasts a long time it becomes a depression. Depressions last more than three years and reduce GDP by at least ten percent.

In September 2008, Lehman Brothers, a sprawling global bank, collapsed. This collapse subsequently brought down the global financial system.

Taxpayers in North America, Europe, and elsewhere spent hundreds of billions of dollars on bailouts.

Despite the massive financial help, the ensuing credit crunch exacerbated what was already a severe downturn. In fact, what followed was the worst recession in eighty years.

Even after 2012, when the Global Financial Crisis was over, there was a very weak and fragile recovery. Workers have had to suffer almost a decade of below-inflation wage increases.

Causes of the 2007/8 global financial crisis

The Economist magazine says that the crisis had multiple causes. The most obvious culprits were the financiers. Especially those financiers who claimed to have found a way to banish risk. In fact, what they had done was to lose track of risk.

Regulators and central bankers were also to blame because they were the ones ‘who tolerated this folly.’

The Economist adds:

“The “Great Moderation”—years of low inflation and stable growth—fostered complacency and risk-taking. A “savings glut” in Asia pushed down global interest rates.”

“Some research also implicates European banks, which borrowed greedily in American money markets before the crisis and used the funds to buy dodgy securities. All these factors came together to foster a surge of debt in what seemed to have become a less risky world.”

Moreover, the proliferation of complex financial products such as derivatives magnified losses and obscured the true extent of risk exposure, contributing to the system’s vulnerability.

Types of financial, business, and economic crises

There are many different types financial, business and economic crises. Let’s have a look at some of them:

-

Banking Crisis

Occurs when a single bank or many banks face insolvency or liquidity issues simultaneously.

For example: “The collapse of a major bank triggered a banking crisis, leading to widespread panic and a run on banks.”

-

Currency Crisis

Takes place when the value of a country’s currency sharply depreciates or becomes highly unstable.

For example: “A sudden loss of confidence in the national currency led to a currency crisis, with exchange rates plummeting overnight.”

-

Sovereign Debt Crisis

Happens when a country cannot fulfill its debt obligations, which may result in a default.

For example: “The government’s inability to service its international debt sparked a sovereign debt crisis.”

-

Corporate Debt Crisis

Arises when a significant number of companies are unable to meet their debt payments, potentially leading to defaults and economic slowdown.

For example: “Overleveraged industries faced a corporate debt crisis as interest rates rose sharply.”

-

Stock Market Crash

A sudden and significant sell-off in the stock market, which may signal or contribute to broader economic problems.

For example: “The rapid sell-off of overvalued stocks resulted in a stock market crash, erasing billions in market capitalization.”

Video – What is a Global Financial Crisis?

This video, from our YouTube partner channel – Marketing Business Network – explains what a ‘Global Financial Crisis’ is using simple and easy-to-understand language and examples.