What is an actuary? Description and types

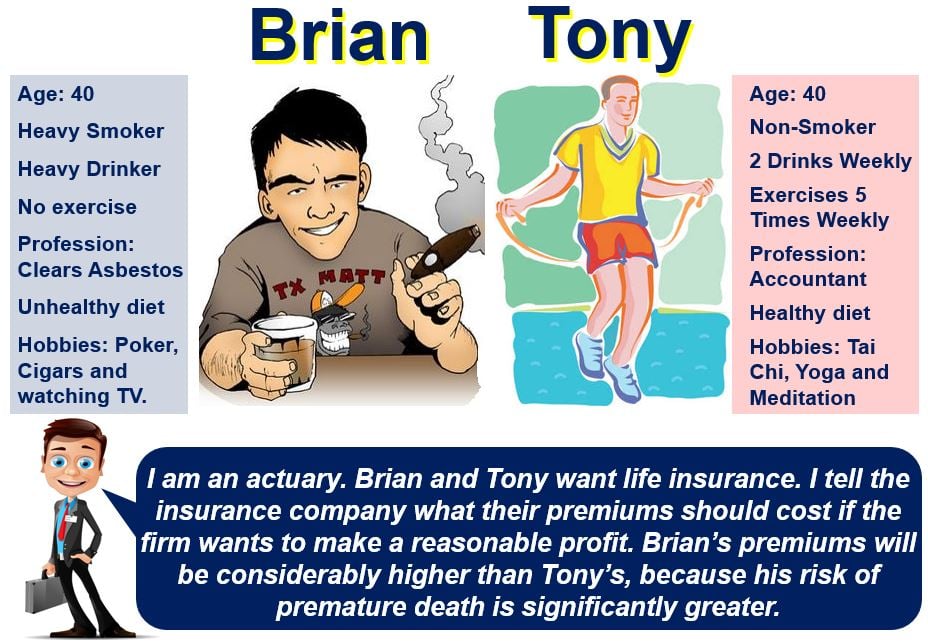

An actuary is a person who analyzes the chances of a risk occurring and what the financial consequences would be. Actuaries use statistics, mathematics, and financial theory to study future events that could happen. Above all, they focus on events of interest to pension programs and insurers.

Many actuaries work for companies that insure against disability, sickness, injury, death, or loss of property.

In other words, an actuary uses statistical and financial theories to assess the likelihood of particular events happening. Additionally, they calculate how much the financial costs would be if they occurred.

Actuaries also calculate how much pension contributions should be to produce specific income levels on retirement.

Additionally, some actuaries determine how much companies should invest to get the best return on investments. They also factor in the potential risks when estimating those amounts.

Actuaries help design and set the price for insurance policies, pension plans, and other financial strategies. They design them so that the plans are financially viable for the provider. Hence, a good knowledge of business finance is crucial.

According to The Society of Actuaries, an actuary is:

“An actuary is a business professional who analyzes the financial consequences of risk. Actuaries use mathematics, statistics, and financial theory to study uncertain future events, especially those of concern to insurance and pension programs. They evaluate the likelihood of those events, design creative ways to reduce the likelihood and decrease the impact of adverse events that actually do occur.”

“Actuaries are an important part of the management team of the companies that employ them. Their work requires a combination of strong analytical skills, business knowledge and understanding of human behavior to design and manage programs that control risk.”

Actuaries – highly-regarded business professionals

Being an actuary is a prestigious position in the world of finance. Above all, actuaries are problem solvers and strategic thinkers with a profound understanding of financial systems.

Actuaries analyze data, evaluate financial risks, and communicate this data to lay people. Lay people are those who are not specialists.

Put simply, an actuary evaluates, manages, and advises on financial risks. They use their business, economics, and financial expertise to provide strategic, financial and commercial advice. Additionally, they have knowledge of probability theory, investment theory, and statistics.

Actuaries apply their mathematical, statistical, and economic awareness to real-life situations in the financial world. They must be able to communicate the difficult topics to a range of people. Many individuals with whom an actuary communicates are non-specialists.

Without actuaries, insurance companies would not be able to function.

Without actuaries, insurance companies would not be able to function.

Good people skills and business knowledge

Good social and communicative skills are therefore of vital importance if you want to be an actuary.

Can you discuss complex topics in an easy-to-understand way? If so, perhaps you should consider training to become an actuary. Furthermore, you also need to be good with numbers, as well as business and financial concepts.

Actuaries may work for consulting firms, the government, or the employee benefits department of a large company. Many actuaries work in banks & investment firms, hospitals and insurance companies.

In fact, any business that needs to manage financial risk needs actuaries.

According to Purdue University’s Department of Mathematics, a career as an Actuary is “better described as a ‘business’ career with a mathematical basis than as a ‘technical’ mathematical career.”

Most actuarial disciplines fall into two main categories – life and non-life:

Life actuaries

Life actuaries, including pension and health actuaries, mainly deal with investment risk, morbidity risk (illness) and mortality risk.

They focus mainly on:

- long-term care insurance

- health savings accounts

- health insurance

- long-term disability insurance

- pension

- annuities

- life insurance

Non-life actuaries

Also known as general insurance, property or casualty actuaries, non-life actuaries deal with both legal and physical risks. Specifically, they deal with risks that affect people or their property.

The products that are most prominent in their work are:

- vehicle insurance

- commercial property insurance

- workers’ compensation

- homeowners insurance

- malpractice insurance

- marine insurance

- terrorism insurance

- product liability insurance

Actuaries – well paid and sought after

There are relatively few actuaries across the world compared to other professions. Hence, their services are in high demand, and they earn high salaries.

In 2014 in the USA, newly-qualified actuaries earned approximately $100,000 per year. Additionally, more experienced professionals earned more than $150,000 annually.

In the UK, a 2014 survey found that actuaries start off with a £50,000 annual salary. Their salaries will rise to considerably more than £100,000 during their career.

On both sides of the Atlantic Ocean, the actuarial profession has a top desirability ranking.

An actuary works reasonable hours – it is typically a nine-to-five office job. They work in comfortable conditions without the need for physical exertion that may lead to injury. Furthermore, they have a virtually recession-proof profession.

Naomi Shavin listed the profession among the top twelve jobs for women in a Forbes article.

To qualify as an actuary in the United States

In the United States, there are many actuarial science programs available from a variety of colleges and universities.

Be An Actuary says the following for people in the USA interested in the profession:

“While there are advantages to attending such programs, you should know that you don’t have to major in actuarial science to become an actuary, nor is an advanced degree required.”

“Many students come to the profession from backgrounds in math, statistics, finance, economics and other areas. However, potential actuaries all seem to have a couple of key things in common an interest in, and an aptitude for, math and a desire to put math skills to use in a business context.”

“To earn an actuarial credential, you must complete a series of actuarial examinations, e-Learning components and other requirements through an actuarial membership organization such as the Casualty Actuarial Society (CAS) or the Society of Actuaries (SOA).”

The Society of Actuaries has a section which lists all the universities and colleges with actuarial programs.

To qualify as an actuary in the United Kingdom

To qualify as an actuary in the UK, you need to apply to become a student member of the Institute and Faculty of Actuaries. You then need to sit and pass their exams, or obtain exemptions and gain a satisfactory level of work-based skills.

It is essential that trainee-actuaries have excellent mathematical skills. The majority of actuaries begin their training after they graduate by joining an actuarial firm as trainees. Work experience develops essential skills which help in passing the exams.

In the UK, actuarial employers seek trainees with a good university degree (2:1 or above). They prefer applicants with degrees in numerate subjects such as mathematics, economics, actuarial science, and statistics. They also consider applicants with a degree in chemistry, physics, or engineering.